The EUR/USD currency pair remained practically motionless on Tuesday. In general, nearly every day, numerous experts, analysts, and forecasters share their opinions, using expressions like "the dollar has appreciated" or "why is the dollar falling?" We also use such epithets and phrases. But it is essential to understand that a 10-pip rise in the pair is also a decline in the value of the American currency. Conversely, a drop of 10 pips signifies the dollar's growth. But should we treat these price changes as actual growth or decline?

From our perspective, when market volatility is minimal, it makes little sense to speak of increases or decreases at all. Essentially, all movements over the last four months have been market noise. What is market noise? It refers to insignificant price fluctuations within a limited range, or simply a flat. Transitioning to the daily timeframe, we see this flat clearly. The price has been trading between 1.1400 and 1.1830 for almost four months now. Some may think this is a sufficiently wide range to be considered flat, but in reality, it is pure flat. Just because it forms on the daily timeframe, the width is appropriate.

Thus, all movements within the flat do not necessarily correspond to the current fundamental or macroeconomic background. Since July 1 (when the flat can be considered to have started), we have seen two cycles of declines and one cycle of growth. Given that the fundamental and macroeconomic backdrop is sharply negative for the USD, the market has treated each growth cycle as a logical outcome. Conversely, declines have been viewed as technical corrections or illogical movements. This is how such movements should be assessed, but overall, all price changes since July 1 have been corrections, flat, and market noise.

Therefore, it is not particularly accurate to state that the dollar has appreciated or depreciated at present. The EUR/USD pair has consistently held around 1.1650 for several months now. As for what happens next, we can determine that using fundamental and macroeconomic analysis.

It should be noted that currency rates are driven by large capital. The market anticipates some events (already known) in advance. In some cases, there is a fundamental basis for a trend, yet we observe a flat. An example of this could be the Federal Reserve. Since the fall of 2022, when inflation in the U.S. began to slow, the market has been waiting for monetary policy easing, and it was indeed in the fall of 2022 that the 16-year dollar growth cycle came to an end. Now, it may seem that everything is in place for the dollar to keep falling, but the market is flat. The flat is needed simply for market makers to form new long positions in the EUR/USD pair. From our point of view, first and foremost, the global dollar trend is over; secondly, a new decline of the dollar will inevitably occur, but not "on schedule," as that would be too simple.

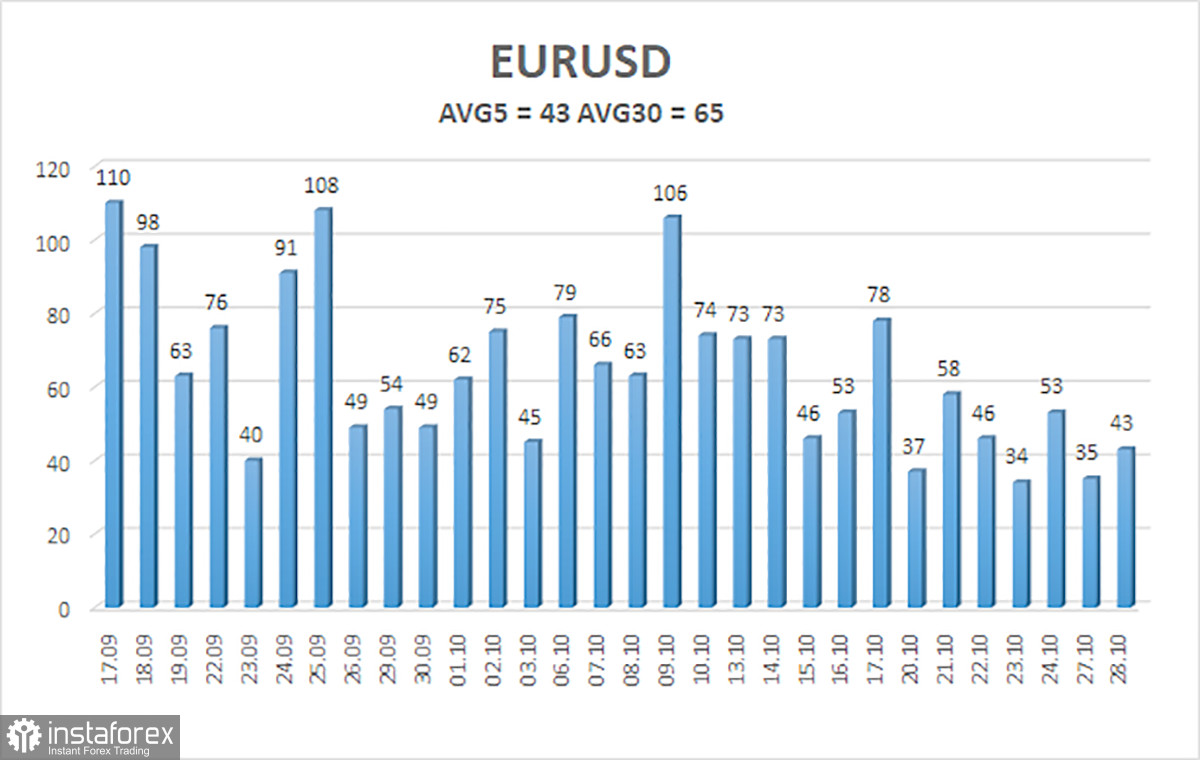

The average volatility of the EUR/USD currency pair over the last five trading days, as of October 29, is 43 pips and is characterized as "low." We expect movement within the range of 1.1621-1.1707 on Wednesday. The upper channel of the linear regression is directed upward, indicating a continued upward trend. The CCI indicator has entered oversold territory, which may signal a new round of upward momentum.

Nearest Support Levels:

- S1 – 1.1597

- S2 – 1.1536

- S3 – 1.1475

Nearest Resistance Levels:

- R1 – 1.1658

- R2 – 1.1719

- R3 – 1.1780

Trading Recommendations:

The EUR/USD pair is attempting to begin a new upward trend on the 4-hour timeframe. The upward trend remains on all higher timeframes, but the daily timeframe has been flat for several months. The U.S. currency continues to be strongly influenced by Donald Trump's policies, which he does not intend to "stop at what has been achieved." Recently, the dollar has been rising, but local reasons are at least ambiguous. However, the flat on the daily timeframe explains everything. If the price is below the moving average, small shorts can be considered with targets at 1.1597 and 1.1536 on purely technical grounds. Above the moving average line, long positions remain relevant with targets at 1.1841 and 1.1902 to continue the trend.

Explanations for the Illustrations:

- Linear Regression Channels: Help determine the current trend. If both are directed in one direction, it indicates a strong trend.

- Moving Average Line (settings: 20.0, smoothed): Determines the short-term trend and trading direction.

- Murray Levels: Target levels for movements and corrections.

- Volatility Levels (red lines): Probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator: Its entry into the oversold area (below -250) or overbought area (above +250) indicates an impending trend reversal in the opposite direction.