Everything comes at a cost. The excessive euphoria in the gold market has resulted in widespread sell-offs, and the same could happen in the US stock markets. The S&P 500 has been holding at its record highs because investors have priced in a federal funds rate cut in October and December. This is a paradox, considering the fact that inflation remains firmly anchored around 3%, while the Fed's target is 2%. To return to that target, interest rates have to be increased; instead, the central bank is lowering them, which is misleading the EUR/USD pair.

The core personal consumption expenditures index dropped to 3% by the end of 2023 following a series of aggressive monetary tightening measures. Two years later, it still hovers at that level. Bloomberg experts forecast that this figure will still be relevant at the end of 2026. The FOMC's unemployment estimates are slightly higher than the current rate, yet still align with full employment conditions. The Fed expects GDP expansion, while the leading indicator from the Atlanta Fed signals a 3.9% growth in GDP for the third quarter. So why lower interest rates?

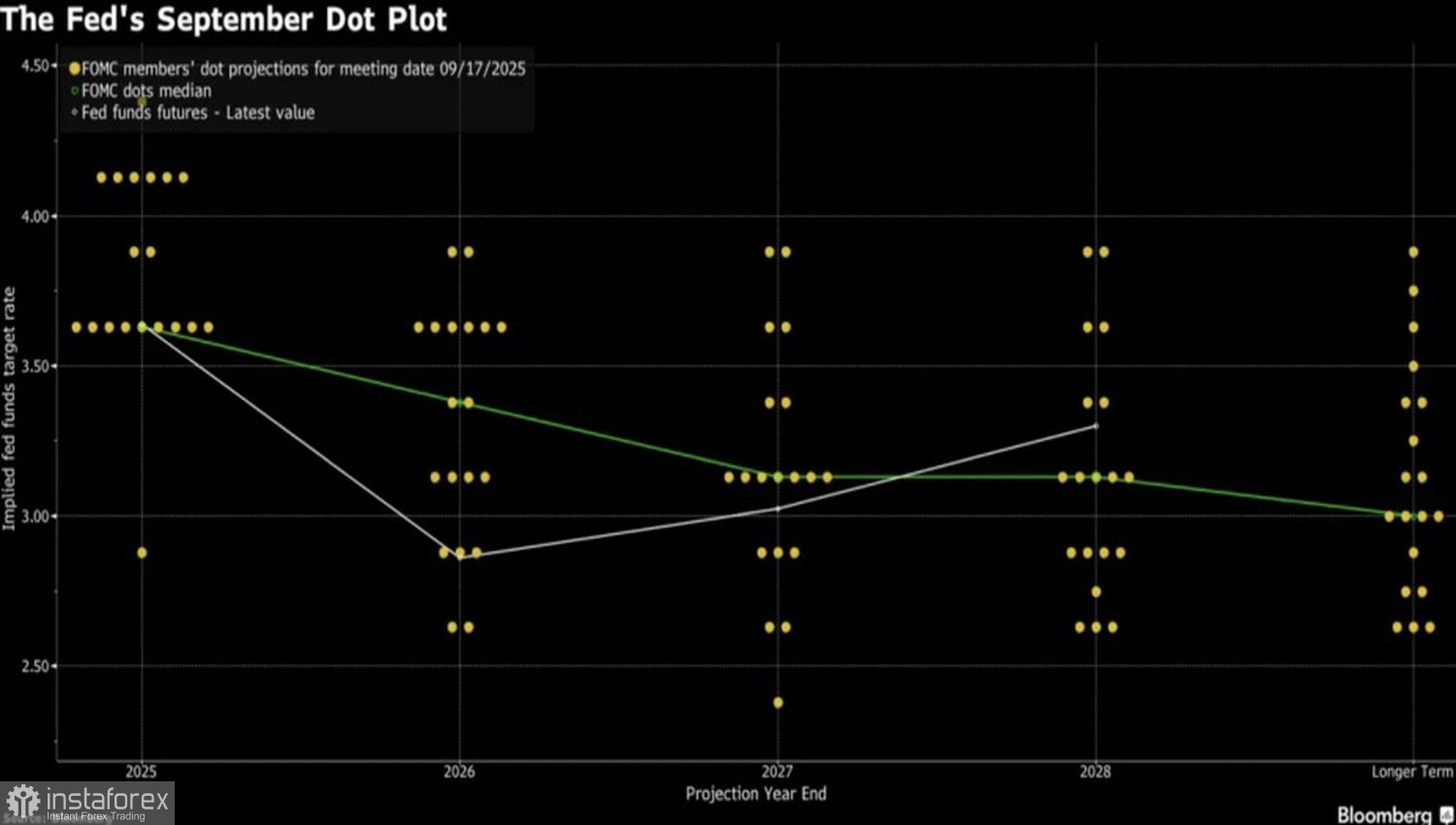

The FOMC's September projection for the federal funds rate indicated that some members believe rate cuts should not be pursued at every meeting. Nine out of the 17 Federal Reserve representatives predicted only a single act of monetary expansion—either in October or December—despite the labor market clearly collapsing between June and August. However, the situation improved in the fall, as evidenced by a weekly increase in private sector employment from ADP of over 14,000 jobs.

