Trade Analysis and Recommendations for the Japanese Yen

The first test of the price at 152.71 occurred when the MACD indicator had already moved significantly down from the zero mark, limiting the downside potential of the pair. The second test of 152.71 took place shortly thereafter while the MACD was in the oversold area, allowing scenario No. 2 for buying the dollar to be realized. As a result, the pair only increased by 40 pips.

Demand for the yen returned today after Japan's core consumer price index rose to 2.1% in October, up from 2.0% recorded in September. This suggests the central bank may return to a more hawkish stance on interest rate increases in the near future.

Despite the slight rise in inflation, pressure on the Bank of Japan is mounting, compelling it to reconsider its current monetary policy. The yen's exchange rate is also influenced by factors such as interest rate differentials with other major central banks, such as the Federal Reserve and the European Central Bank. The prospect of rate hikes in Japan supports the national currency. Investors begin to price in the possibility of the Bank of Japan revising its policy, leading to an increased demand for the yen. The only question is when the central bank will make this move and how aggressive the rate hikes will be. The upcoming BoJ meetings will be crucial for determining the yen's future.

Regarding the intraday strategy, I will primarily rely on implementing scenarios No. 1 and No. 2.

Buy Scenarios

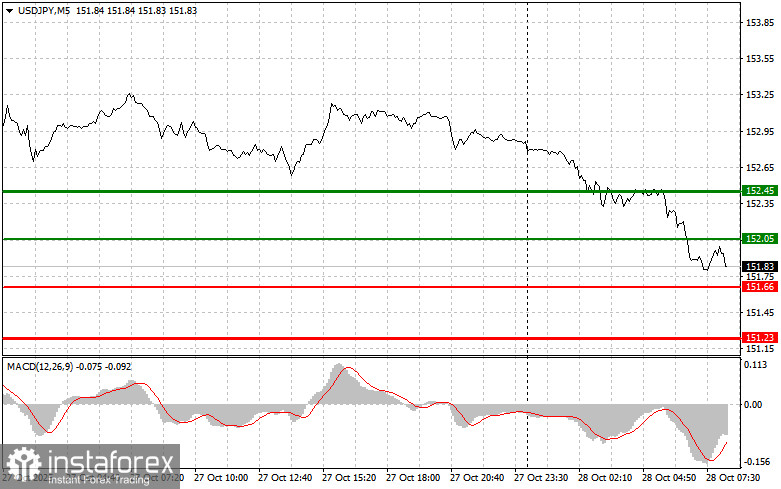

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 152.05 (green line on the chart), targeting a move to 152.45 (thicker green line on the chart). At around 152.45, I intend to exit my purchases and immediately sell in the opposite direction (expecting a movement of 30-35 pips from the entry point). It is best to resume buying the pair during corrections and major pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today if there are two consecutive tests of 151.66 when the MACD indicator is in the oversold area. This will limit the downside potential of the pair and lead to an upward market reversal. One can expect growth towards the opposite levels of 152.05 and 152.45.

Sell Scenarios

Scenario No. 1: I plan to sell USD/JPY today only after it breaches the 151.66 level (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 151.23 level, where I plan to exit my sales and immediately buy in the opposite direction (expecting a move of 20-25 pips from there). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today if there are two consecutive tests of 152.05 when the MACD indicator is in the overbought area. This will limit the upside potential of the pair and lead to a market reversal downwards. One can expect a decline towards the opposite levels of 151.66 and 151.23.

What's on the Charts:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price for setting Take Profit or manually securing profits since further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price for setting Take Profit or manually securing profits since further decline below this level is unlikely.

- MACD Indicator: It is important to be guided by overbought and oversold zones when entering the market.

Important: Beginner traders in the Forex market need to make entry decisions very cautiously. It is best to stay out of the market before important fundamental reports to avoid sudden fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not employ money management and trade in large volumes.

And remember, to trade successfully, you need to have a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.