The market has fallen into a slumber, and the most interesting question now is not about the next actions of the Federal Reserve or the European Central Bank, nor about Donald Trump or Xi Jinping. The intriguing question is when we will see normal market movements again. For the EUR/USD instrument, the wave structure has already undergone its second or third cycle. Initially, wave 4 became extended, and now its internal wave c is unwilling to assume a simple three-wave form. There are certain chances for this wave to complete, but buyers continue to ignore numerous factors and news, which is detrimental to the euro, the wave structure, and trading in general.

The new week is expected to bring plenty of interesting events, in contrast to the previous week, when the only exciting day was Friday. Setting aside minor events, we will have at least the GDP report, the unemployment report, the ECB meeting, and the inflation report. For the first time in a long while, I can say that the European news flow will match the strength of that from the U.S. However, we will discuss the news from the U.S. later.

The reports in Europe will indeed be significant, but unfortunately, they may have little impact. An increase in the unemployment rate will put pressure on the euro, while weak GDP data may aid sellers of the euro. However, the inflation report at this time is practically meaningless, and we should not expect much from the ECB meeting.

The Consumer Price Index in Europe is gradually rising, but this growth does not allow the ECB to make moves in either direction. If inflation were to drop below 2%, the ECB could consider additional monetary easing. Conversely, if inflation were rising more robustly and quickly, the ECB might start contemplating interest rate hikes. However, by the end of October, the CPI is expected to remain around 2% (with a year-on-year decline to 2.1%). Thus, inflation appears to be the least significant of all the important reports.

Regarding the ECB meeting, the market does not expect any changes in monetary policy. Christine Lagarde's speech is also unlikely to bring any changes, as she has spoken very frequently in October, multiple times each week. There has been no significant information from her regarding the central bank's plans.

