Trade Analysis for Thursday:

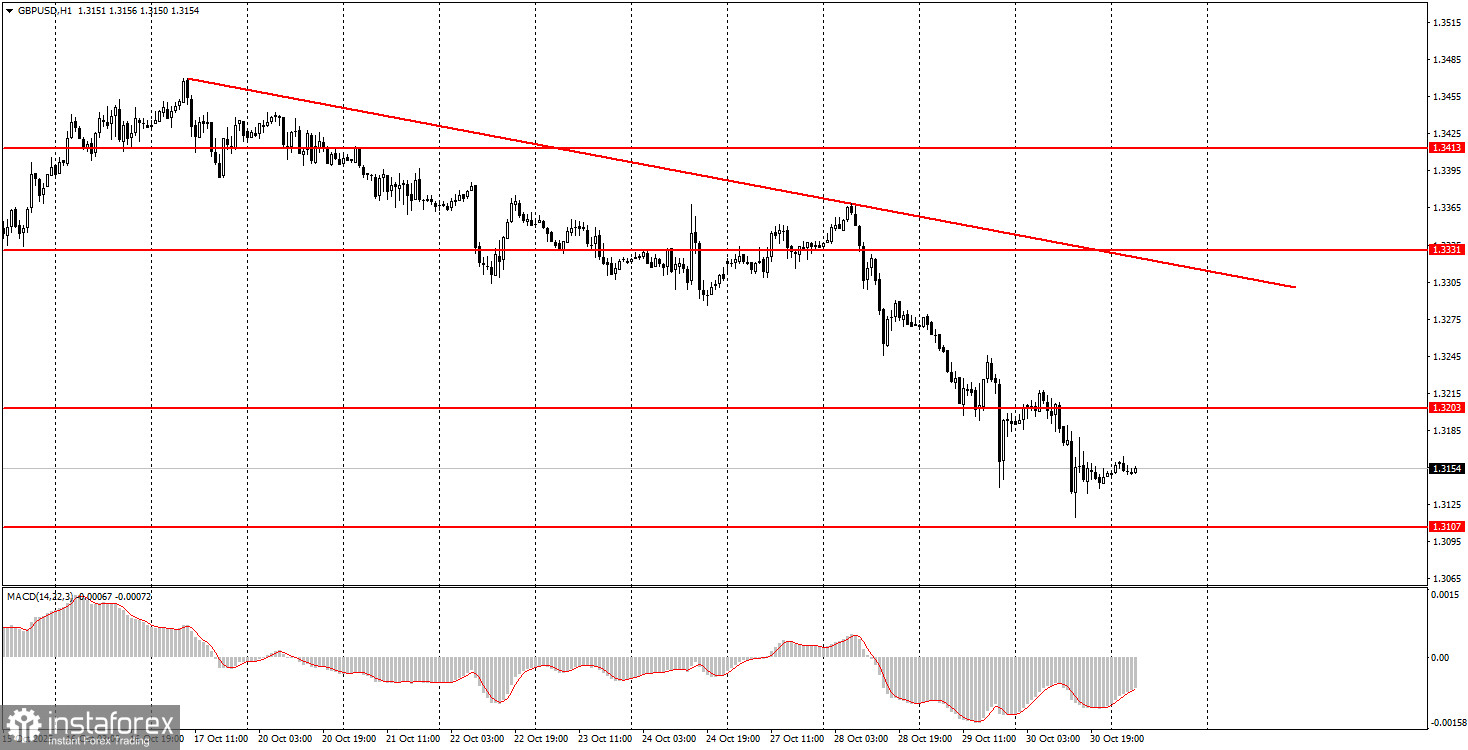

1H Chart of the GBP/USD Pair

On Thursday, the GBP/USD pair continued its downward movement despite no noteworthy events in either the UK or the US. However, the FOMC results were announced the day before, and just a couple of days ago, UK Treasury Chief Rachel Reeves gave a speech, which the market usually reacts to by selling the pound. Even though Reeves did not announce anything particularly resonant and the Federal Reserve made a decision that everyone anticipated, the British pound keeps falling. We still consider the decline of the British currency to be illogical, a point we have been making for several weeks. This narrative began in early October, and for a whole month, we have been observing a significant divergence between the fundamental and macroeconomic backdrop and the direction of the GBP/USD pair. If such a case were isolated, it could be attributed to misinterpretation of the facts or coincidence. But this has been ongoing for a whole month. The flat on the daily timeframe remains relevant, and we consider it the main reason for the pound's decline.

