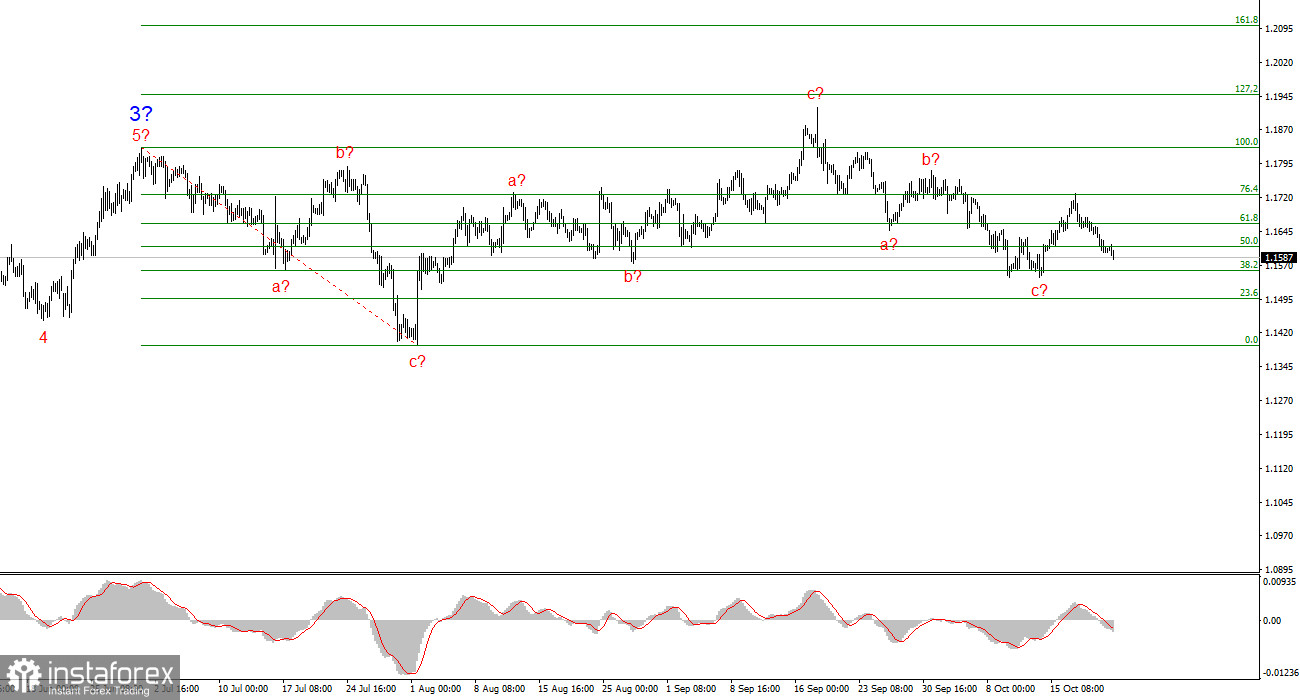

The wave pattern on the 4-hour EUR/USD chart has transformed — unfortunately, not for the better. It's still too early to conclude that the upward section of the trend has been canceled, but the recent decline in the euro has made it necessary to adjust the wave count.

At this point, we can see a series of three-wave structures (a-b-c). It can be assumed that they are part of the larger wave 4 within the overall upward trend section. In this case, wave 4 has taken on an unnaturally extended form, though overall the wave pattern still maintains its integrity.

The upward trend construction continues, while the news background mostly fails to support the U.S. dollar. The trade war initiated by Donald Trump continues. The confrontation with the Federal Reserve continues. Market "dovish" expectations regarding Fed policy are growing. The U.S. government shutdown is still ongoing. The market has a rather low opinion of Trump's first nine months in office, even though GDP growth in Q2 reached nearly 4%.