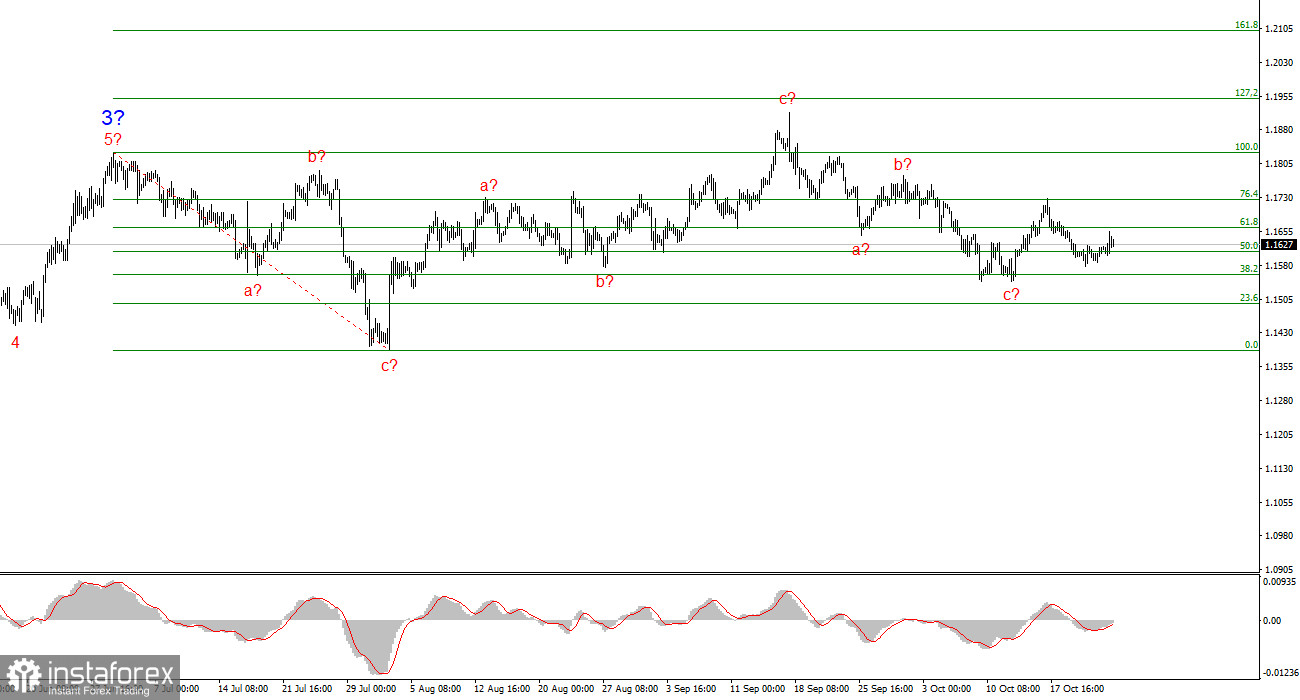

Wave Structure Analysis for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues building an upward trend segment. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the U.S. dollar's decline. The targets for the current trend segment could reach up to the 25 figure. We are currently observing the formation of corrective wave 4, which is taking on a highly complex, elongated form. Therefore, I continue to consider only long positions for the near future. I expect the euro to reach 1.2245 by the end of the year, which corresponds to 200.0% on the Fibonacci.

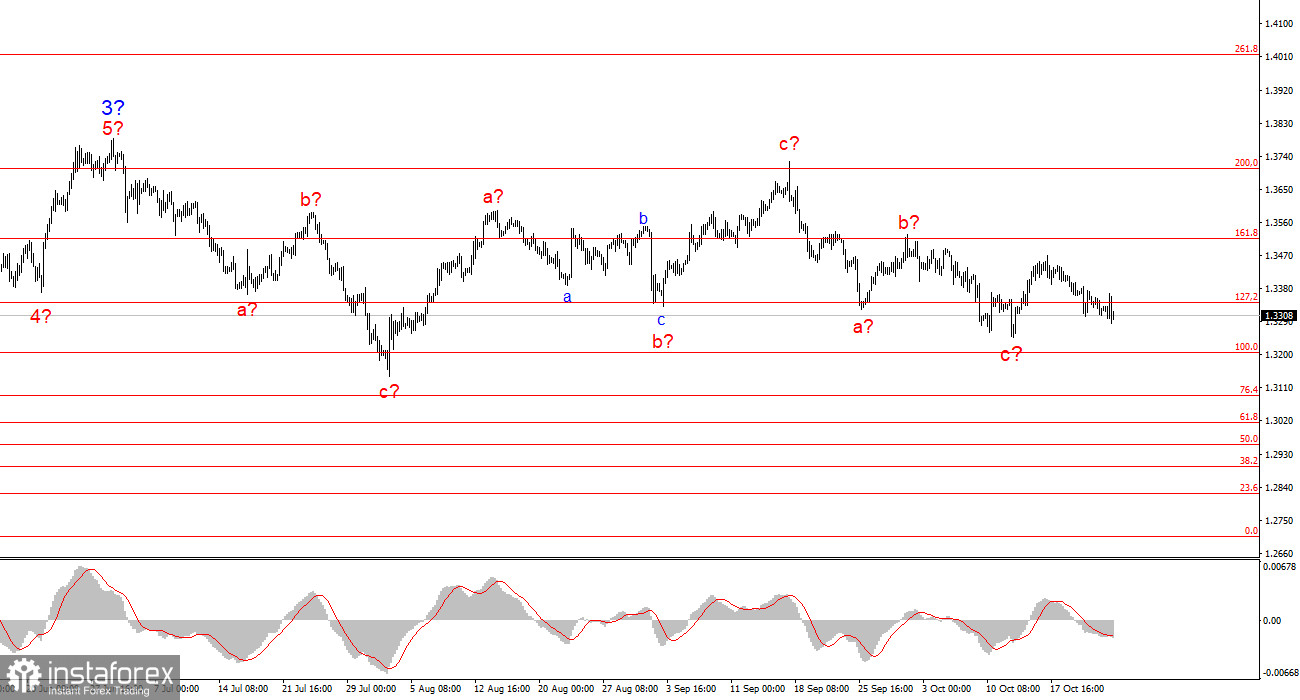

Wave Structure Analysis for GBP/USD:

The wave structure of GBP/USD has evolved. We continue to deal with a bullish, impulsive segment of the trend, but its internal wave structure is becoming more complex. Wave 4 is taking on a three-wave form, and its structure is far more extended than that of wave 2. The next downward three-wave structure is presumed complete, but it could potentially be further complicated. If that is indeed the case, the upward movement of the instrument within the global wave structure may resume, with initial targets around the 38 and 40 figures, although the correction is ongoing at this time.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often carry changes.

- If there is uncertainty in what is happening in the market, it is better not to enter.

- There can never be 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.