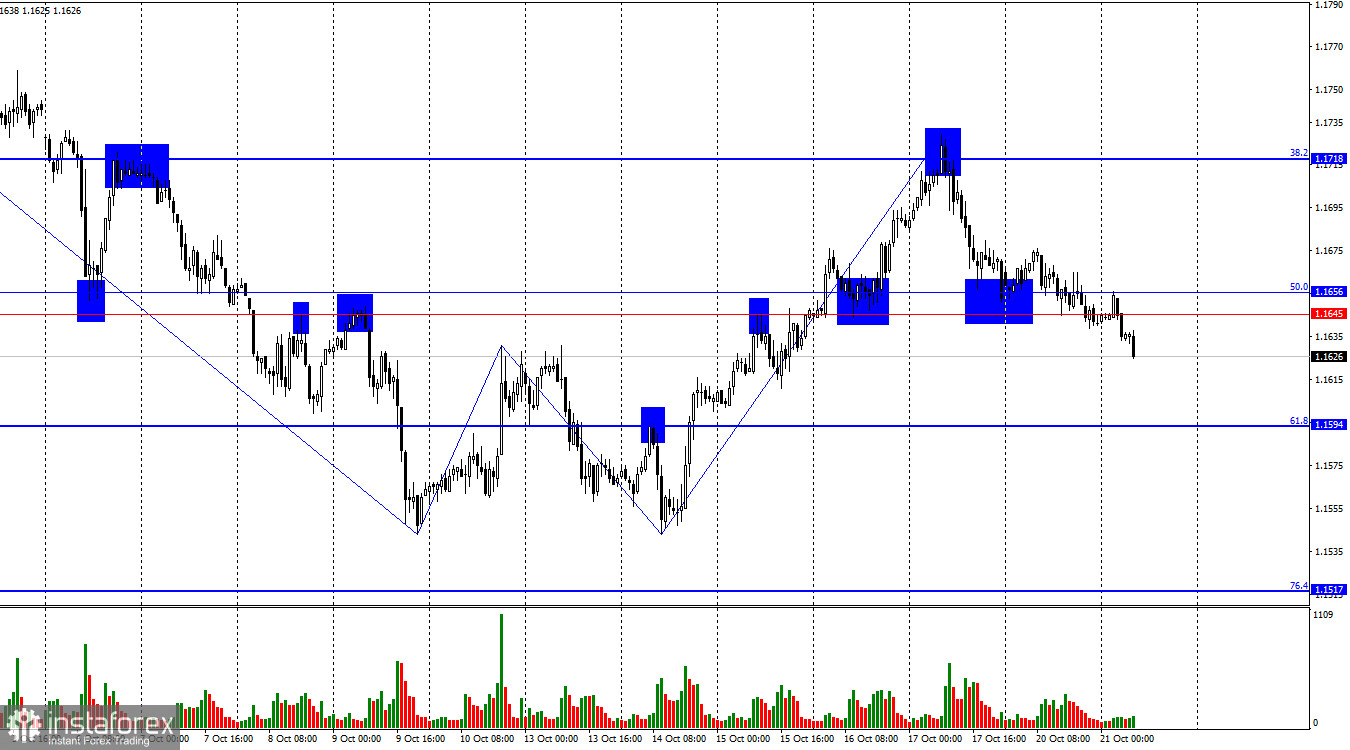

On Monday, the EUR/USD pair continued to decline despite the fairly strong support level of 1.1645–1.1656. Consolidation below this zone allows for expectations of further decline toward the next 61.8% retracement level at 1.1594. A close above this zone, however, would allow for a renewed rise toward the 38.2% Fibonacci level at 1.1718.

The wave structure on the hourly chart remains simple and clear. The last upward wave broke the previous wave's peak, while the most recent completed downward wave did not break the previous low. Thus, at the moment, the trend has shifted to bullish. Recent labor market data, the changed outlook for Fed monetary policy, Trump's renewed aggression toward China, and the ongoing government shutdown all support bullish traders. However, the bulls continue to attack very sluggishly, as if unwilling to take advantage of the favorable background for reasons unknown.

On Monday, there was no significant news background at all. During the day, Donald Trump made new remarks directed at China, and Bundesbank President Joachim Nagel also spoke. However, trader activity was so low that it's doubtful anyone paid much attention. The U.S. president said nothing of real importance. Talks with China are still "planned" for November; Trump continues to complain about Beijing's decision to restrict exports of rare earth metals and is again threatening 100% tariffs. Nagel noted that ECB interest rates could change, though he sees this as unlikely.

