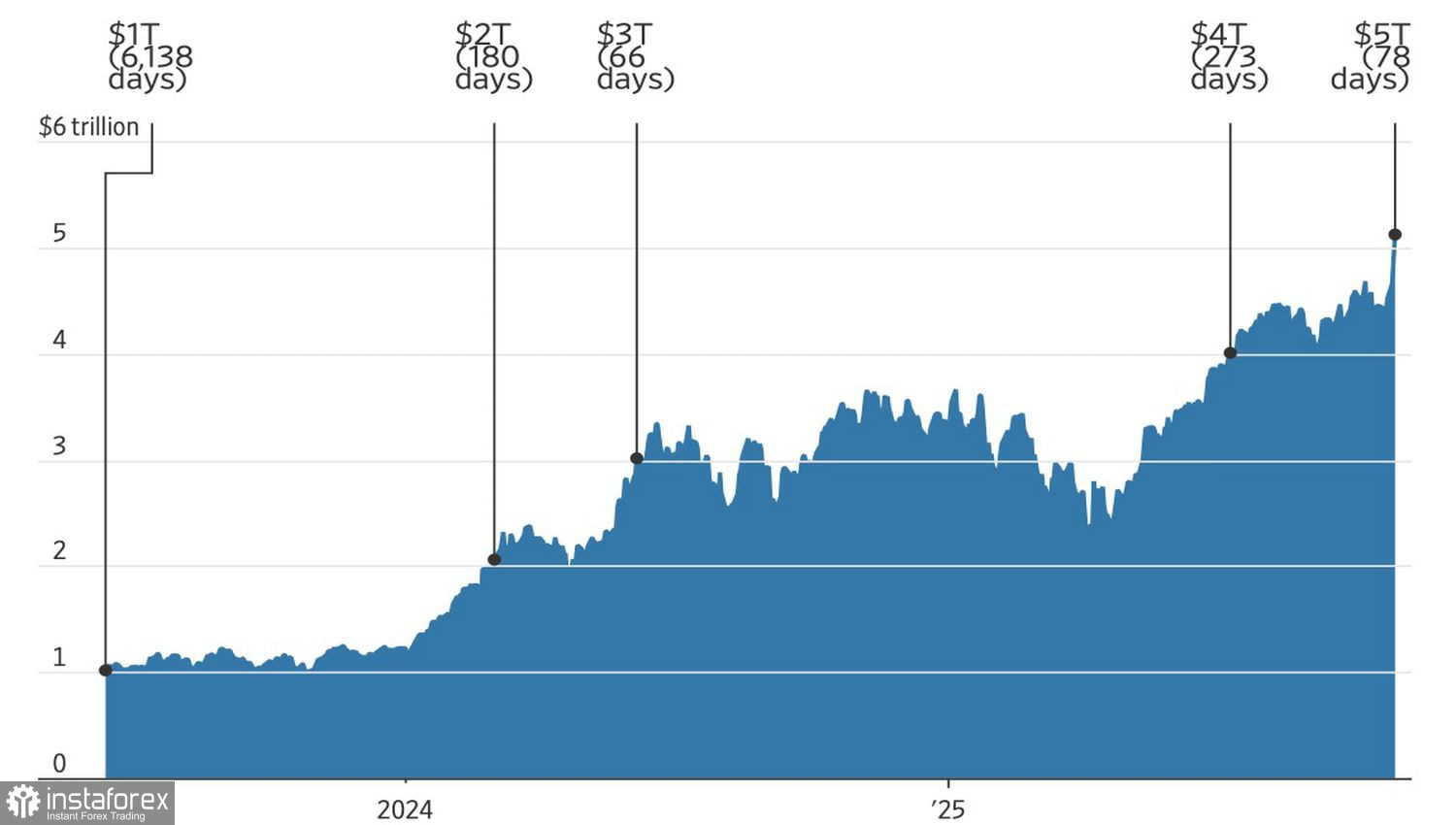

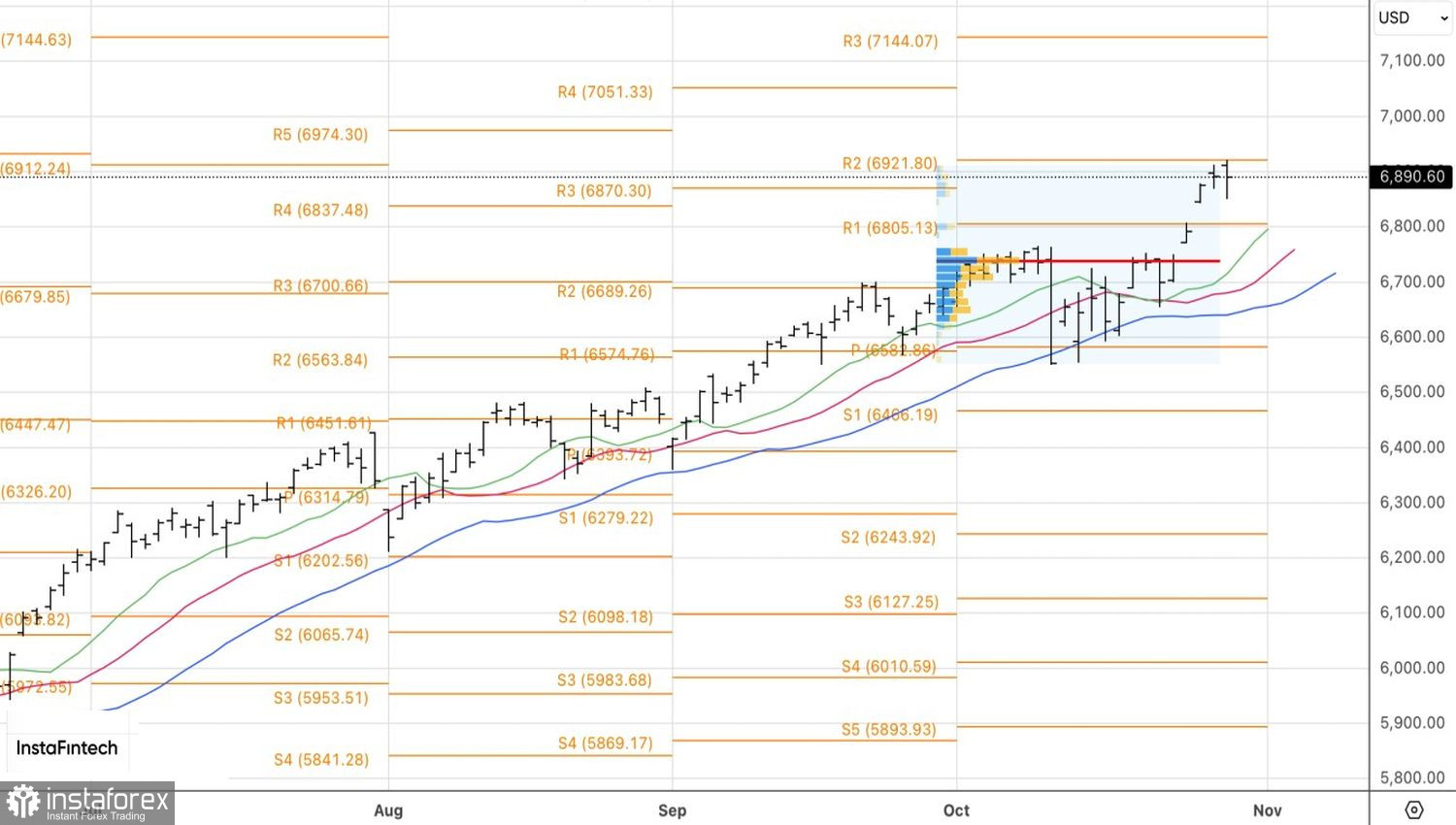

The US stock market managed to set a new record before Jerome Powell poured a bucket of cold water on buyers. Encouraged by the reduction in the federal funds rate to 4% and by NVIDIA's market capitalization surpassing $5 trillion for the first time in history, the S&P 500 reached an earlier target of 6920. However, the split within the Federal Reserve has raised doubts about the continuation of the monetary expansion cycle in December. This remains an unresolved issue.

