On Tuesday, Japan's newly appointed Prime Minister Sanae Takaichi outlined her economic priorities, announcing plans to develop a stimulus package to boost the broader economy and support household spending. Proposed measures include eliminating a temporary gasoline tax and raising the income tax exemption threshold—each of which will require additional government spending. This, in turn, will necessitate further bond issuance, causing Japan's already high national debt to swell even further.

Crucially, a higher interest rate from the Bank of Japan would increase the cost of servicing this debt, decreasing the likelihood of a near-term rate hike. While the exact size of the new stimulus package is still being finalized, it is expected to surpass the previous supplementary budget of £13.9 trillion proposed under the Ishiba administration.

This announcement triggered a broad market reaction: a rally in Japanese equities, a rise in bond yields, and renewed yen weakness.

Regarding monetary policy, Prime Minister Takaichi emphasized that although the BoJ is responsible for setting monetary policy, the government is fully accountable for macroeconomic outcomes, of which monetary policy is a component. This approach implies significant government influence over the Bank's decisions. As a result, the BoJ is unlikely to act independently and may need added time to coordinate with the government, making a rate hike at next week's meeting increasingly improbable.

Markets have already responded accordingly. Rate hike expectations have been sharply revised lower. On October 21, Bloomberg, citing sources familiar with the matter, reported that BoJ policymakers "see no need for an urgent rate hike next week," though "they recognize conditions may warrant a rate increase by December."

The prospect of a delay in the rate decision until December is becoming increasingly likely.

Since an October rate hike had been priced into the yen before Takaichi's election, the repricing of expectations to December has forced yen depreciation, which is currently unfolding in real time.

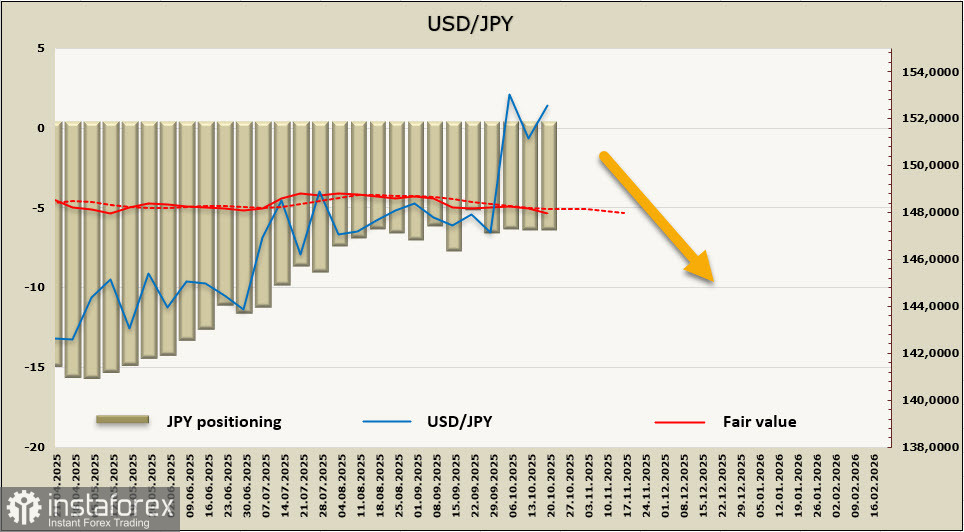

The model price remains near its long-term average, with a slight southern deviation, but given the ongoing U.S. government shutdown and incomplete data, directional conclusions should be approached with caution.

USD/JPY has advanced following the surprise appointment of Takaichi, as the odds of a BoJ hike next week declined. Subsequent political developments have added little additional clarity, making the yen's weakening trend understandable.

The model price reflects market consensus. If the Fed continues cutting rates and the BoJ eventually tightens policy, the interest rate spread would shift in favor of the yen, making it more attractive. However, consensus does not guarantee accuracy—BoJ may delay its rate hike, while the Fed might slow the pace of easing.

In the short term, USD/JPY may continue to rise toward the significant resistance zone at 154.00–154.20. However, if expectations shift and markets conclude that the BoJ is indeed prepared to hike rates soon, the pair could quickly decline toward the lower boundary of the channel at 146.80–147.10.