Trade Review and Trading Advice on the Euro

The price test at 1.1596 occurred when the MACD indicator was starting to move above the zero line, confirming a valid entry point to buy the euro. As a result, the pair rose to the target level near 1.1617.

Dovish remarks from Federal Reserve officials on the future path of interest rates, along with hints of an imminent end to the Fed's quantitative tightening program, exerted downward pressure on the U.S. dollar.

Today will be devoted to analyzing macroeconomic data, specifically the Eurozone PMI figures for October: manufacturing and services activity indicators, as well as the composite index. These figures reflect the region's economic conditions and indicate the current state of the production and services sectors, as well as overall business sentiment. Higher-than-expected results may support the euro, while disappointing data could reduce demand for risk assets. In addition, the comments accompanying the data releases are important, as they often contain valuable insights into the Eurozone's economic outlook.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Scenarios

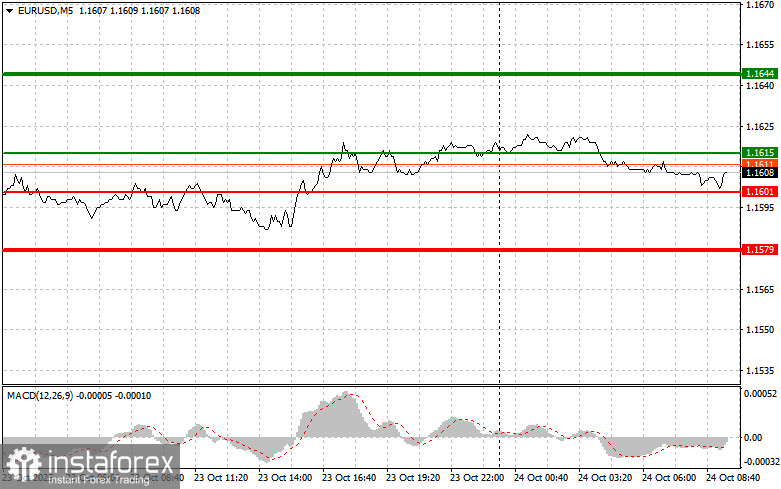

Scenario No. 1: Today, I will buy the euro at a price of around 1.1615 (green line on the chart), with an upward target at 1.1644. At 1.1644, I plan to exit the trade and sell the euro in the opposite direction, aiming for a 30–35-pip move from the entry point. A further rise in the euro can only be expected following positive index data.

Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario No. 2: I also plan to buy euros today if the 1.1601 level is tested twice in a row, while the MACD indicator is in the oversold zone. This would limit the downside potential and could result in a bullish reversal. A rise toward 1.1615 and 1.1644 is anticipated.

Sell Scenarios

Scenario No. 1: I plan to sell the euro after it reaches 1.1601 (red line on the chart), targeting 1.1579. At 1.1579, I will exit the market and buy in the opposite direction (anticipating a 20–25-pip rebound). Selling pressure may return if the data is weak.

Important: Before selling, ensure that the MACD indicator is below the zero mark and just beginning to decline.

Scenario No. 2: I also intend to sell the euro today if two consecutive tests of the 1.1615 level occur while the MACD indicator is in the overbought zone. This would cap the pair's upside potential and result in a downside reversal. A drop to the 1.1601 and 1.1579 levels may then be expected.

What's on the Chart:

Thin green line – entry price for buying the trading instrument

Thick green line – anticipated level for placing Take Profit or manually locking in gains, as further growth above this level is unlikely

Thin red line – entry price for selling the trading instrument

Thick red line – anticipated level for placing Take Profit or manually locking in gains, as further decline below this level is unlikely

MACD Indicator – it's crucial to use overbought and oversold zones when making trading decisions

Important: Beginner Forex traders must make entry decisions carefully. Ahead of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, your entire deposit can be lost very quickly—especially if you don't practice money management and trade with large positions.

And remember, successful trading requires a well-defined trading plan, as demonstrated above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.