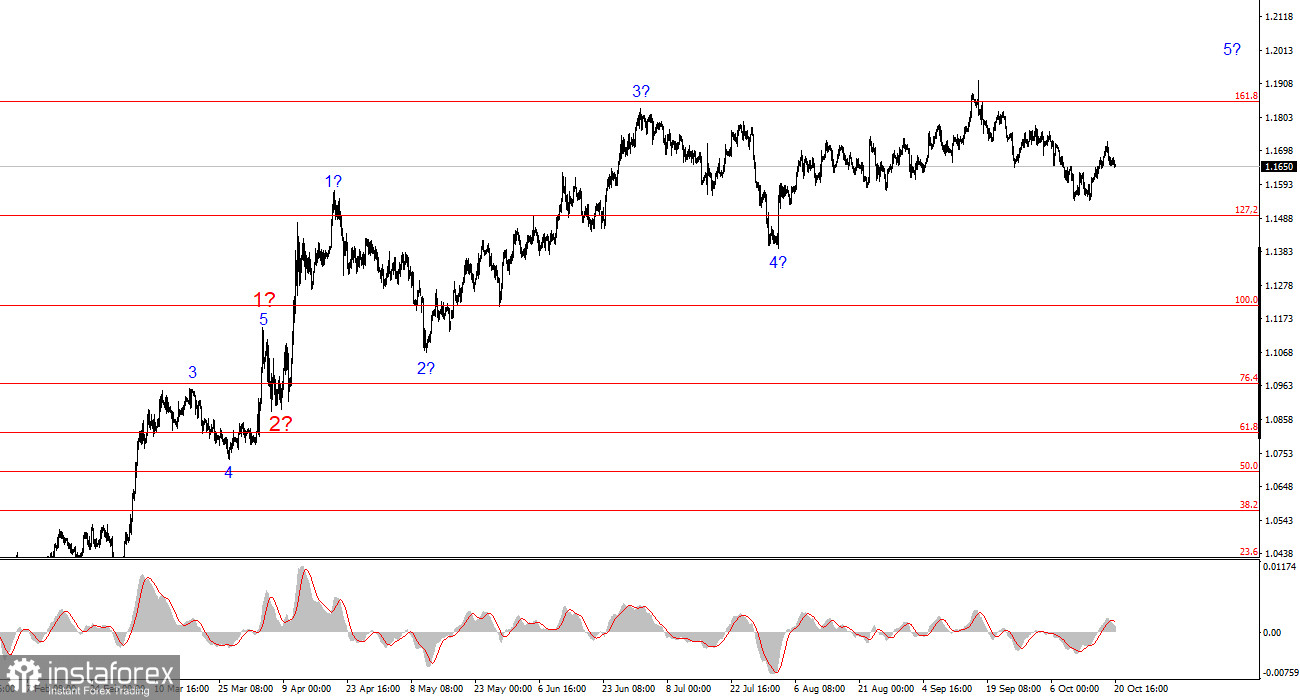

The wave pattern on the 4-hour chart for EUR/USD has transformed — unfortunately, not for the better. It's still too early to conclude that the upward segment of the trend has been canceled, but the recent decline in the European currency has made it necessary to refine the wave labeling.