In short, nothing important was said on Monday, and Tuesday's news background will be no better. There will be another speech by Christine Lagarde, but she has little news to tell traders. The ECB is maintaining a stable monetary policy stance and keeping inflation under control, so there is no need for rate adjustments. Inflation in the European Union has risen slightly over recent months, but not enough to sound the alarm. In any case, the ECB only recently ended its monetary easing program, making it unlikely to begin tightening just a few months later.

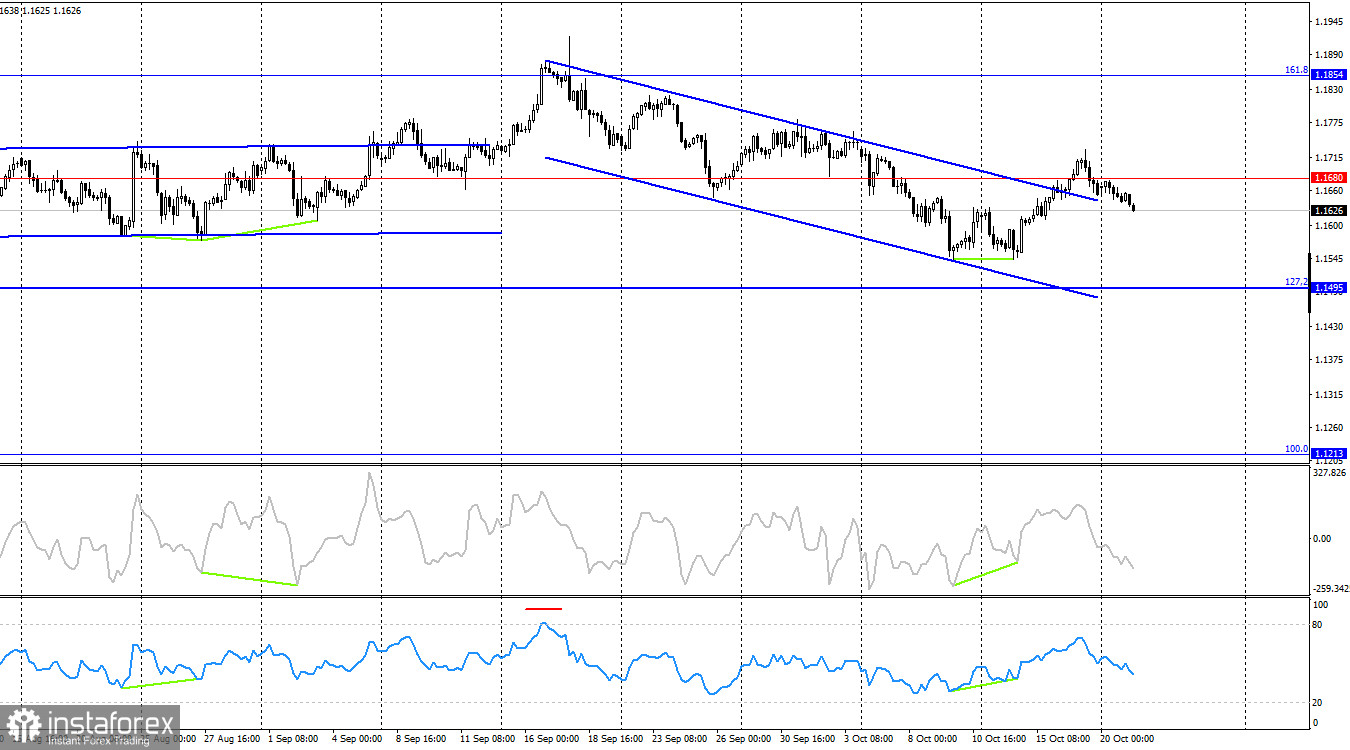

On the four-hour chart, the pair reversed in favor of the U.S. dollar and consolidated below the 1.1680 level, which allows traders to expect some further decline. However, earlier, the pair also consolidated above the downward trend channel following the formation of a bullish divergence on the CCI indicator. Thus, the upward movement could resume toward the next 161.8% retracement level at 1.1854. Market movements remain very weak, so the hourly chart analysis appears more relevant at this stage.

