Trade Analysis and Advice on Trading the Euro

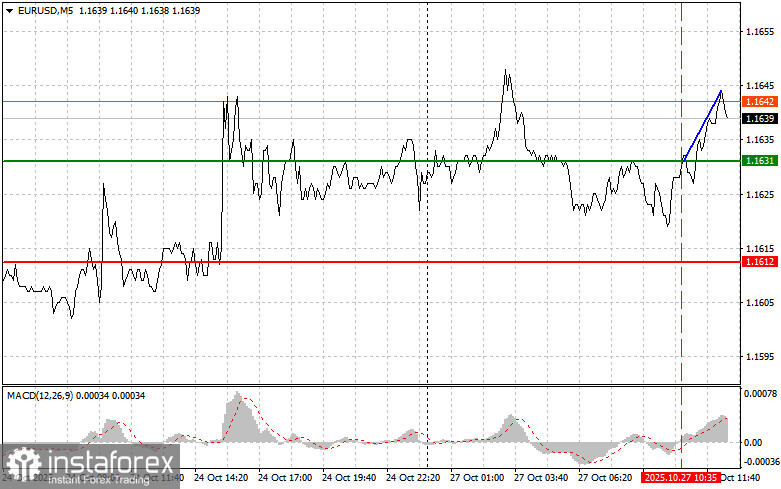

The test of the 1.1631 price level occurred when the MACD indicator had just begun to move upward from the zero line, confirming the correctness of the entry point for buying the euro. As a result, the pair rose by only 10 points.

The rise in Germany's IFO Business Climate Index triggered a wave of euro buying in the first half of the trading day. The increase in this indicator is undoubtedly a sign of growing confidence in the European economy. Germany, as the leading economy in the euro area, plays a key role in the stability and growth of the entire region. An improvement in economic expectations may indicate that the country is successfully adapting to new conditions, including trade issues and tariffs from the U.S., as well as problems arising from the energy crisis. The increase in the IFO Business Expectations Index is certainly a positive sign for both the euro and the German economy. However, it should be understood that other indicators — particularly in Germany's manufacturing sector — remain weak, so there's no reason for excessive optimism yet.

In the second half of the day, traders will focus on the release of the U.S. Leading Indicators Index for September. Even if the data turns out to be positive, its impact on strengthening the dollar will be limited. Investor sentiment currently reflects a more conservative outlook on the global economy. Although the easing of geopolitical tensions provides some support for risk assets, the further direction of EUR/USD will depend entirely on the strategies adopted by central banks.

As for the intraday strategy, I will rely mainly on the implementation of Scenarios #1 and #2.

Buy Signal

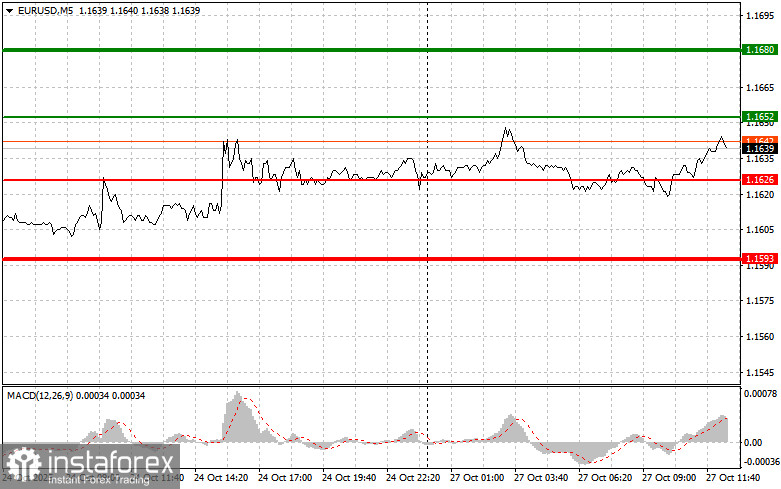

Scenario #1: Today I plan to buy the euro when the price reaches 1.1652 (green line on the chart) with the target of rising to 1.1680. At 1.1680, I plan to exit long positions and open short ones in the opposite direction, expecting a 30–35 point pullback from the entry point. Today's euro growth will likely be driven by dollar weakness, rather than a strong European economy.Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1626 price level, at a time when the MACD is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 1.1652 and 1.1680 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1626 (red line on the chart). The target will be 1.1593, where I plan to exit short positions and immediately open long ones in the opposite direction (expecting a 20–25 point rebound from this level). Downward pressure on the pair may return at any moment today.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1652 price level, when the MACD is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1626 and 1.1593 can be expected.

Chart Legend

- Thin green line – entry price at which the instrument can be bought

- Thick green line – target price for setting a Take Profit or manually closing a trade, as further growth above this level is unlikely

- Thin red line – entry price at which the instrument can be sold

- Thick red line – target price for setting a Take Profit or manually closing a trade, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to pay attention to overbought and oversold zones

Important Notice

Beginner Forex traders should make market entry decisions with great caution. Before the release of major fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit — especially if you neglect money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on current market conditions are, from the outset, a losing strategy for an intraday trader.