Saturday, October 18, a new wave of protests swept across the United States. Millions of Americans took to the streets in cities across the country under the slogan "No kings," demonstrating against the policies of President Donald Trump. In the ninth month of what Trump calls "the greatest presidency in history"—the one that has supposedly "ended nine wars" and "restored the U.S. economy"—many Americans believe democracy has been destroyed, and that Trump is laying the foundations of a new autocratic regime.

Protesters voiced opposition to the political persecution of Trump's opponents, as well as the militarization of immigration enforcement, an effort that increasingly involves federal troops and the National Guard. In response to the protests—which began as peaceful demonstrations—Trump has deployed even more troops to American cities.

But peace was short-lived. As of this morning, the protests have escalated into mass unrest and violent street clashes. Police are firing at demonstrators (hopefully with rubber bullets), and tear gas has been deployed. This marks the third major wave of demonstrations since Trump returned to office. Americans are fiercely criticizing his actions, arguing that his governance undermines the integrity of both Congress and the judiciary.

Despite the national turmoil, Trump spent the night attending a charity gala at one of his private clubs, where entry cost $1 million per ticket. This is not the first instance in which Trump has monetized personal face time with attendees, selling seats at his table for hundreds of thousands of dollars.

It's also worth noting the scale of public opposition. The first major anti-Trump protest, which was also aimed at Elon Musk—who had become entangled in Trump's administration—occurred at 1,300 locations. The second demonstration took place at 2,100 sites. Yesterday's protests expanded to 2,700 different venues across the country.

All this leads to one clear conclusion: America is rising up against Trump, his authoritarian methods, and his imperial ambitions. Americans want to live in a country where democracy isn't an empty word and where the president doesn't break the law with impunity, week after week. The people's protests are understandable—they are demanding the restoration of lawful, democratic governance.

If blame is to be placed, it rests with the voters' own decision one year ago. Trump didn't take office by force. Many were dissatisfied with the perceived indecisiveness of Joe Biden. So now, they have something new—a version of "fun" that the nation is unlikely to forget for decades to come.

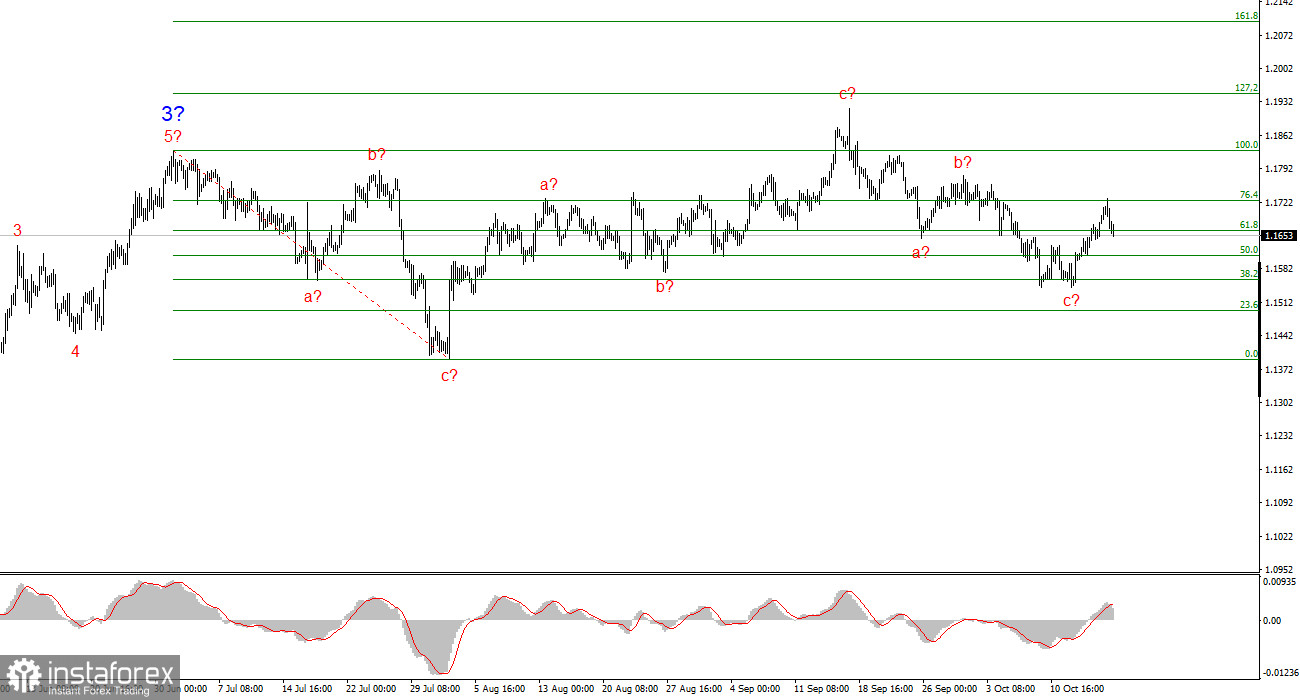

Wave Analysis of EUR/USD:

