Yesterday, US stock indices closed with gains. The S&P 500 rose by 1.07%, while the Nasdaq 100 added 1.37%. The industrial Dow Jones strengthened by 1.12%.

Wall Street traders continue to buy stocks amid positive signals from corporate America and hopes for easing tensions between the world's two largest economies. The yield on 10-year Treasury bonds fell by three basis points to 3.98%. Gold prices surged.

Optimism in the stock market is fueled not only by quarterly earnings reports exceeding expectations, but also by growing speculation over a possible resolution to trade disagreements. The easing of tensions between the United States and China provides significant support to the market. News about the resumption of negotiations and the sides' willingness to seek compromise instills hope that a full-scale trade war, which could inflict serious damage on the global economy, will be avoided. This has a positive impact on shares of companies engaged in international trade and reliant on supplies from China.

Yesterday, US President Donald Trump reiterated his threat to raise tariffs on Chinese goods if no agreement is reached by November 1. At the same time, he emphasized that the plan to meet with Chairman Xi Jinping next week remains in place.

The earnings season is in full swing: around 85% of companies in the S&P 500 have reported profits above forecasts. This has contributed to a recovery in stock prices: yesterday, the index posted its best two-day gain since June. Traders, who were deprived of data due to the shutdown for several weeks, can now rely on strong corporate reports. Yesterday, Apple Inc. shares hit their high following the release of its report.

Many market participants believe that despite spikes in volatility, the underlying backdrop for equities remains favorable. Recently, any period of weakness leads to aggressive buying, and while institutional investors have become more cautious, retail investors continue to show a buying tendency. "The combination of a better growth and earnings outlook, supportive policy, and investors eagerly buying dips justifies a more positive medium-term outlook," UBS Global Wealth Management said.

However, there are those who view the market with caution. Strategists at Deutsche Bank AG noted that overall positioning in equities fell sharply last week and sentiment generally turned bearish. Meanwhile, Morgan Stanley stated that a deal between the US and China and stability in earnings revisions are necessary to reduce the risk of further stock corrections.

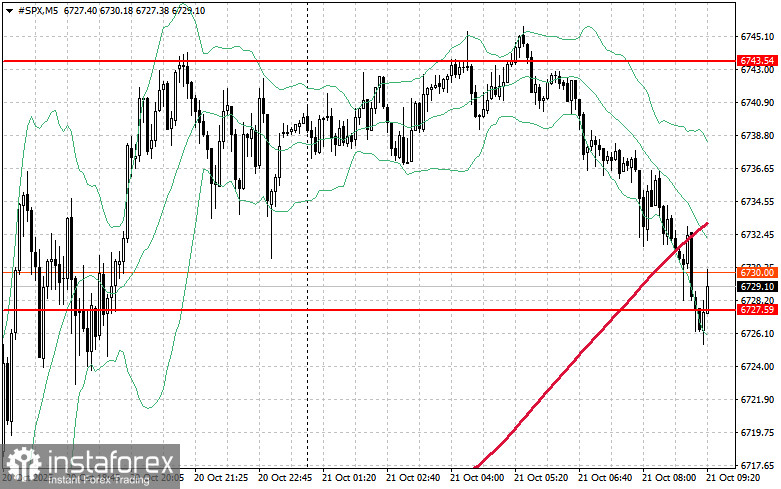

As for the technical picture of the S&P 500, the main goal for buyers today will be to break through the nearest resistance level of $6,743. This will help the index gain ground and also open the possibility for a move to the new level of $6,756. Equally important for bulls will be maintaining control at $6,769, which will strengthen buyers' positions. In case of a downward move amid reduced risk appetite, buyers must assert themselves in the area of $6,727. A break below this level will quickly push the trading instrument back to $6,711 and open the road toward $6,697.