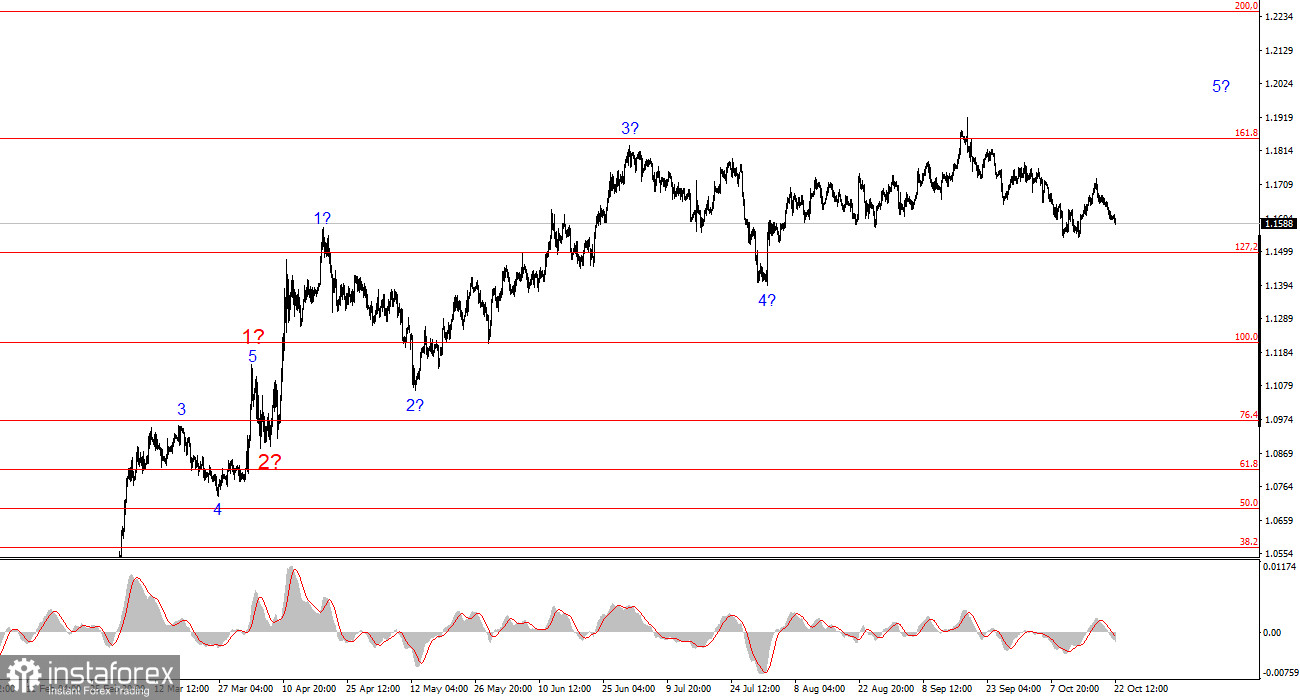

In my view, the construction of the upward trend section is not yet complete, and its potential targets extend up to the 1.25 level. Based on this, the euro may continue to decline for some time without any strong fundamental reasons (as in the past three weeks), yet the wave structure will still remain consistent.

The EUR/USD pair lost another 20 basis points on Wednesday, and overall has fallen about 100 points this week. That's not much — and indeed, it doesn't seem to be. Despite the euro's decline in recent days and weeks, this movement does not affect the broader wave structure. The upward trend continues to form; it's just that its internal structure has become more complex and elongated.

Unfortunately, such complications are quite common — although they're not ideal for traders. Still, that's the reality of the market. In recent weeks, we've seen low volatility and narrow price ranges.

There was no significant news on Wednesday. The first interesting reports are expected only on Friday, so tomorrow the market may continue to trade in the same fashion as in the past three days. Personally, I see no fundamental reason for the market to reduce demand for the euro, but the pair must move somewhere nonetheless.

Based on this, I consider the current decline to be a random fluctuation, driven mainly by the absence of news catalysts. It's quite possible that the current downward wave sequence will take the form of a five-wave structure (a-b-c-d-e). If that's the case, the pair could fall toward the 1.15 level.

General Conclusions

Based on my analysis of EUR/USD, I conclude that the pair continues to build an upward trend section. The wave pattern still depends entirely on the news background — specifically, on decisions by Donald Trump, as well as the domestic and foreign policy of the White House administration.

The targets of the current trend section could extend up to the 1.25 level. At the moment, we are likely seeing the formation of corrective wave 4, which is nearing completion but has taken a very complex and extended form. Therefore, in the short term, I continue to consider buying positions only. By the end of the year, I expect the euro to rise toward 1.2245, corresponding to the 200.0% Fibonacci extension.

On a smaller scale, the entire upward trend section is clearly visible. The wave count is somewhat non-standard, since the corrective waves vary in size — for example, the larger wave 2 is smaller than the inner wave 2 within wave 3. However, such cases do occur.

I would like to remind traders that it's better to focus on recognizable, clear structures on the chart rather than trying to identify every individual wave. At this point, the upward structure appears mostly clear and coherent.

The Main Principles of My Analysis

- Wave structures should be simple and clear. Complex patterns are difficult to interpret and often indicate upcoming changes.

- If you are uncertain about the market situation, it's better to stay out.

- There is never 100% certainty about the market's direction. Always remember to use Stop Loss protective orders.

- Wave analysis can be combined with other analytical approaches and trading strategies.