No volatility — no problem. According to Bank of America, subdued US dollar trading has allowed investors to step away from the "Sell America" narrative. Ultimately, this has led to short-covering on the greenback and has helped the USD index stabilize. This can be attributed to a mix of divergent factors contributing to the formation of a medium-term consolidation range in EUR/USD.

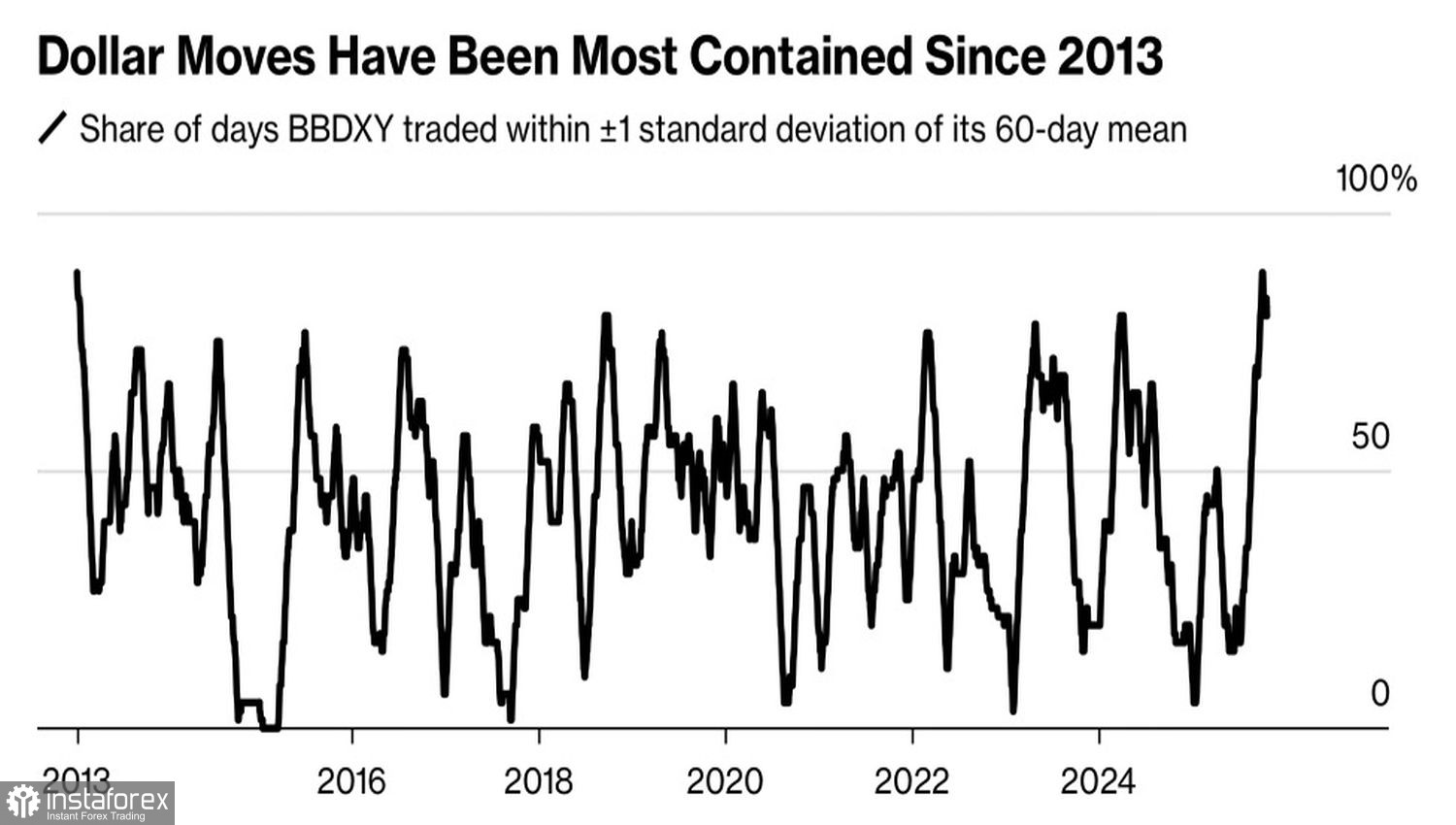

Over the last 60 trading days, the US dollar has remained within one standard deviation of its average 80% of the time. At the beginning of October, that figure stood at 88% — the highest level in over a decade.

Share of USD traded within one standard deviation range (visual/chart reference if applicable)

The driver behind the USD index's lack of movement has been political uncertainty. The current US government shutdown has lasted 22 days, making it the second-longest in history. Typically, during such events, the US dollar tends to weaken. However, what makes this October unique is the weakness of the greenback's competitors. The euro is under pressure due to a budgetary deadlock in France, while the yen is struggling as Japan's new prime minister curtails the Bank of Japan's ability to pursue monetary tightening.

As a result, EUR/USD is facing opposing forces, leading to a consolidation of the major currency pair. If not for US political instability, the euro would likely be strengthening against the dollar. European Central Bank Vice President Luis de Guindos has confirmed he is satisfied with the current monetary policy settings, and interest rates are seen as appropriate. Markets do not expect rate cuts in either October or December. In contrast, derivatives linked to the Fed are pricing in two rate cuts by the end of 2025.

