Review of Macroeconomic Reports:

There are no macroeconomic reports scheduled for Wednesday. While at least secondary reports were published in Germany on Monday and Tuesday (which did not provoke any market reaction), there will be none on Wednesday. The only event of the day is the Federal Reserve meeting, accompanied by a press conference with Jerome Powell.

Review of Fundamental Events:

There will only be one fundamental event on Wednesday. For obvious reasons, representatives of the Fed and the European Central Bank cannot provide comments or interviews on the economy or monetary policy right now, so today the focus should be solely on the Fed meeting. The decision the central bank will make today is essentially already known – a 0.25% reduction in the key rate. However, what Powell will convey during the press conference remains a mystery.

It is worth noting that a "shutdown" is ongoing in the U.S., so many government agencies are not operating. In October, crucial reports on the labor market and unemployment have not been published, leaving the state of these indicators to speculation. The Fed will likely make a preemptive move and lower the key rate, but it's essential to understand how the U.S. central bank plans to act moving forward, in December and January. From our perspective, the Fed's dovish stance should already be exerting pressure on the dollar. Nevertheless, the dollar has been rising throughout October, for various reasons.

General Conclusions:

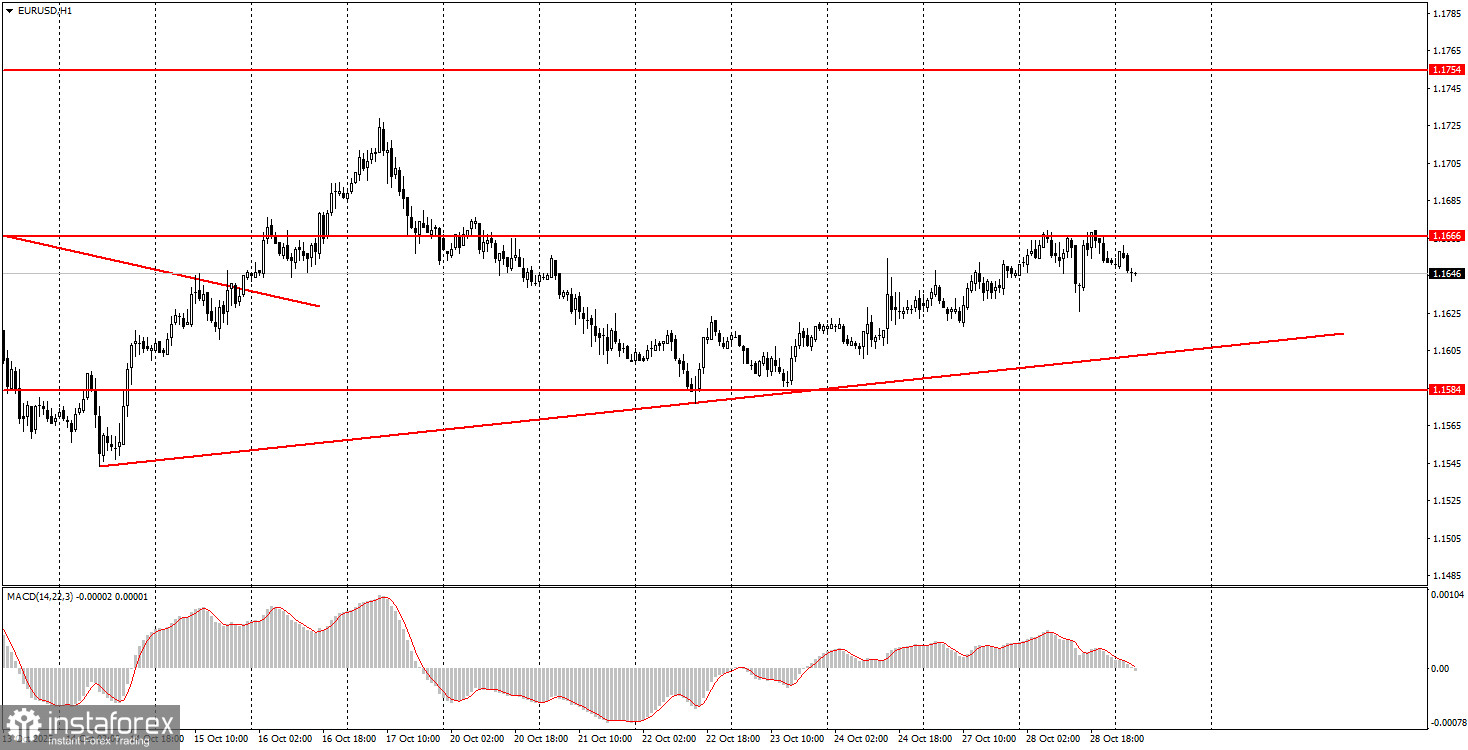

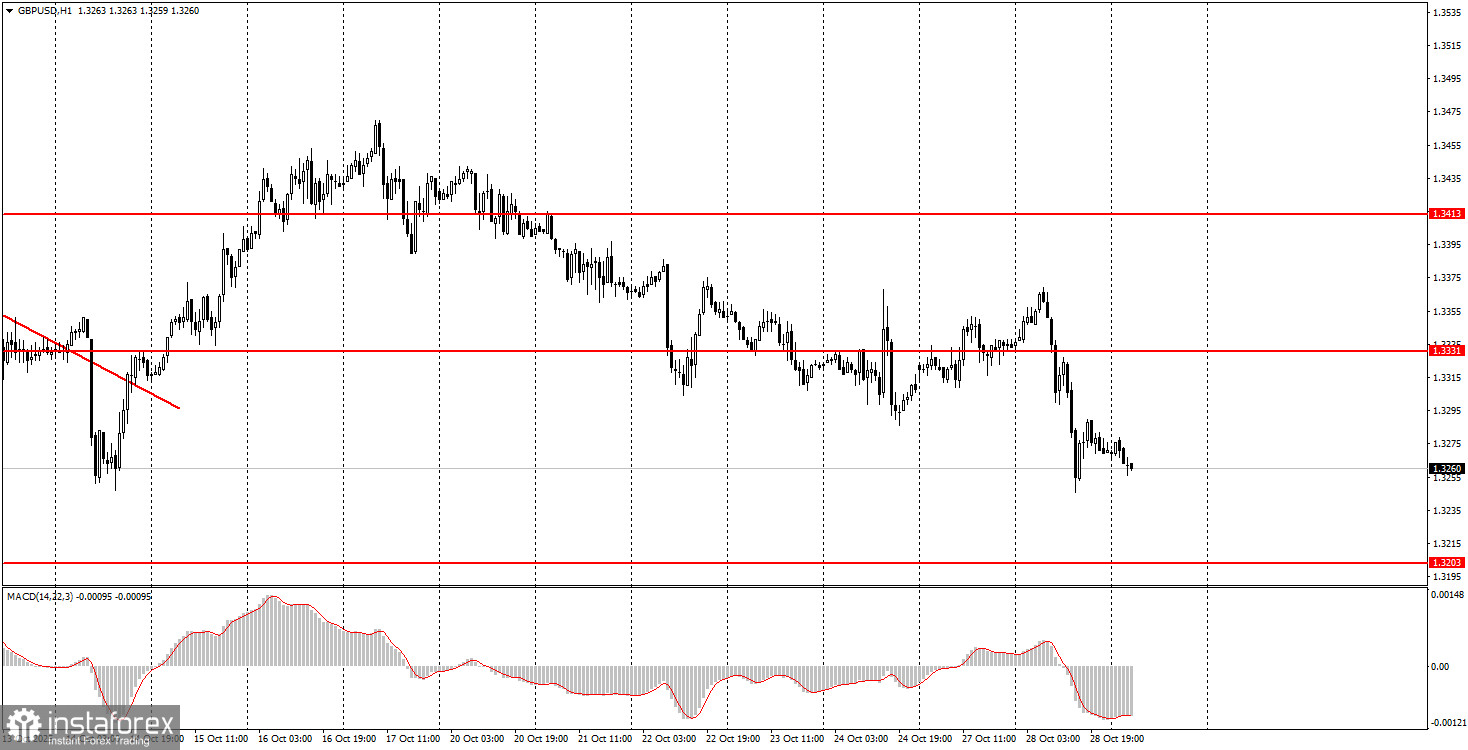

During the third trading day of the week, both currency pairs may trade chaotically. In the first half of the day, the same low-volatility movements may persist; in the second half, volatility could spike. The euro has a trading range of 1.1655-1.1666, from which both long and short positions can be considered. The British pound is trading around 1.3259, which can also be traded from. However, most signals at this time do not trigger target levels, as market volatility remains very low.

Basic Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form the signal (bounce or breakout of a level). The less time it takes, the stronger the signal.

- If two or more trades based on false signals were opened around a specific level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades should be opened during the time period between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly timeframe, trading signals from the MACD indicator are ideally used only when there is good volatility and a trend confirmed by a trend line or trend channel.

- If two levels are too close together (5 to 20 pips apart), treat them as a support or resistance area.

- After a 15-20-pip move in the correct direction, a Stop Loss should be set to breakeven.

What's on the Charts:

- Price Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction for trading.

- MACD Indicator (14,22,3): The histogram and signal line – a supplementary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly impact the movement of the currency pair. Therefore, trading during their release should be done with utmost caution or exit the market to avoid sudden price reversals against the preceding movement.

Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and effective money management are essential for success in trading over the long term.