The U.S. economic calendar remains limited due to the ongoing government shutdown. As a result, political developments will take center stage in the coming week. Chief among them is the ongoing budget standoff between Democrats and Republicans—though at the moment, it's clear that there are no real negotiations taking place. Donald Trump's team shows no desire to reach a compromise with the opposition, instead applying pressure by threatening mass layoffs of government employees and shutting down key programs initiated by Democrats.

In essence, Trump remains true to form—avoiding compromise and continuing to issue ultimatums. Over the weekend, new mass protests erupted across the United States in opposition to Trump's policies. In several cities, the demonstrations escalated into violent clashes with police. Social tensions are rising sharply within the U.S.

Meanwhile, tensions are also escalating between the U.S. and China. Trump has pledged to raise tariffs on Chinese imports if Beijing doesn't scale back its tightening of rare-earth export controls. So far, China has not reversed its course. Trump has since walked back parts of his threat—but officially, the tariff decision still stands.

From an economic data standpoint, the coming week offers only a few notable reports. Among them are existing home sales, inflation figures, business activity indexes, and the University of Michigan Consumer Sentiment Index. Clearly, the most important of these will be the Consumer Price Index (CPI). Inflation in the U.S. is expected to climb to 3.1% in September. If confirmed, this could lend noticeable support to the U.S. dollar by reducing the likelihood of a dovish monetary policy path from the Federal Reserve.

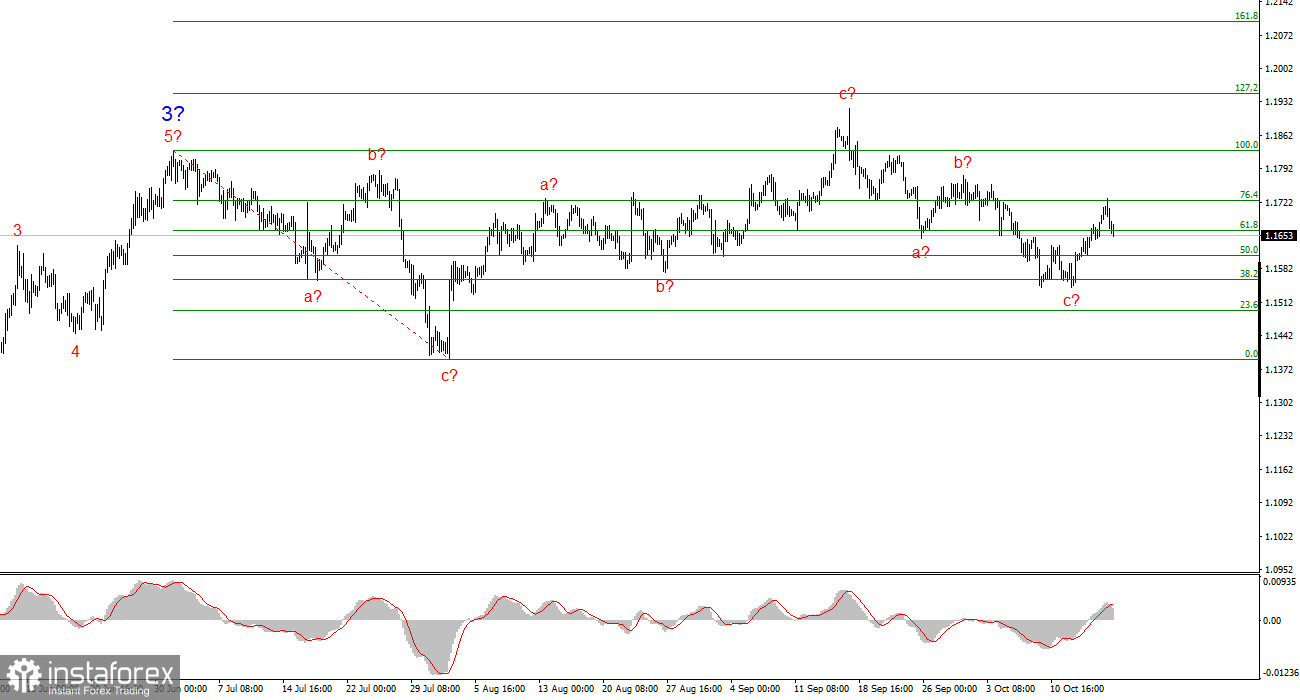

Wave Analysis of EUR/USD:

Based on the current wave analysis, EUR/USD continues to build a bullish segment of the trend. The wave structure remains heavily influenced by news flows, particularly related to Trump's decisions and the internal and external policies of the new White House administration. The target zone for this trend could extend toward the 1.25 area. At present, the market appears to be forming corrective wave 4, which is nearing completion. This structure is particularly long and complex, but still fits the overall bullish trend shape. Consequently, I continue to view buying opportunities as more favorable. By year-end, I expect the euro to rise to 1.2245, which corresponds to the 200.0% Fibonacci level.