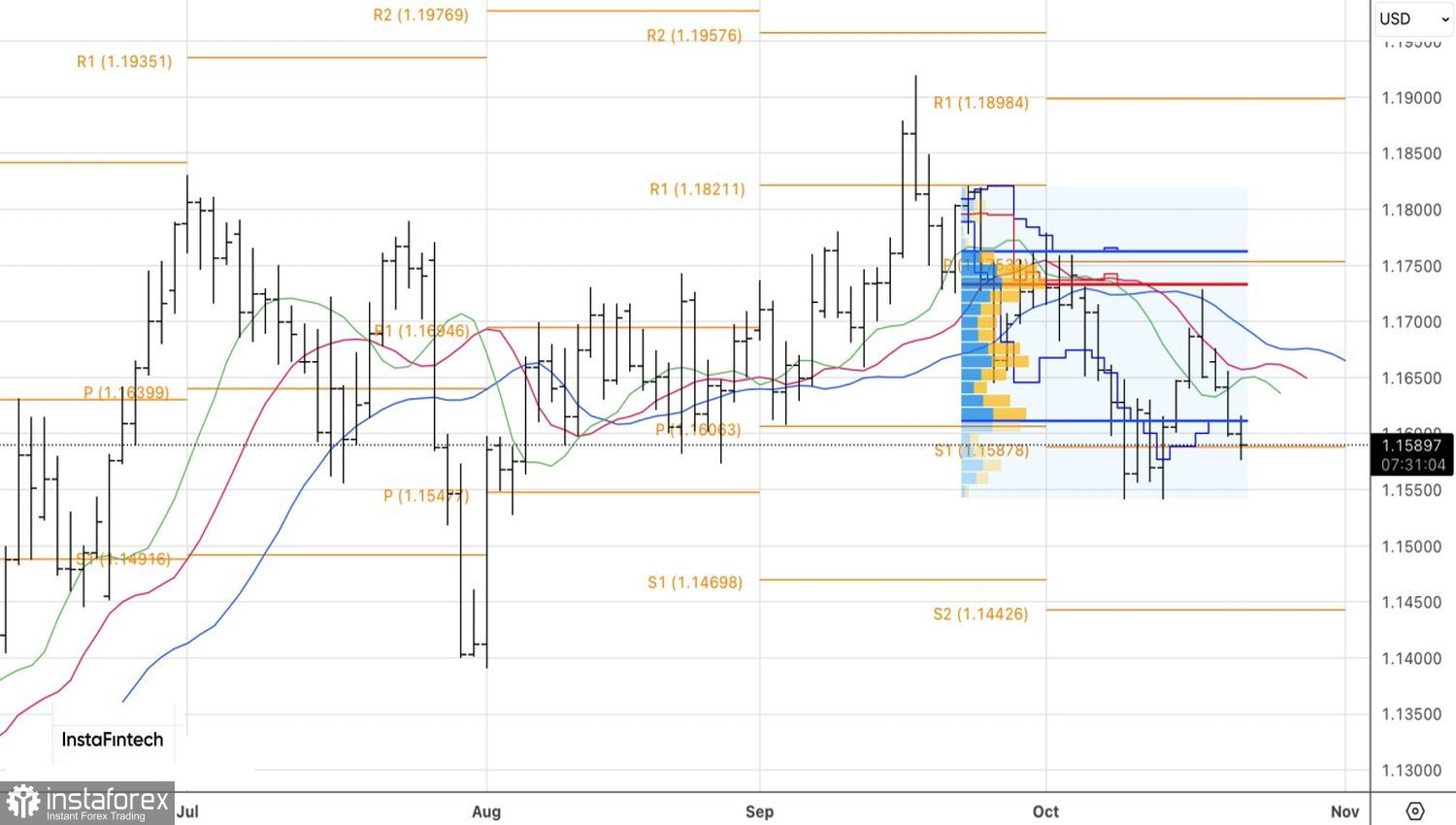

In the medium term, the EUR/USD consolidation range of 1.14–1.18 is more likely to be broken to the upside than the downside. Increased EU defense spending and Germany's fiscal stimulus efforts will support economic acceleration in the eurozone. Meanwhile, US GDP growth is expected to slow due to tariffs — costs that will likely fall on American consumers rather than importers. As a result, the divergence in economic growth between the US and the eurozone is expected to narrow, lending support to the euro.

Another bullish factor for EUR/USD is foreign investors hedging currency risks when purchasing US securities, which involves selling the US dollar. As long as TACO (Trump Always Capitulates Optics) sentiment dominates markets, the greenback and the S&P 500 tend to move in the same direction. However, this alignment cannot last forever. Eventually, their paths will diverge, and the US stock market rally is likely to lend a helping hand to the euro.

From a technical perspective, the daily EUR/USD chart is forming a doji bar. If the bulls succeed in pulling the pair back into the fair value range of 1.161–1.176, any shorts initiated from the 1.1645 level should be closed and reversed. Long positions will become resonable.