Monday Trade Review:

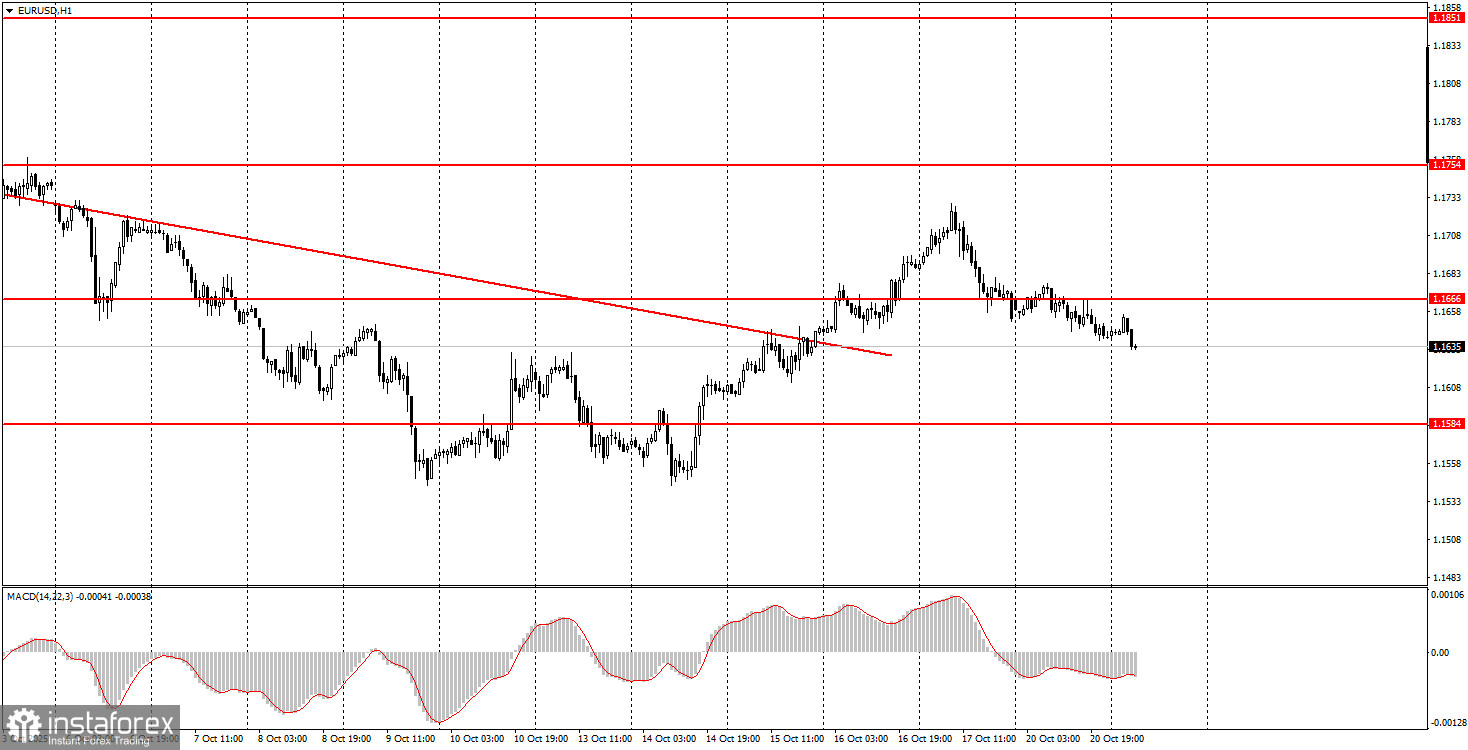

1-Hour Chart of EUR/USD

On Monday, the EUR/USD currency pair posted 37 pips of volatility. In short, there is little to analyze from the previous session. There were no significant or even mildly interesting macroeconomic or fundamental events throughout the day. As such, price movement was also limited. The uptrend on the 1-hour timeframe remains intact after breaking through another descending trendline, but once again, we observe a lack of enthusiasm from traders to buy the euro or take any decisive action.

This suggests that while the upward movement may continue, it is likely to be extremely sluggish. On the daily timeframe, price remains locked in a flat (sideways) structure, which appears to be the root cause of ongoing market stagnation. Volatility has been declining for several weeks, and even important events now offer limited market impact.

