Trade Review and Tips for Trading the Japanese Yen

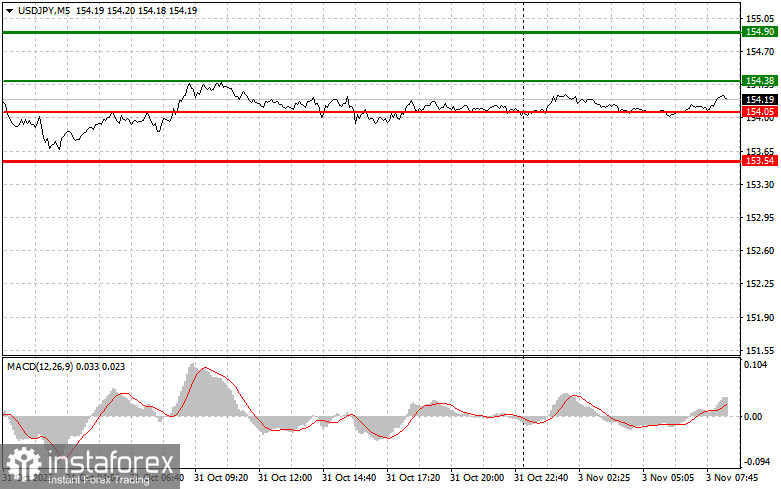

The test of the 154.02 price coincided with the MACD indicator falling significantly from the zero mark, which limited the pair's downward potential. For this reason, I did not sell the dollar. The second test of this price occurred when the MACD was in the oversold area, allowing the implementation of Scenario No. 2: buying dollars amid the pair's ongoing upward trend.

It is evident that the growth of the USD/JPY pair has become less active, primarily due to recent statements from Finance Minister Satsuki Katayama, who mentioned that the Japanese government is closely monitoring the yen's exchange rate, issuing its first clear warning about fluctuations in the currency rate. In these conditions, it is best to act on corrections of the pair, allowing for market entry not at current highs but at more attractive prices. I also want to remind you that last week, the Bank of Japan did not provide any indications regarding future changes in monetary policy towards tightening, which will likely maintain a bullish market for the USD/JPY pair. However, do not forget the interventions, whose risk has clearly increased following Katayama's remarks.

For my intraday trading strategy, I will primarily focus on implementing Scenarios 1 and 2.

Buy Scenarios

- Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 154.38 (green line on the chart), targeting a move to 154.90 (thicker green line on the chart). Near 154.90, I intend to exit my long positions and initiate shorts in the opposite direction (anticipating a movement of 30-35 pips back from this level). It's best to resume buying the pair during corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

- Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 154.05 while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposite levels of 154.38 and 154.90.

Sell Scenarios

- Scenario No. 1: I plan to sell USD/JPY today only after the 154.05 level is updated (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 153.54 level, where I plan to exit my shorts and open immediate longs in the opposite direction (anticipating a move of 20-25 pips back from this level). Selling is best done as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement.

- Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price at 154.38 while the MACD indicator is in the overbought area. This would limit the upward potential of the pair and lead to a market reversal downward. A decrease can be expected towards opposite levels of 154.05 and 153.54.

What the Chart Shows:

- Thin Green Line: Entry price at which one can buy the trading instrument.

- Thick Green Line: Expected price level to set Take Profit or manually secure profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price at which one can sell the trading instrument.

- Thick Red Line: Expected price level to set Take Profit or manually secure profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it's crucial to be guided by overbought and oversold areas.

Important: Beginner traders in the Forex market must make trading decisions cautiously. Before the release of crucial fundamental reports, it is best to stay out of the market to avoid sudden price swings. If trading during news releases, always set stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, as presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.