The topic of a fresh round of confrontation between China and the United States has been discussed endlessly—yet there's simply no other issue commanding more attention in the market at the moment. As I've said numerous times before, the biggest problem is the lack of clarity. Market participants have no idea what kind of developments to expect.

The "trade truce" between China and the U.S. is set to expire on November 10. I use quotation marks intentionally, because in reality, there is no truce. Journalists were quick to label the reciprocal reduction in tariffs a "ceasefire." But by late October, can anyone honestly speak of peace between Beijing and Washington?

This trade war was initiated by Donald Trump, likely under the assumption that all countries would obediently follow the White House's lead. Some did. But not China. Beijing speaks little, but acts decisively. Washington talks plenty, but does little. Both global heavyweights hold an ace up their sleeve: for the U.S., it's a massive and wealthy consumer market; for China, it's rare-earth metals.

The U.S. market is well understood. Chinese rare-earth metals, however, are a far more complex and sensitive subject. While China is not the only country in the world with reserves of these critical metals—used in electronics, defense systems, and space exploration—it is by far the largest producer. Thus, Beijing can, in fact, use its position to pressure the global supply chain, as virtually every technologically advanced nation depends on them.

Until recently, China had avoided weaponizing this advantage, refraining from threatening export restrictions. But Trump's tariffs poked the sleeping bear. Either his team underestimated China's resolve, or they acted with undue arrogance. What did the U.S. President expect? That China wouldn't respond? That China had no means of retaliation? That it wouldn't dare? And yet—it did! Notably, Chinese officials rarely speak about the European Union or other countries. Their focus remains firmly on the United States. And rightly so.

Given all of this, I personally doubt the negotiations in Malaysia will end in success. In any case, Beijing has played its trump card, and now it's Washington's turn to show more flexibility.

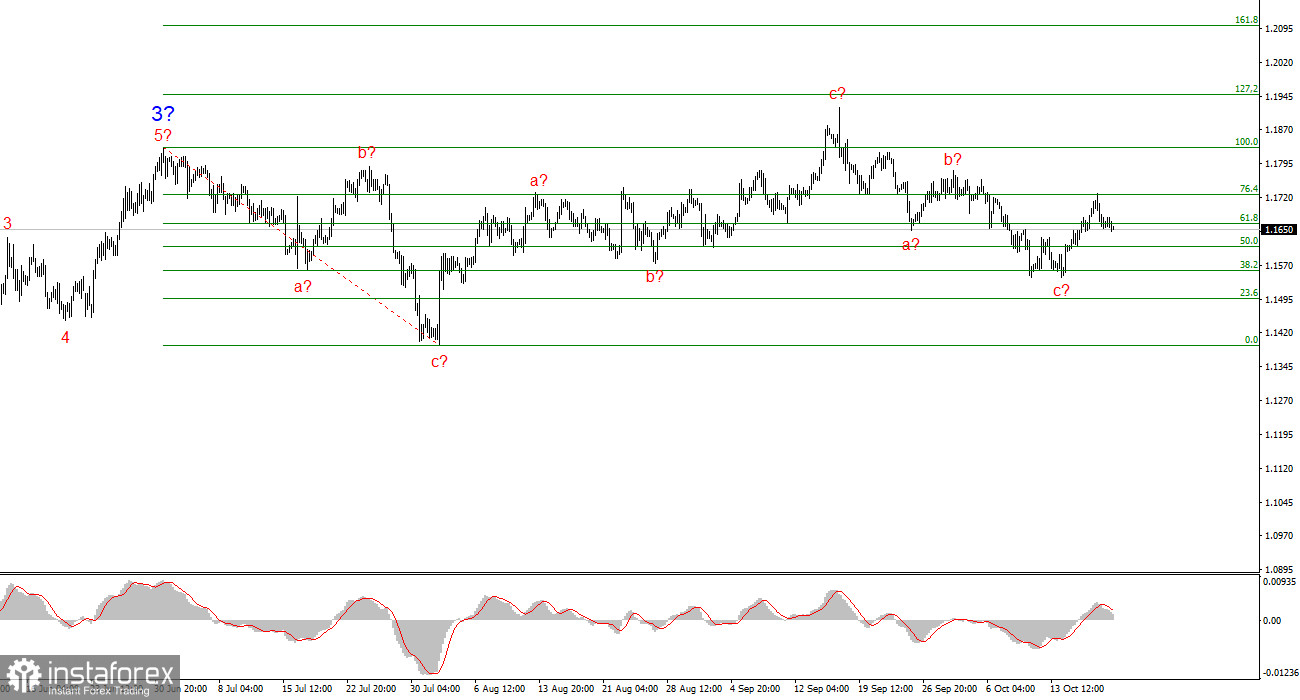

Wave Outlook for EUR/USD:

