Trade Review and Strategy for the Euro

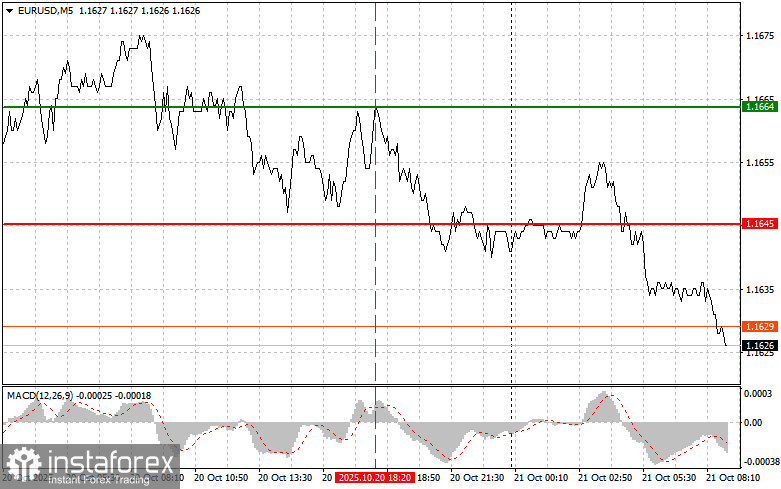

On Monday, the test of the 1.1664 price level occurred when the MACD indicator had already moved well above the zero line, limiting the pair's upward potential. For this reason, I chose not to buy the euro.

The euro came under pressure earlier in the day following weak German Producer Price Index data and failed to recover during the U.S. session. Market participants responded to the negative data, leading to U.S. dollar strength and euro weakness. The absence of significant economic reports from the U.S. meant the euro had no support, and attention has now shifted to the upcoming central bank meetings, which are expected to clarify the future direction of monetary policy.

This morning, no eurozone economic data is scheduled, so all attention is focused on European Central Bank President Christine Lagarde's speech. Her cautious remarks on interest rates, especially against a backdrop of falling inflation, may offer limited support to the euro. However, significant strengthening is unlikely. Markets will analyze her every word, searching for any signals regarding the European Central Bank's future policy stance. It is expected that her caution will reflect the need to find a balance between controlling inflation and stimulating economic growth.

For today's intraday strategy, I will focus on the execution of Scenario 1 and Scenario 2.

Buy Scenarios

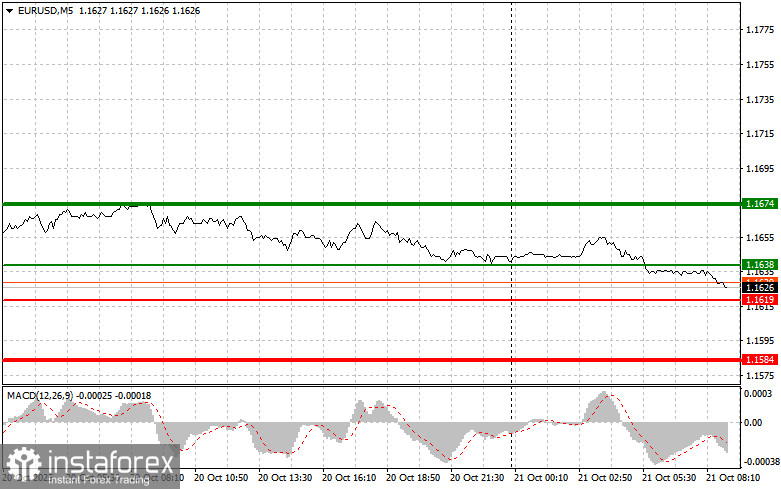

Scenario 1: Buy EUR/USD at 1.1638 (thin green line) with a target at 1.1674 (thick green line). At 1.1674, I plan to exit long positions and open short positions on a reversal, targeting a movement of 30–35 pips from the entry level. Consider this setup only after clear hawkish signals from Lagarde.

Important: Before placing a buy order, confirm that the MACD indicator is above the zero line and just starting to rise.

Scenario 2: Buy EUR/USD after two consecutive tests of the 1.1619 level, provided MACD is in oversold territory. This would suggest limited downside potential and an opportunity for a reversal back toward 1.1638 and 1.1674.

Sell Scenarios

Scenario 1: Sell EUR/USD at 1.1619 (thin red line) with a target at 1.1584 (thick red line). Exit short positions here and consider reversing to long positions for a 20–25 pip move back up. Selling is justified if euro weakness persists due to weak fundamentals.

Important: Before selling, ensure MACD is below the zero line and just beginning to decline.

Scenario 2: Sell EUR/USD after two consecutive tests of the 1.1638 level, provided MACD is in overbought territory. This signal limits upside potential and could lead to a reversal toward 1.1619 and 1.1584.

Chart Key Explanations

- Thin green line – approximate entry point for long positions

- Thick green line – suggested Take Profit level or area to secure gains, as growth above this point is unlikely

- Thin red line – approximate entry point for short positions

- Thick red line – suggested Take Profit level or area to secure gains, as further decline is unlikely

- MACD Indicator – use overbought/oversold conditions to guide entry decisions

Important Note for Beginner Traders

If you are just starting out in Forex, exercise extreme caution when entering the market. It is safest to stay out during the release of major fundamental news to avoid being caught in sharp price swings. If you decide to trade during news events, always set Stop Loss orders to limit potential losses. Not placing Stop Loss orders can lead to rapid account depletion, especially if you don't apply proper money management techniques or trade with overly large positions.

Remember, successful trading requires a clear and structured plan like the one outlined above. Spontaneous decisions based on short-term market noise are a losing strategy for intraday traders. Stick to your plan, manage your risk, and only enter the market when conditions match your criteria.