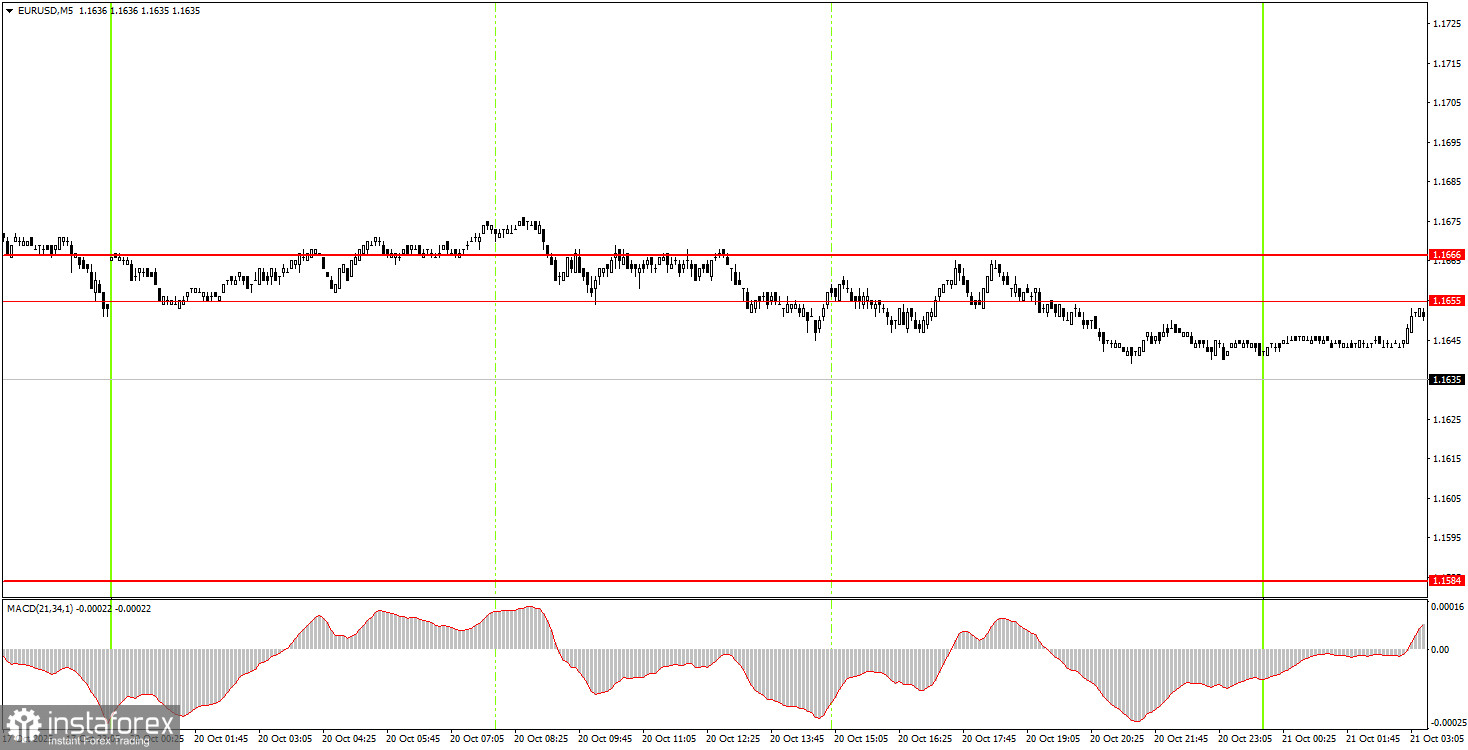

5-Minute Chart of EUR/USD

On the 5-minute chart, only one clear trading signal was generated on Monday. During the U.S. session, the price barely managed to consolidate below the 1.1655–1.1666 area, allowing novice traders to open short positions. Eight hours after the signal formed, the price had moved lower by just 10 pips. Further downside may occur today, but strong momentum is unlikely.

How to Trade on Tuesday

On the 1-hour chart, EUR/USD continues to show signs of an upward trend. A descending trendline has been breached, and the fundamental and macroeconomic background remains heavily unfavorable for the U.S. dollar. Therefore, we continue to expect the resumption of the broader 2025 uptrend. However, traders must remain cautious due to the persistent flat on the daily timeframe. This flat is causing low volatility and erratic behavior on shorter timeframes.

EUR/USD may move in either direction on Tuesday due to the continued lack of macro and fundamental catalysts. A short signal has already formed in the 1.1655–1.1666 area, so a moderate decline remains possible. Nonetheless, market movements are likely to remain muted—similar to Monday.

On the 5-minute timeframe, the following levels should be monitored for Tuesday: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. In the eurozone, a speech by European Central Bank President Christine Lagarde is scheduled today, but market interest in her comments is minimal. The U.S. economic calendar is empty.

Key Rules of the Trading System:

- Signal strength is determined by how quickly it forms (bounce or breakout). The faster it forms, the stronger the signal.

- If two or more false signals occurred near a level, all subsequent signals from that level should be ignored.

- In flat markets, pairs may produce many false signals or none at all. At the first sign of flat trading, it's best to step back.

- Trades should be opened between the start of the European session and the middle of the U.S. session. All trades must be manually closed afterward.

- On the 1H timeframe, MACD signals should only be traded if supported by good volatility and a visible trend confirmed by trendlines or channels.

- If two levels are too close together (5–20 pips), treat them as a support/resistance zone.

- After gaining 15 pips in the correct direction, set your Stop Loss to breakeven.

What's on the Charts:

- Support and resistance levels – key targets for entry and exit; ideal for placing Take Profit orders.

- Red lines – trendlines or channels highlighting the current market trend and preferred trading direction.

- MACD (14,22,3) – histogram and signal line – used as an additional confirmation tool for entry and exit signals.

Important Note for Beginners:

Major news events (always shown on economic calendars) can significantly impact currency movements. During critical news releases, trade with extreme caution—or exit the market entirely—to avoid abrupt reversals.

Remember: not every trade will be profitable. Developing a well-defined trading strategy and disciplined risk/money management are essential to achieving long-term success in forex trading.