Based on my analysis, the EUR/USD pair continues forming an upward segment of the trend. The wave structure remains entirely dependent on the news background—especially decisions by Trump and the external and internal policies of the new White House administration. The current wave could extend to the 1.25 area. At present, we appear to be witnessing the formation of corrective wave 4, which is nearing completion, though it is taking on a complex and extended form. Therefore, I continue to consider only buying opportunities. By year-end, I expect the euro to rise to 1.2245, which corresponds to the 200.0% Fibonacci level.

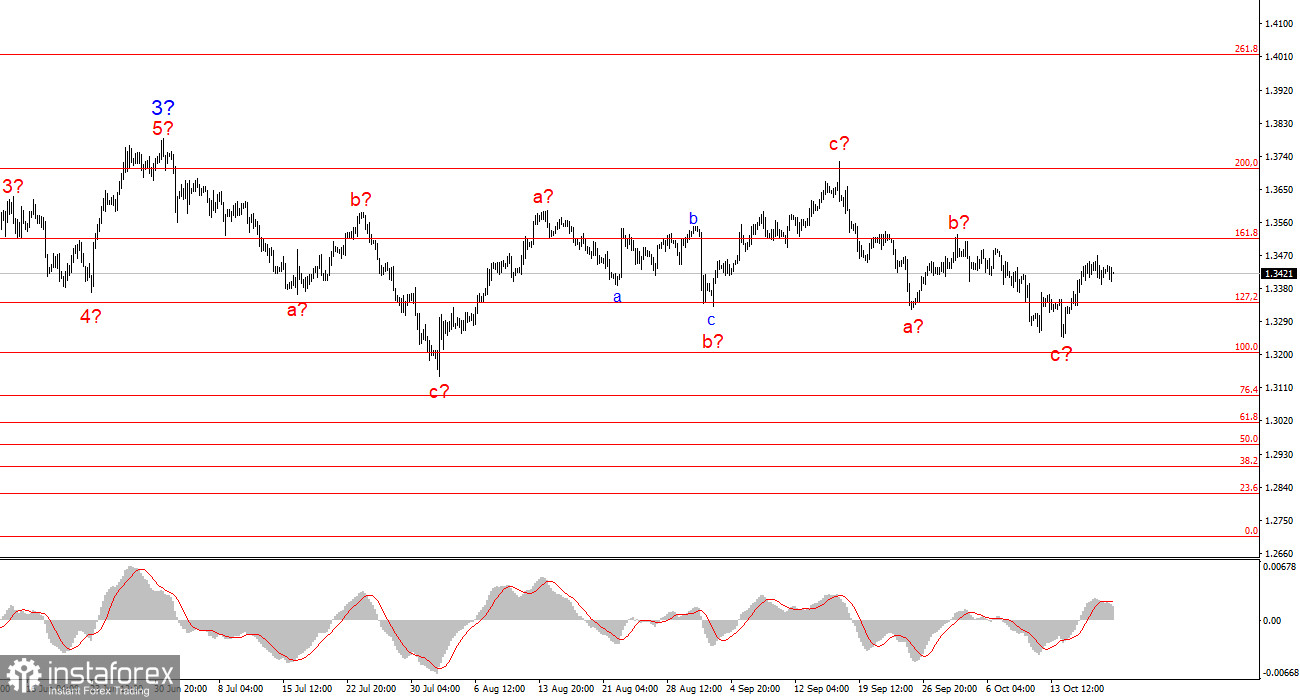

Wave Outlook for GBP/USD:

The wave structure of GBP/USD has evolved. We are still dealing with a bullish, impulsive phase of the trend, but its internal wave makeup is becoming more complex. Wave 4 is taking on a three-wave form, with a structure that is significantly more extended than wave 2. Another bearish three-wave pattern appears to have completed. If this is confirmed, then upward movement may resume in the context of the global wave structure, with initial targets near the 1.38 and 1.40 levels.

Core Principles of My Analysis:

- Wave structures should be straightforward and easy to interpret. Complex formations are more difficult to trade and often shift unpredictably.

- If you're uncertain about market conditions, it's better to stay out.

- Absolute certainty in the market direction is never possible. Always use protective orders, such as Stop Loss.

- Wave analysis can—and should—be combined with other forms of analysis and trading strategies.