Trade Analysis and Tips for Trading the Japanese Yen

Given the very low market volatility, the price never reached the levels I had indicated earlier, so in the first half of the day I remained without any trades.

During the U.S. session, attention should be paid to the Federal Reserve representatives. Speeches by FOMC members Mary Daly and Lisa D. Cook could trigger new, much stronger market movements—but only if we hear something new. Investors are eager to learn what these influential FOMC members think about inflation prospects, interest rates, and the overall state of the economy. Will they maintain their previously dovish stance after last week's rate cut, or adopt a wait-and-see approach? The answers to these questions will shape the future dynamics of the currency market.

The U.S. ISM Manufacturing Index for October will also be in focus. This index acts as a barometer of the health of the U.S. economy. An increase would confirm stability and strength, attracting investors to the dollar. As a result, the dollar would strengthen, putting pressure on the yen as the weaker currency. However, since the indicator remains below the 50-point mark, minor changes are unlikely to offer strong support to the dollar.

As for the intraday strategy, I will rely mainly on Scenarios No. 1 and No. 2.

Buy Signal

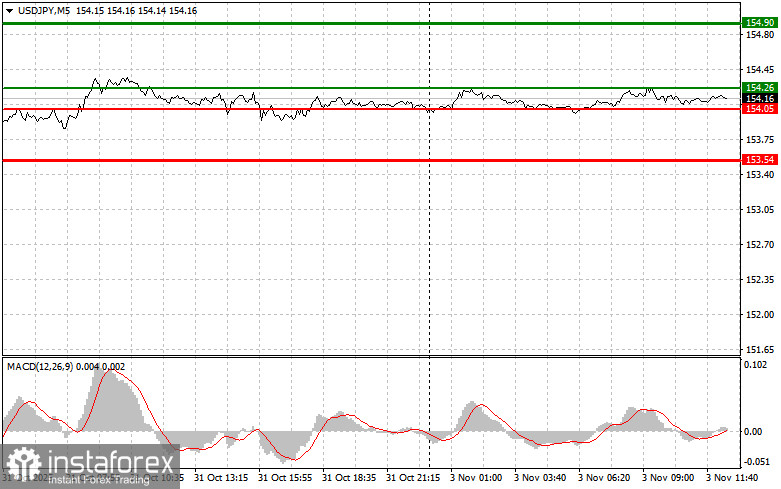

Scenario No. 1: I plan to buy USD/JPY today when the price reaches around 154.26 (green line on the chart), targeting growth to 154.90 (thicker green line on the chart). Around 154.90, I intend to close buy positions and open sales in the opposite direction (expecting a 30–35 point pullback from the level). You can expect the pair to rise only if the Fed adopts a strong (hawkish) position.Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY if the price tests 154.05 twice in a row while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 154.26 and 154.90 can then be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after breaking below 154.05 (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 153.54, where I intend to exit sales and immediately open buys in the opposite direction (expecting a 20–25 point rebound from the level). Selling pressure on the pair may return if the Fed takes a dovish stance.Important: Before selling, make sure the MACD is below the zero mark and just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY if the price tests 154.26 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 154.05 and 153.54 can then be expected.

Chart Explanation

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – suggested Take Profit level or point to manually secure profits, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – suggested Take Profit level or point to manually secure profits, as further decline below this level is unlikely;

- MACD Indicator – when entering the market, focus on overbought and oversold zones.

Important Notes for Beginner Forex Traders

Beginner traders in the Forex market should be extremely cautious when deciding to enter the market. Before important fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly—especially if you ignore money management and trade with large volumes.

And remember: For successful trading, you must have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on current market conditions is an inherently losing strategy for an intraday trader.