Trade Analysis and Tips for Trading the Euro

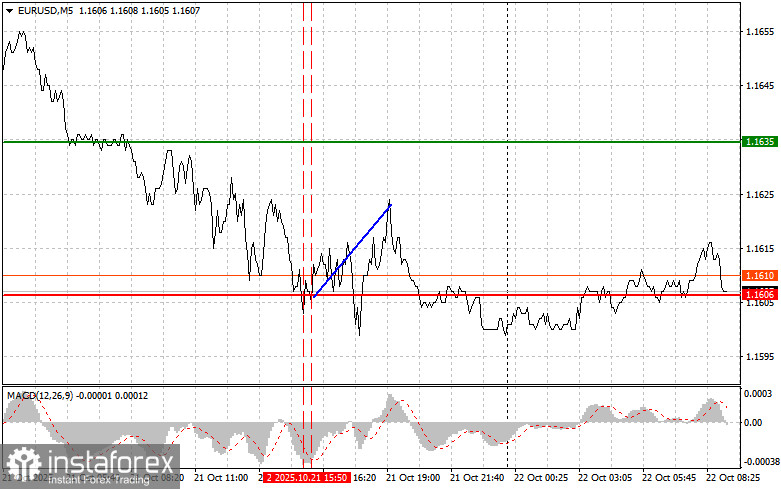

The price test of 1.1606 occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the euro. The second test of this level occurred when the MACD indicator was in the oversold zone, triggering Scenario #2 for buying the euro, which resulted in a 20-pip rise in the euro's value.

President Trump's inconsistent approach to resolving trade disputes with China continues to keep investors from active operations with the euro. Uncertainty about the possibility of reaching a full-fledged trade agreement negatively affects market sentiment, with participants preferring to observe rather than act. One moment, Trump states he's ready to meet with Xi, and then a few hours later, he says he intends to impose 155% tariffs on China starting November 1.

Today, no economic data is scheduled to be published in the Eurozone during the first half of the day, which automatically shifts attention to the speech by European Central Bank President Christine Lagarde. Traders will pay close attention to her comments regarding future inflation trends, economic growth, and subsequent monetary policy actions. Market participants are looking for hints on how concerned the central bank is about pricing and its willingness to implement further monetary stimulus if needed.

In addition to Lagarde's speech, investors will also be following developments from the US and China regarding the status of a trade agreement.

For the intraday strategy, I will rely primarily on the execution of Scenarios #1 and #2.

Buy Scenarios

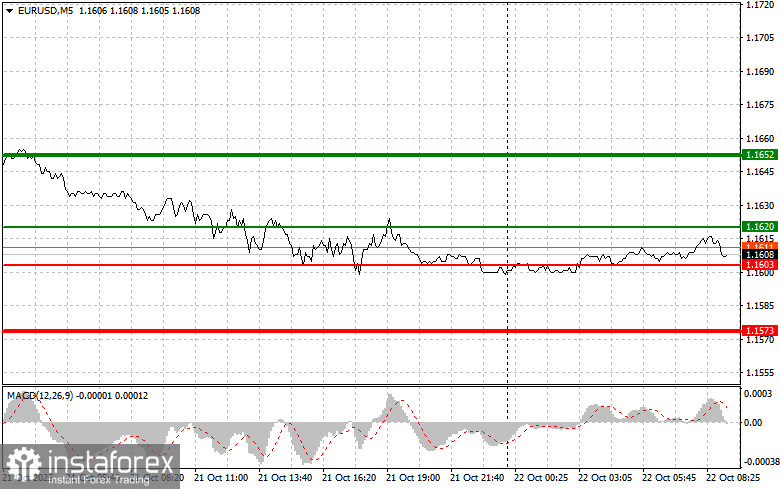

- Scenario #1: Today, I plan to buy the euro upon reaching the price of 1.1620 (green line on the chart), targeting growth toward 1.1652. At 1.1652, I plan to exit the market and sell the euro on a pullback, expecting a move of 30–35 pips from the entry level. Euro growth should only be expected following a hawkish stance from Lagarde.

- Important: Before buying, confirm that the MACD indicator is above the zero line and just starting to rise from it.

- Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1603 level while the MACD indicator is in the oversold zone. This would limit downside potential and trigger a reversal to the upside. Growth can then be expected toward the 1.1620 and 1.1652 levels.

Sell Scenarios

- Scenario #1: I plan to sell the euro after it reaches the 1.1603 level (red line on the chart), targeting a move down to 1.1573. At 1.1573, I will exit short positions and buy immediately on a rebound (expecting a 20–25 pip counter-move). Pressure on the pair would return today if Lagarde delivers dovish comments.

- Important: Before selling, confirm that the MACD indicator is below the zero line and just starting to decline from it.

- Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1620 level, while the MACD indicator is in the overbought zone. This would limit upside potential and result in a reversal down. A decline can be expected toward the 1.1603 and 1.1573 levels.

What's on the Chart:

- Thin green line – entry price to buy the trading instrument

- Thick green line – projected price for placing Take Profit or manually exiting long positions (further growth beyond this point is unlikely)

- Thin red line – entry price to sell the trading instrument

- Thick red line – projected price for placing Take Profit or manually exiting short positions (further decline below this point is unlikely)

- MACD Indicator – when entering trades, it's important to follow overbought and oversold zones

Important: Beginner traders on the Forex market must be very cautious when making entry decisions. Before the release of key fundamental reports, it is generally best to stay out of the market to avoid sudden price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you could quickly lose your entire deposit—especially if you do not use money management and trade with high volumes.

Remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decision-making based on the current market situation is an inherently losing strategy for intraday traders.