Macroeconomic Report Analysis:

There are very few macroeconomic reports scheduled for Wednesday. Only in the United Kingdom will an inflation report for September be published in about an hour. Expert forecasts suggest that the Consumer Price Index will rise to 4.0%, which is double the Bank of England's target level. We believe that with such a level of inflation (or higher), which has also been rising for a whole year, there can be no talk of a new key rate cut. Thus, rising inflation may support the British currency. In Germany, the European Union, and the United States, no important reports are scheduled for today.

Fundamental Event Analysis:

Few fundamental events are scheduled for Wednesday, and virtually none of them are of interest. Over the past few weeks, we have witnessed numerous speeches from representatives of the European Central Bank, BOE, and the Federal Reserve, so the positions of all three central banks are thoroughly understood. A new speech by Christine Lagarde today is unlikely to provide the market with food for thought. Let us recall that inflation in the Eurozone rose more than expected in September, which does not imply a new easing of monetary policy. However, even without the latest inflation report, the ECB was not inclined to lower the key interest rate. Thus, with the release of the new inflation report, nothing has changed.

General Conclusions:

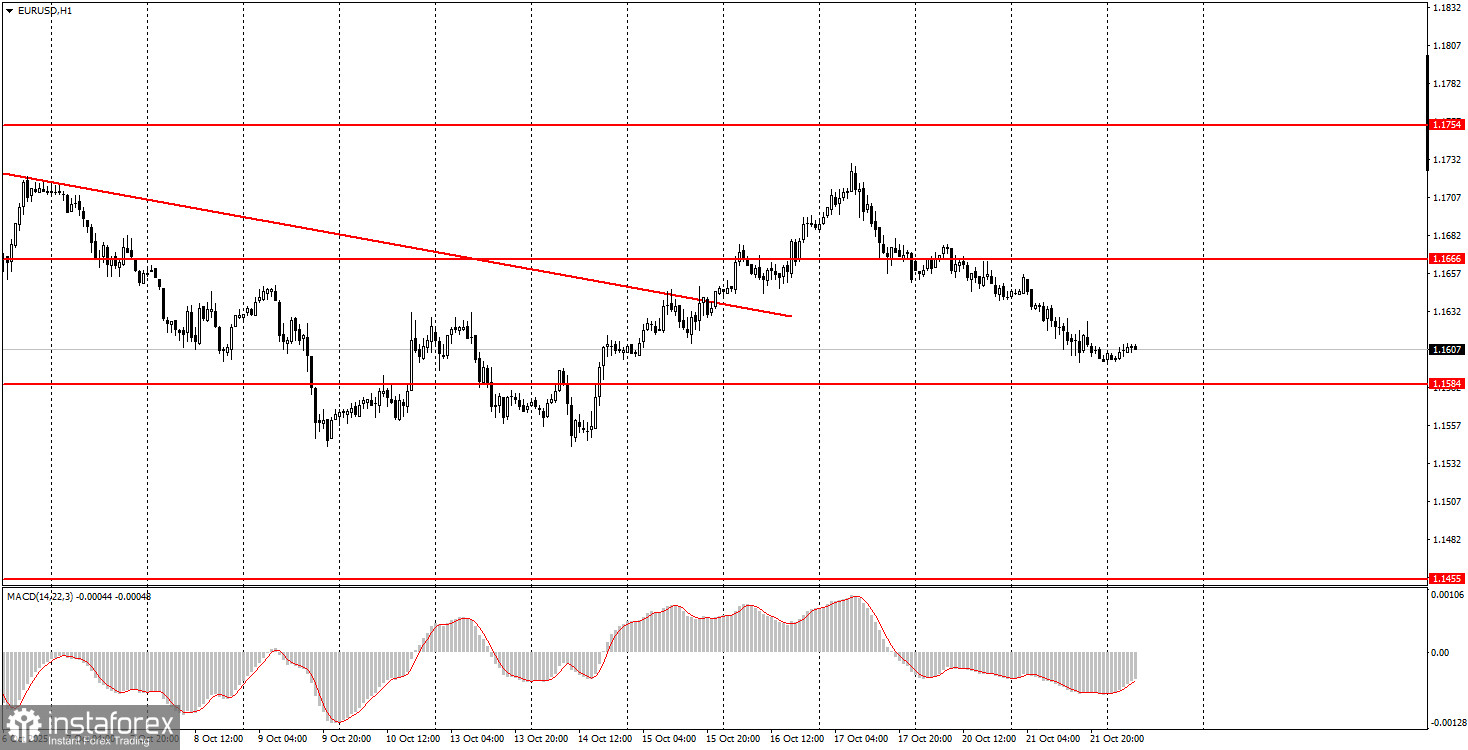

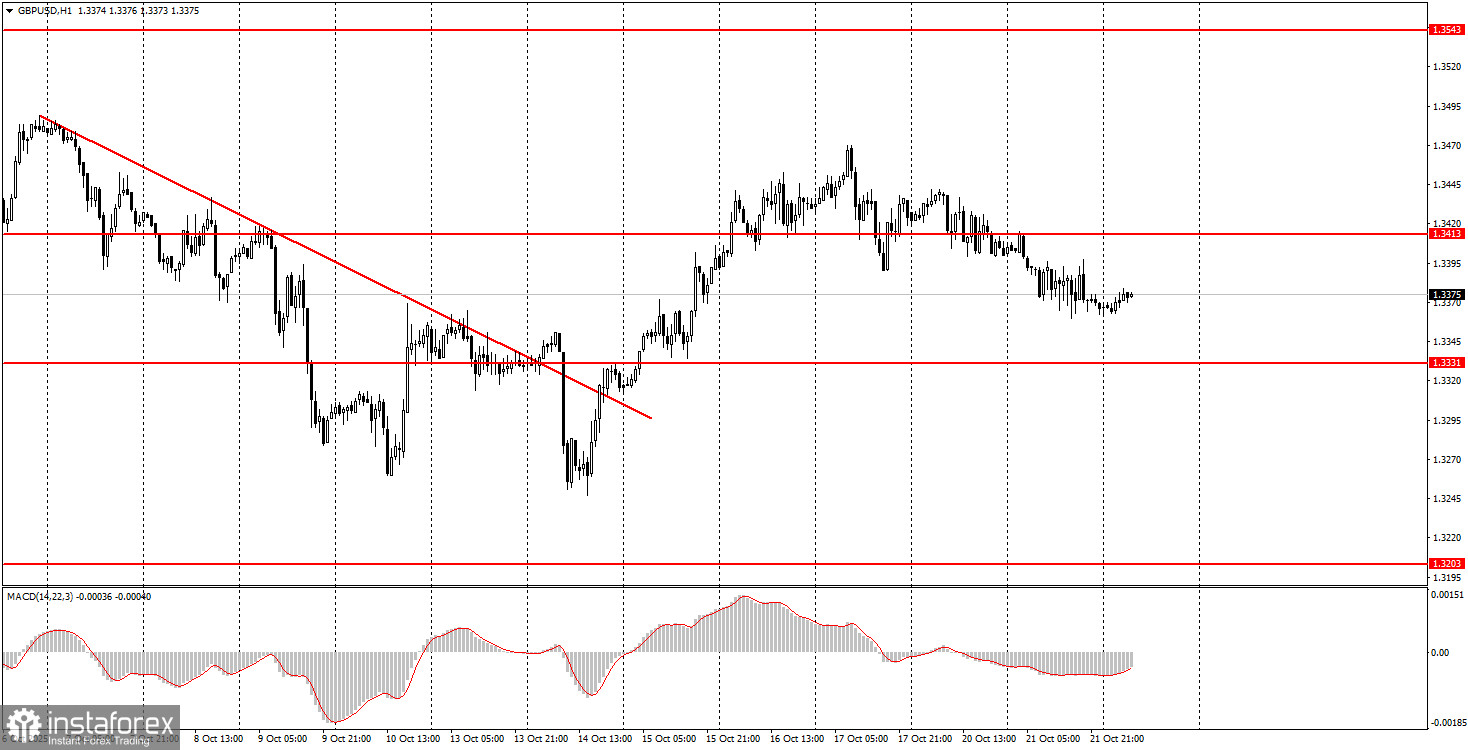

During the third trading day of the week, both currency pairs may once again remain in a low-volatility flat. The European currency has a good trading zone at 1.1571–1.1584, from which both long and short positions can be considered. The British pound is located precisely between the areas of 1.3329–1.3331 and 1.3413–1.3421. However, let us remind that market volatility is currently low, and the macroeconomic background is practically absent. Only the pound has a chance to show significant movement today due to the inflation report.

Core Trading System Rules