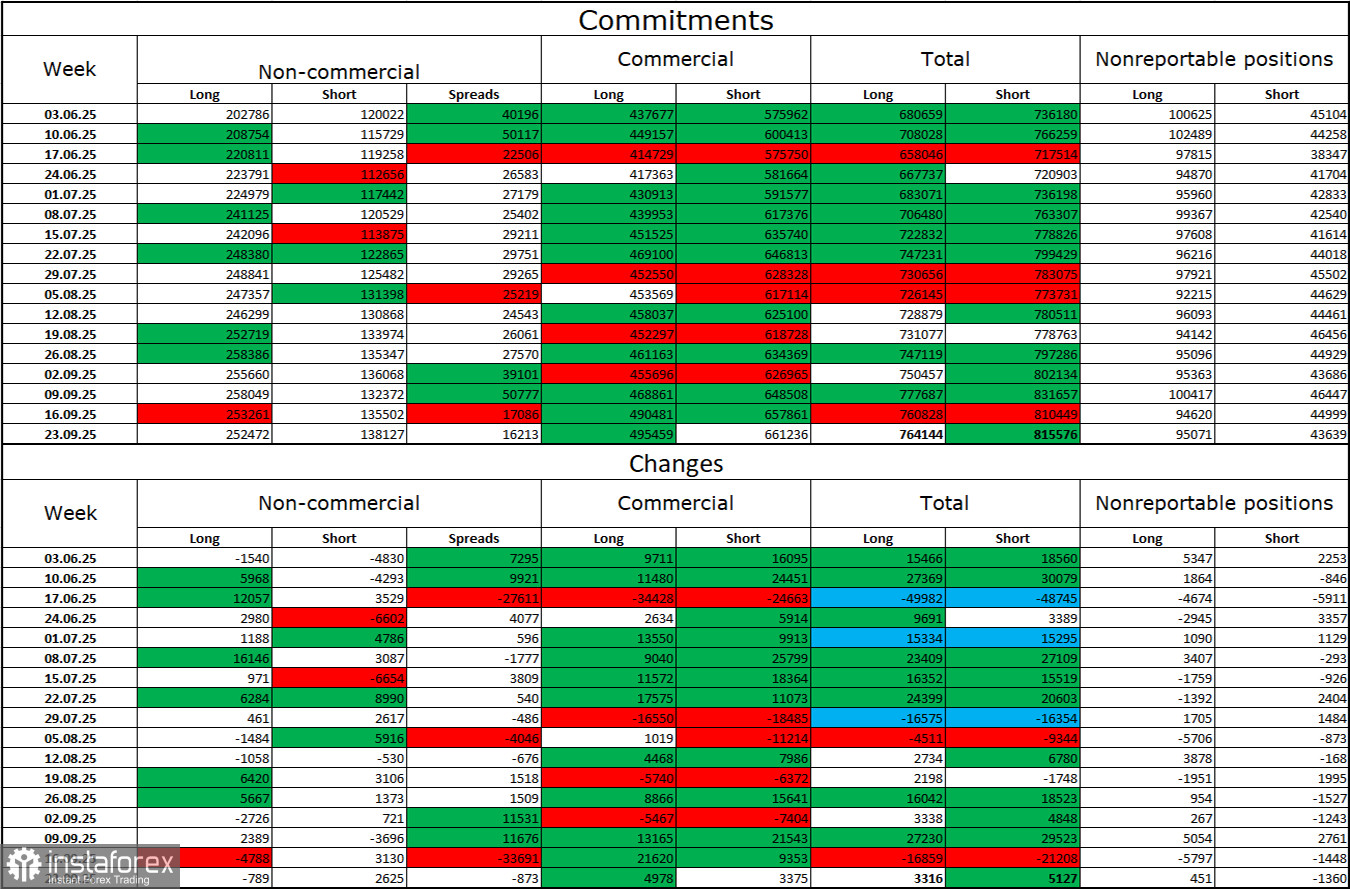

Commitments of Traders (COT) Report:

During the most recent reporting week, professional traders closed 789 long positions and opened 2,625 short positions. The sentiment of the non-commercial group remains bullish, largely thanks to Donald Trump, and continues to strengthen over time. The total number of long positions held by speculators now stands at 252,000, compared to 138,000 short positions — nearly a two-to-one ratio.

Also note the large number of green cells in the table above — these reflect a strong increase in long positions on the euro. In most cases, interest in the euro is growing, while interest in the dollar is falling.

For thirty-three consecutive weeks, large traders have been reducing short positions and adding long positions. Trump's policies remain the most influential factor for traders, as they may create long-term structural problems for the U.S. economy. Despite the signing of several key trade agreements, many important economic indicators continue to show decline.

News Calendar for the U.S. and the Eurozone:

- Eurozone – Speech by ECB President Christine Lagarde (11:00 UTC).

For October 21, the economic calendar contains only one noteworthy event for traders. The impact of the news background on market sentiment on Tuesday will likely be weak.

EUR/USD Forecast and Trading Advice:

Sales were possible after a rebound from the 1.1718 level on the hourly chart, with a target of 1.1656 — this target has already been reached. New short positions became possible after a close below the 1.1645–1.1656 level, targeting 1.1594 — these trades can currently be kept open. Buying can be considered today in case of a rebound from 1.1594, with targets at 1.1645–1.1656.

Fibonacci grids are drawn between 1.1392–1.1919 on the hourly chart and 1.1214–1.0179 on the four-hour chart.