What if the Fed is reducing interest rates under pressure from Donald Trump? The US president insists that borrowing costs should drop to 1%. His team, led by Treasury Secretary Scott Bessen, believes that the federal funds rate is too high. Stephen Miran, an FOMC member, advocates for several cuts of 50 basis points each.

Moreover, one of the Committee's doves, Christopher Waller, is a leading candidate to succeed Jerome Powell as the Federal Reserve Chairman when he steps down in 2026. Waller argues that a weak labor market will ultimately slow inflation; therefore, there is a need to ease monetary policy, at least for preventive measures.

However, the Federal Reserve is not a one-act play. If other members of the Open Market Committee still perceive the economy and the labor market as strong, why should they remain silent? The hawks are gaining strength, and if Jerome Powell hints at caution in the near future, the chances of rate cuts in December will diminish. This would favor the US dollar.

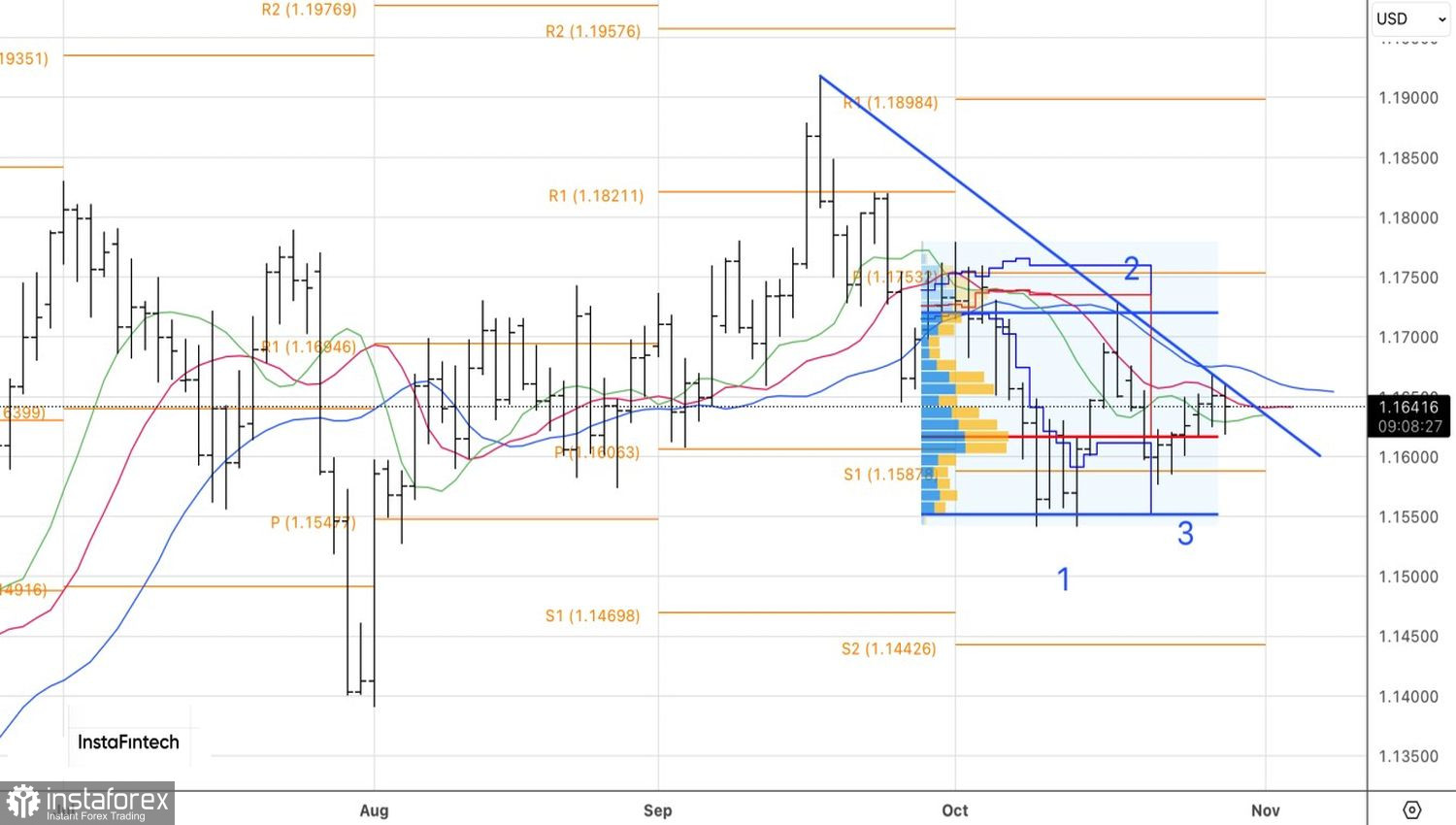

Technically, the daily chart for EUR/USD shows consolidation around the moving averages, indicating market uncertainty. It makes sense to return to buying only if the trendline near the 1.1660 mark is breached. A successful test of this level would increase the chances of a rally toward the upper border of the fair value range of 1.1550-1.1720 and the pivot level of 1.1755.