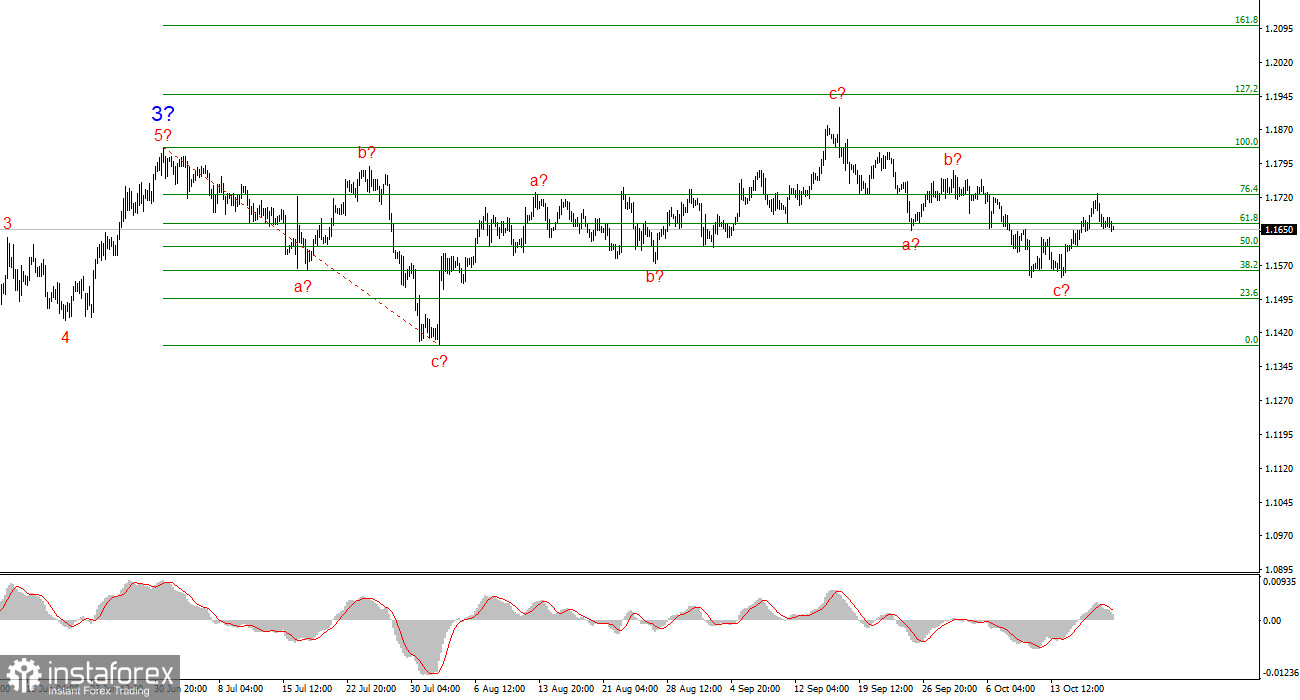

Now, we see a series of three-wave structures a-b-c. It can be assumed that these are components of the larger wave 4 within the upward segment of the trend. In this case, wave 4 has taken on an unnaturally extended form, but overall, the wave structure remains coherent.

The formation of the upward trend segment continues, while the news background still largely fails to support the dollar. The trade war initiated by Donald Trump is ongoing. The confrontation with the Federal Reserve persists. The market's dovish expectations regarding the Fed's rate policy are growing. The U.S. government shutdown continues. The market's assessment of Trump's performance over the first nine months remains quite low, even though economic growth in the second quarter reached nearly 4%.

In my view, the formation of the upward segment of the trend is not yet complete, with targets extending up to the 1.25 level. Based on this, the euro may continue to decline for some time — even without any clear reason (as in the past three weeks) — while the overall wave pattern will still retain its integrity.

The EUR/USD exchange rate barely changed on Monday. Market activity was very low amid a complete lack of events or news. Of course, if one wishes, some "news" can always be found. For example, Donald Trump said today that he "won't allow China to play rare earth games." In my opinion, such a statement sounds hostile rather than conciliatory.

Recall that last week, many analysts believed that trade tensions between the U.S. and China were easing since the U.S. president promised not to raise tariffs by 100% for too long. That was seen as a temporary measure to encourage Beijing to be more cooperative in the November talks. However, I would note that Trump's overall rhetoric toward China cannot be described as positive or peaceful. It is Washington that constantly makes accusations, issues new ultimatums, and demands compliance with its own terms. Therefore, there is no guarantee that the trade war won't escalate again tomorrow.

Meanwhile, the market continues to wait for something concrete, as clarity is severely lacking at the moment. Trump can promise anything and threaten anyone, but all market participants know well that what the U.S. president says today may be completely different tomorrow. Therefore, I think the first meaningful movements this week will come after the U.S. inflation report is released.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues to form an upward trend segment. The wave pattern remains entirely dependent on the news background related to Trump's decisions and the domestic and foreign policy of the new White House administration. The targets of the current trend segment may extend up to the 1.25 level.

At present, we can observe the formation of corrective wave 4, which is nearing completion but has taken on a very complex and extended shape. Therefore, in the near future, I continue to consider only buying positions. By the end of the year, I expect the euro to rise to 1.2245, corresponding to 200.0% on the Fibonacci scale.

On a smaller scale, the entire upward segment of the trend is visible. The wave pattern is not perfectly standard since the corrective waves differ in size — for example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, such situations do occur. I remind you that it's best to identify clear structures on charts rather than focus on every single wave. The current upward structure raises almost no questions.

The Main Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are difficult to trade and often subject to change.

- If you're uncertain about the market situation, it's better to stay out of it.

- Absolute certainty in market direction never exists. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.