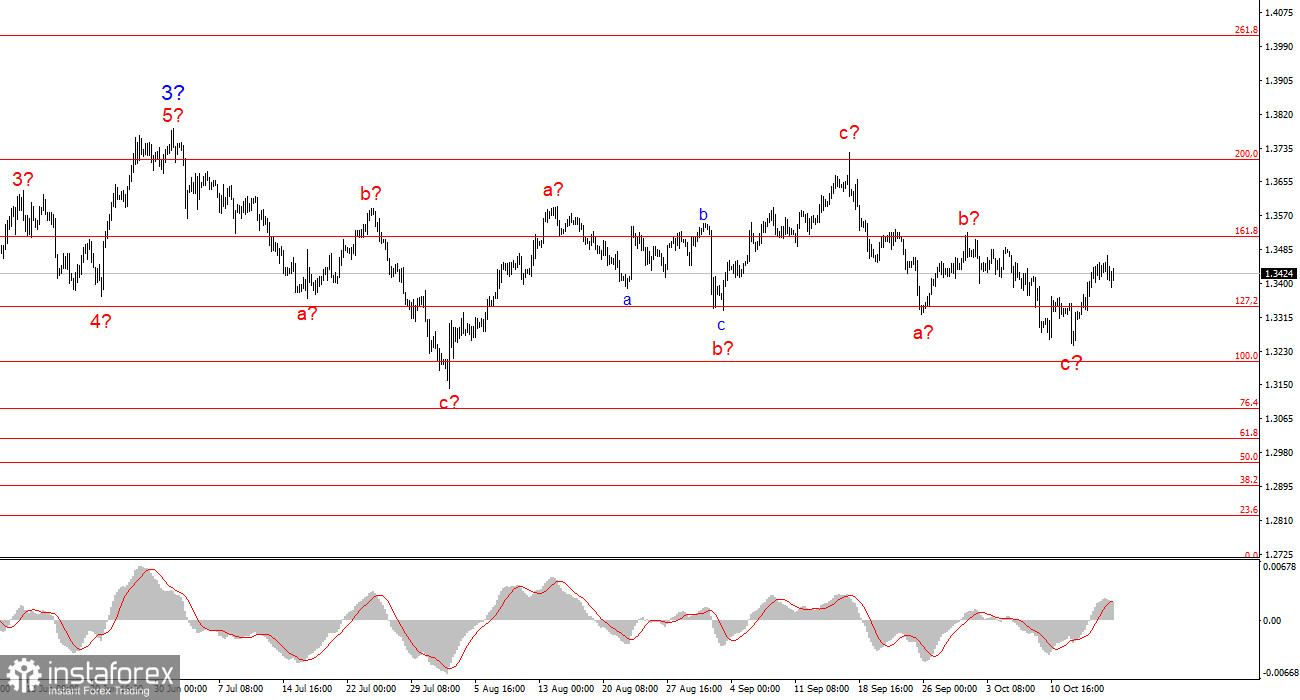

Wave Analysis of GBP/USD:

The wave structure of GBP/USD has shifted. The pair remains within a bullish impulse wave, but the internal layout has become more complex. Wave 4 is developing into a three-wave corrective pattern that is significantly longer than wave 2. The most recent downward three-wave correction appears to be complete. If confirmed, the upward movement within the global wave structure is likely to resume. Initial targets remain at 1.3800 and 1.4000. As always, price action should be confirmed by technical signals and key levels, but these wave structures provide a broader framework for medium-term trend direction.

Key Principles of This Wave Analysis:

- Wave structures should be simple and understandable. Complicated structures are difficult to trade and are more likely to shift.

- If there is uncertainty about market conditions, it is better to stay out.

- There is never absolute certainty in market direction. Always use stop-loss orders.

- Wave analysis can and should be combined with other tools and trading strategies for a comprehensive approach.