Based on the current wave analysis, EUR/USD continues to build a bullish segment of the trend. The wave structure remains heavily influenced by news flows, particularly related to Trump's decisions and the internal and external policies of the new White House administration. The target zone for this trend could extend toward the 1.25 area. At present, the market appears to be forming corrective wave 4, which is nearing completion. This structure is particularly long and complex, but still fits the overall bullish trend shape. Consequently, I continue to view buying opportunities as more favorable. By year-end, I expect the euro to rise to 1.2245, which corresponds to the 200.0% Fibonacci level.

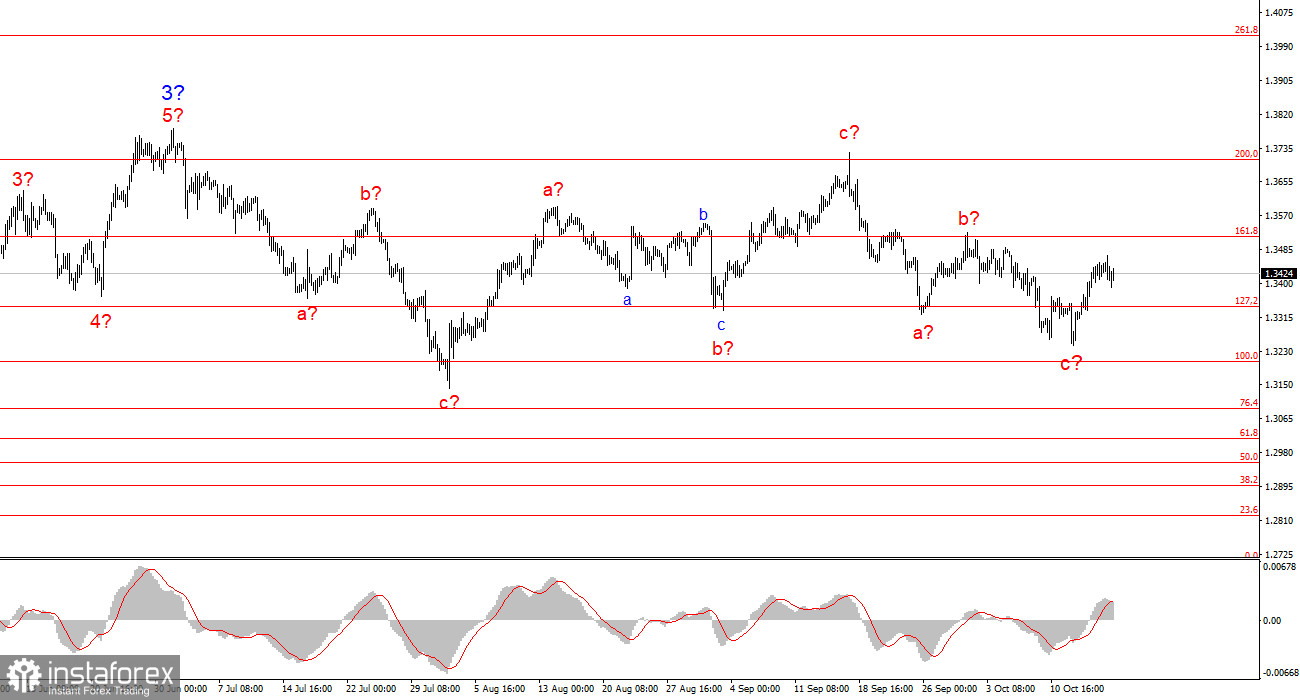

Wave Analysis of GBP/USD:

The wave structure of GBP/USD has shifted. The pair remains within a bullish impulse wave, but the internal layout has become more complex. Wave 4 is developing into a three-wave corrective pattern that is significantly longer than wave 2. The most recent downward three-wave correction appears to be complete. If confirmed, the upward movement within the global wave structure is likely to resume. Initial targets remain at 1.3800 and 1.4000. As always, price action should be confirmed by technical signals and key levels, but these wave structures provide a broader framework for medium-term trend direction.

Key Principles of This Wave Analysis:

- Wave structures should be simple and understandable. Complicated structures are difficult to trade and are more likely to shift.

- If there is uncertainty about market conditions, it is better to stay out.

- There is never absolute certainty in market direction. Always use stop-loss orders.

- Wave analysis can and should be combined with other tools and trading strategies for a comprehensive approach.