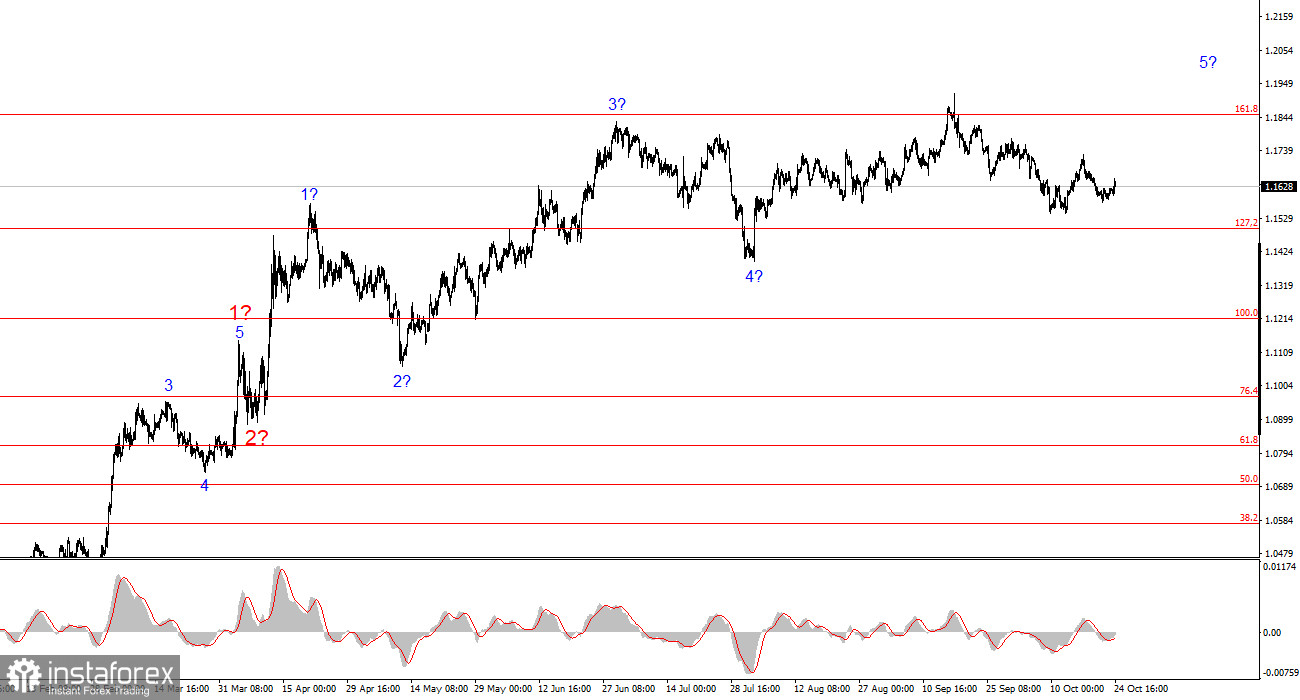

The wave pattern on the 4-hour chart for EUR/USD has changed — unfortunately, not for the better. It's still too early to conclude that the upward trend segment has ended, but the latest decline in the euro has made it necessary to clarify the wave structure.

