Analysis of Macroeconomic Reports:

A few macroeconomic reports are scheduled for Friday. Germany will release its retail sales report, while the Eurozone will release its inflation data. It's worth noting that yesterday, traders essentially ignored a much larger and more significant batch of reports from the European Union. Therefore, it is unlikely that these two reports today will provoke a strong market reaction. The euro and pound continue to be sold off for various reasons, which can still be attributed to the flat situation on the daily timeframe. Additionally, the consumer price index in the Eurozone currently has a very weak influence on the prospects for the European Central Bank's monetary policy and should not be considered a super-important indicator.

Analysis of Fundamental Events:

General Conclusions:

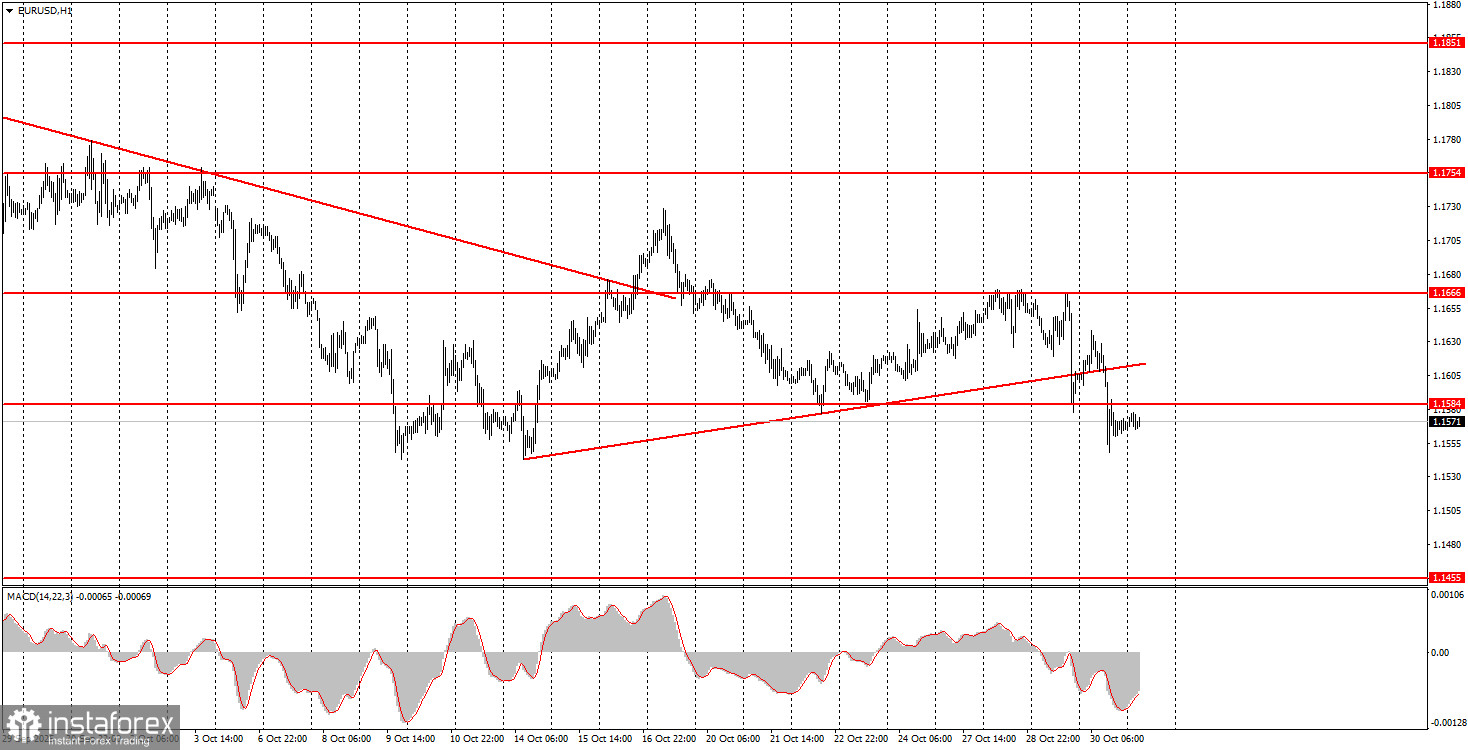

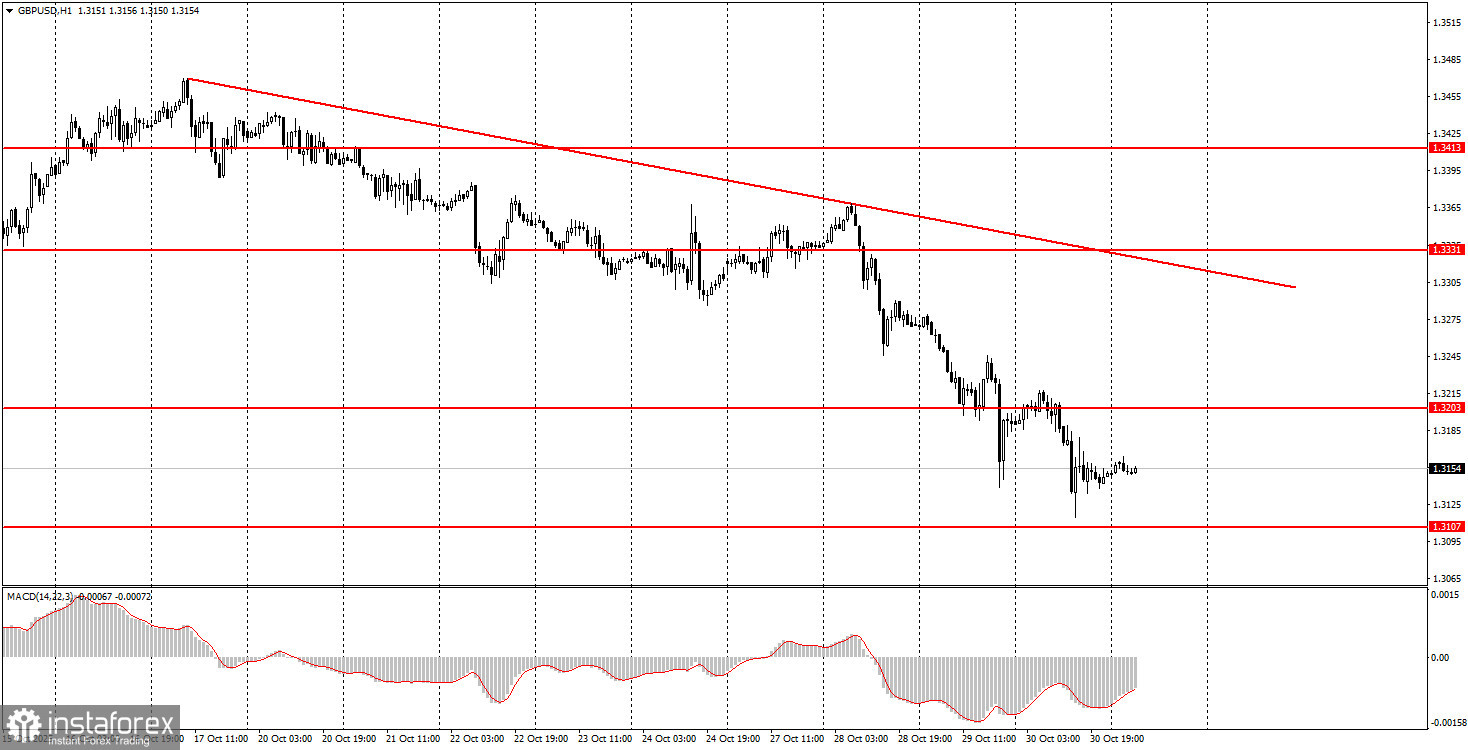

During the last trading day of the week, both currency pairs may trade chaotically once again. There will be little macroeconomic data today, so volatility may be weak. The European currency is trading near the 1.1571-1.1584 area, making it a potential entry point for novice traders today. The British pound is trading between 1.3102-1.3107 and 1.3203-1.3211, so it will be necessary to wait for new trading signals to form.

Core Principles of the Trading System:

- The strength of a signal is determined by the time it took to form (bounce or breakout). The less time required, the stronger the signal.

- If two or more trades have been opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can produce numerous false signals or none at all. At the first signs of a flat, it is better to cease trading.

- Trades should be opened during the time frame between the start of the European session and the middle of the American session, and then all trades should be closed manually.

- On the hourly timeframe, trade signals from the MACD indicator should ideally only be traded in the presence of good volatility and a trend confirmed by a trendline or trending channel.

- If two levels are too close to each other (5 to 20 pips), they should be considered as a support or resistance area.

- After moving 15-20 pips in the right direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support and Resistance Levels: Levels that serve as targets for buying or selling. Take Profit levels can be placed near these levels.

- Red Lines: Channels or trend lines that display the current trend and indicate the preferred direction for trading.

- MACD Indicator (14,22,3): Histogram and signal line serve as a supplementary indicator that can also be used as a source of signals.

Important: Important speeches and reports (always found in the news calendar) can significantly impact currency movements. Therefore, during their release, trading should be approached with utmost caution or exit the market to avoid sharp price reversals against the preceding movements.

Beginners trading in the Forex market should remember that not every trade can be profitable. Establishing a clear strategy and money management principles are essential for success in trading over the long term.