Dynamics of NVIDIA Capitalization

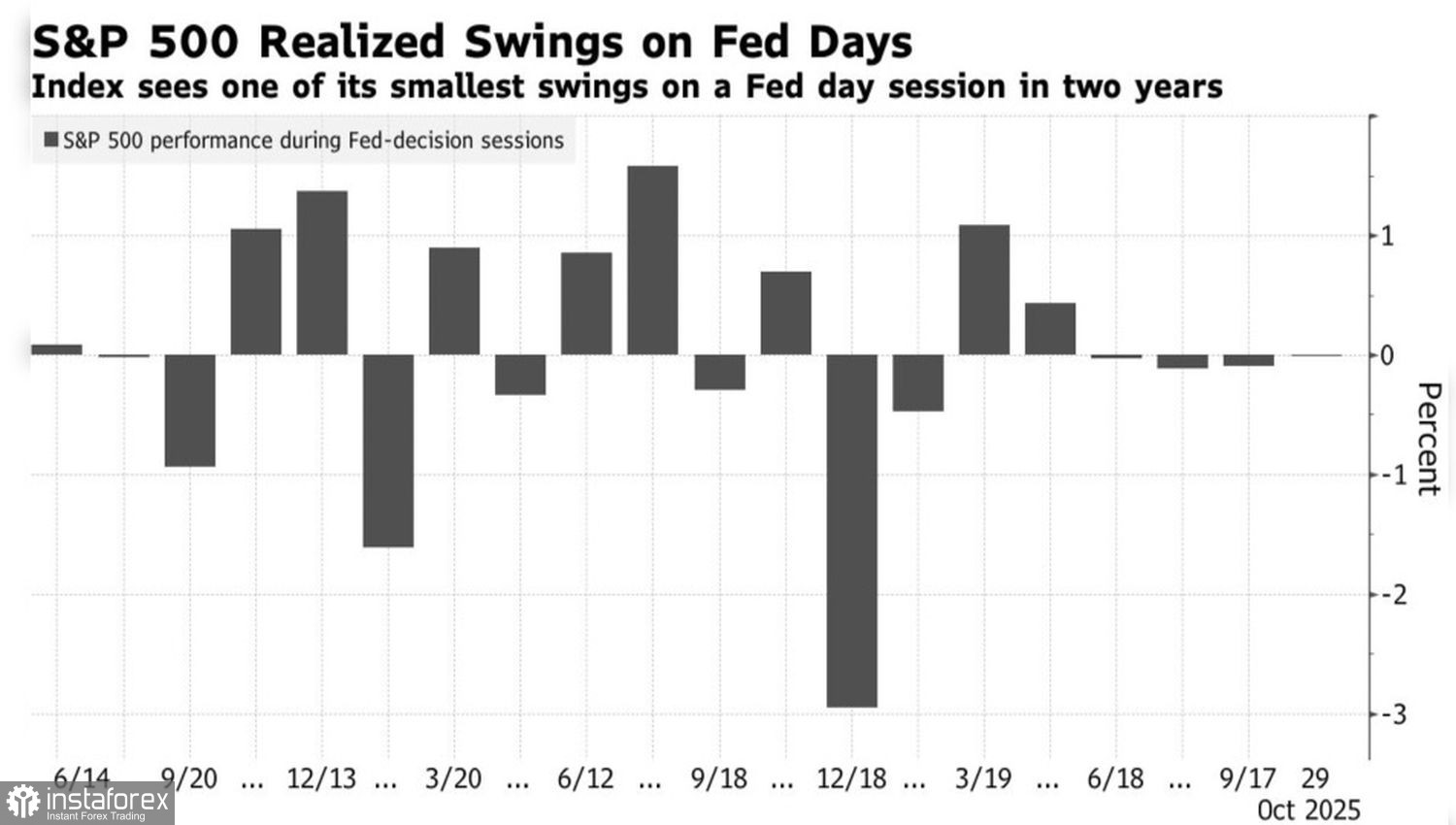

The reaction of the broad stock index to the Fed's verdict was one of the most subdued in a long time. However, this is only the surface of the iceberg. Beneath it, a genuine storm of turbulence played out. About 400 S&P 500 companies closed the trading day in the red zone, while only 100 finished in the green. This was due to the fastest rise in US Treasury yields since July and a decrease in the likelihood of a December rate cut from more than 90% to 65%.

A dissenting "hawk" emerged within the FOMC. Kansas City Fed President Jeffrey Schmid refused to support the majority's opinion. He voted to keep the rate at 4.25%. In contrast, the human president, Stephen Miran, continues to advocate for a 50-basis-point rate cut.

Reaction of the S&P 500 to the FOMC Meeting Outcomes

Jerome Powell declined to answer whether American stock valuations are inflated. The Fed chair acknowledged that artificial intelligence technologies are contributing to increased consumer spending and accelerating economic growth, and they are relatively insensitive to changes in the federal funds rate. Unsurprisingly, following such comments, tech giants recovered their previously incurred losses, and the S&P 500 regained some positions.

In the futures market, a lone bet of more than $20 million emerged, predicting that the broad stock index would rise by 30% by the end of 2026. This makes even the most ardent "bulls" feel uneasy. An S&P 500 rise to 9000 would overshadow the 17% rally expected in 2025. From the levels of the April low, the index has risen by 38%, with its market capitalization increasing by $17 trillion.

The S&P 500 has been above the dynamic support of the 50-period moving average for 125 consecutive days. In the last three decades, there have been only three instances when an equity market rally lasted longer. Consequently, the further the S&P 500 pursues its upward trend, the greater the concerns become about a corrective move. Will investors' reevaluation of Jerome Powell's remarks trigger this correction?

Technically, on the daily chart, the S&P 500 has achieved the previously set target for long positions at 6920 and formed a bar with a long lower shadow. A breakout above its maximum at 6920 will serve as a basis for new purchases targeting pivot levels at 7045 and 7140.