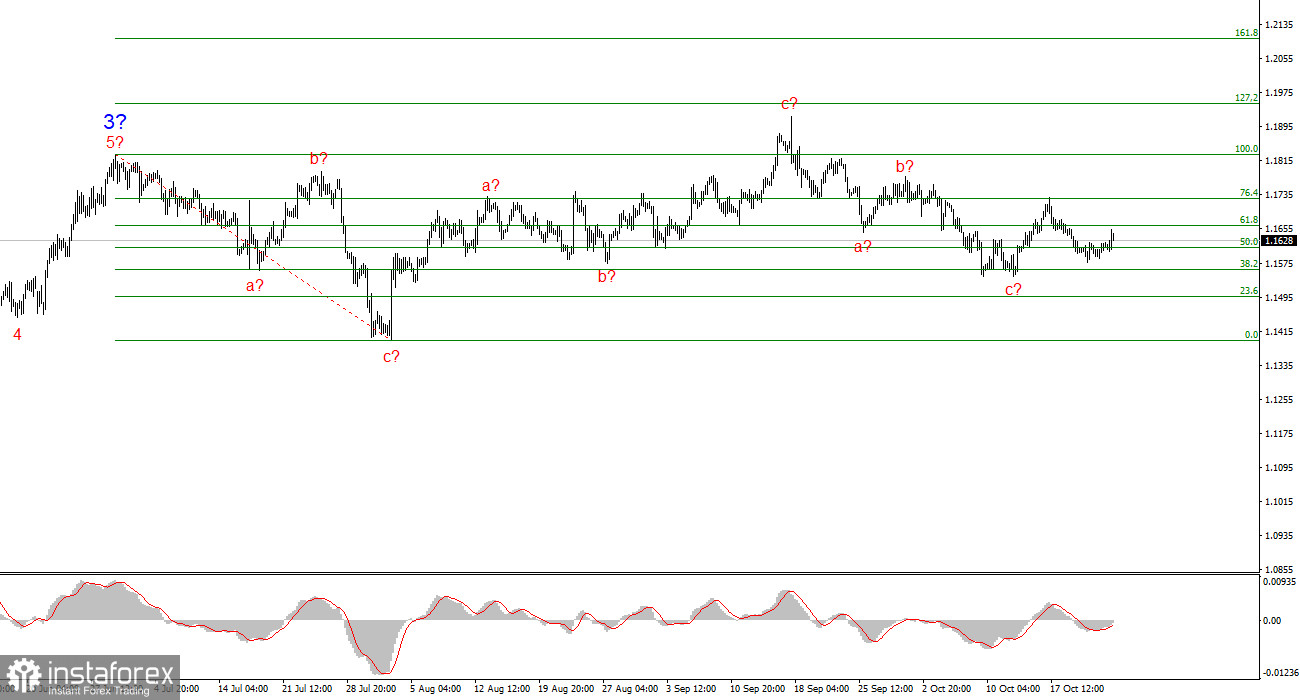

We can now see a series of three-wave patterns (a-b-c), which may be part of the global wave 4 within the overall upward trend. In this case, wave 4 has taken on an unnaturally extended form, but overall, the wave structure remains coherent and intact.

The formation of the upward trend continues, while the news background still largely favors currencies other than the dollar. The trade war initiated by Donald Trump continues. The confrontation with the Federal Reserve continues. The market's dovish expectations regarding the Fed's rate policy are growing. In the U.S., the government shutdown drags on. The market holds a low opinion of Trump's first nine months in office, even though economic growth in Q2 reached nearly 4%.

In my view, the upward trend segment is not yet complete, with potential targets extending up to the 1.25 level. This means that the euro may still decline for some time, even without any clear reason for it (as in the last three weeks). Nevertheless, the wave structure remains consistent.

The EUR/USD pair rose by 15 basis points on Friday — the result of what was expected to be the most important day of the week in terms of news background. Let's recall: today, Germany, the Eurozone, and the United States released their October business activity indexes, and the U.S. additionally published its inflation report — a key release ahead of next week's Federal Reserve meeting on interest rates.

Among all these reports, the market reacted only to U.S. inflation data. Undoubtedly, that was the most important and interesting release, and although forecasts missed the mark, the PMI data also offered a few surprises.

For quite some time now, markets have grown accustomed to Eurozone business activity coming in below expectations more often than not. However, this time, all four European reports came in above forecasts — not by much, but still above.

- Germany's manufacturing PMI exceeded expectations by 0.1 point, while the services PMI came in 2.2 points higher.

- The Eurozone manufacturing PMI beat expectations by 0.5 points, and the services PMI by 1.5 points.

Four out of four reports were positive for the euro, yet the market showed no willingness to buy the European currency. The construction of complex corrective structures continues, and the market fails to react to news, even when it's clearly positive.

General Conclusions

Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward trend segment. The wave structure still largely depends on news factors related to Trump's decisions, as well as the foreign and domestic policies of the new U.S. administration. The targets of the current trend segment may extend up to the 1.25 level. At present, we are likely seeing the formation of corrective wave 4, which is taking on a complex and extended form. Therefore, in the near future, I continue to consider only buying positions. By the end of the year, I expect the euro to rise toward 1.2245, which corresponds to the 200.0% Fibonacci level.

On the smaller scale, the entire upward trend segment is visible. The wave pattern is not entirely standard, since corrective waves differ in size. For example, major wave 2 is smaller than internal wave 2 of wave 3 — though such cases do happen. Let me remind you: it is best to identify clear and readable structures on charts, rather than focusing on every single wave. At present, the upward structure raises almost no questions.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to revisions.

- If there is uncertainty about what's happening in the market, it's better to stay out.

- Absolute certainty in market direction is impossible. Always use Stop Loss orders for protection.

- Wave analysis can be combined with other forms of analysis and trading strategies.