- The strength of any signal is determined by how quickly it forms (breakout or rebound). The faster it forms, the stronger the signal.

- If two or more false trades have occurred near a level, all subsequent signals from that level should be ignored.

- During flat markets, any pair may generate many false signals—or fail to generate any at all. In these scenarios, it's better to suspend trading when the flat is confirmed.

- Trades should be executed between the beginning of the European session and the midpoint of the U.S. session. All open positions should be manually closed afterward.

- On the 1-hour chart, MACD-based trades should only be executed when good volatility and a clear trend are present, preferably confirmed by a visible trendline or channel.

- If two levels are located too close together (5–20 pips), treat them as a support/resistance area rather than individual levels.

- Once a trade moves 15-20 pips in your favor, the Stop Loss should be moved to breakeven to protect capital.

What's on the Chart?

- Support and resistance levels represent key price zones, often suitable for placing Take Profit orders.

- Red lines indicate trendlines or trend channels and denote the current market direction.

- The MACD (14,22,3) indicator and its histogram/signal line serve as a useful tool for confirming entries.

- Murray levels can help estimate the range or limits of trend and correction phases.

- Volatility levels (red horizontal lines) define the probable price range based on recent price action.

- The CCI indicator provides reversal signals when entering overbought (above +250) or oversold (below -250) zones.

Important Note for Beginners

Trading during major news events (as listed on the calendar) can significantly impact price movement. During such times, trade cautiously or step out of the market entirely to avoid a sharp reversal against your position.

Beginners must remember that not every trade can be profitable. The key to long-term success in forex is maintaining a consistent strategy, reinforcing discipline, controlling risk, and following sound money management principles.