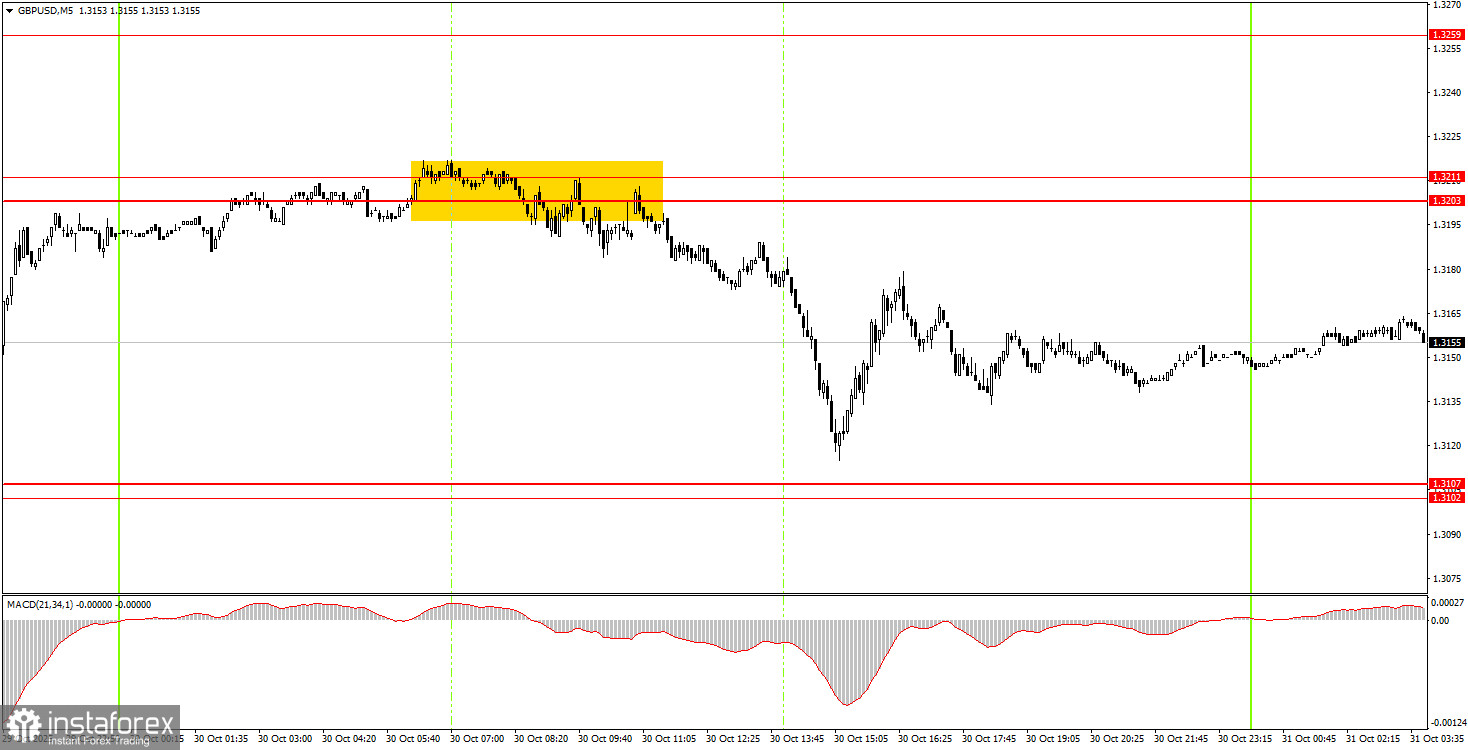

5M Chart of the GBP/USD Pair

On the 5-minute timeframe, one very good sell signal formed on Thursday in the 1.3203-1.3211 area. The price bounced from this area three times in a row and then moved downward. Unfortunately, the nearest target was not reached, but novice traders could still have made a decent profit on the short position, which could have been manually closed at any time.

How to Trade on Friday:

On the hourly timeframe, the GBP/USD pair began to form a new upward trend but ended it very quickly. At this time, the pound is again declining for absolutely any reason. As we have mentioned, there are no grounds for the dollar's prolonged growth, so we expect movements only to the north in the medium term. However, the flat factor continues to pull the pair down in the long term, which represents an entirely illogical development.

On Friday, novice traders can confidently trade from the 1.3203-1.3211 or 1.3102-1.3107 areas. The price currently rests exactly between these two zones, so execution can be expected from either.

On the 5-minute timeframe, trading can presently occur at levels 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652. There are no significant events or reports scheduled in the UK or the US on Friday, so volatility may decrease to low levels, and trending movement throughout the day may be absent.

Core Principles of the Trading System:

- The strength of a signal is determined by the time it took to form (bounce or breakout). The less time required, the stronger the signal.

- If two or more trades have been opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can produce numerous false signals or none at all. At the first signs of a flat, it is better to cease trading.

- Trades should be opened during the time frame between the start of the European session and the middle of the American session, and then all trades should be closed manually.

- On the hourly timeframe, trade signals from the MACD indicator should ideally only be traded in the presence of good volatility and a trend confirmed by a trendline or trending channel.

- If two levels are too close to each other (5 to 20 pips), they should be considered as a support or resistance area.

- After moving 20 pips in the right direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support and Resistance Levels: Levels that serve as targets for buying or selling. Take Profit levels can be placed near these levels.

- Red Lines: Channels or trend lines that display the current trend and indicate the preferred direction for trading.

- MACD Indicator (14,22,3): Histogram and signal line serve as a supplementary indicator that can also be used as a source of signals.

Important: Important speeches and reports (always found in the news calendar) can significantly impact currency movements. Therefore, during their release, trading should be approached with utmost caution or exit the market to avoid sharp price reversals against the preceding movements.

Beginners trading in the Forex market should remember that not every trade can be profitable. Establishing a clear strategy and money management principles are essential for success in trading over the long term.