Trade Analysis and Tips for Trading the Japanese Yen

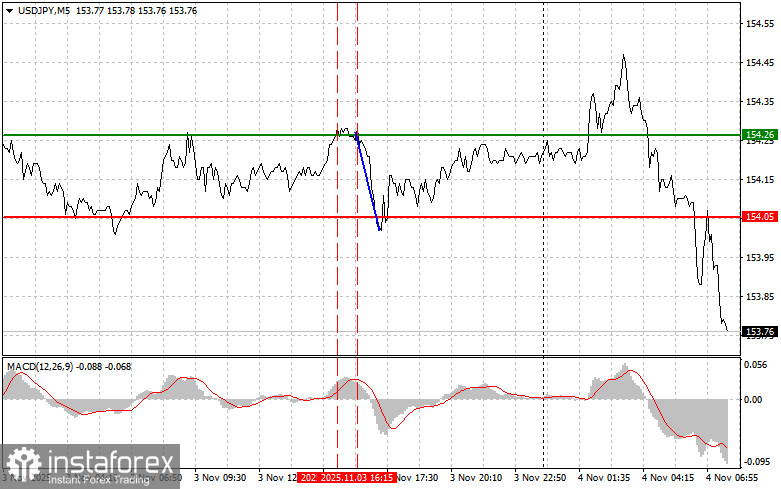

The test of the 154.26 price coincided with the MACD indicator moving significantly above the zero line, limiting the pair's upward potential. For this reason, I did not buy the dollar. The second test of this price occurred when the MACD was in the overbought area, enabling the implementation of Scenario No. 2 for selling dollars. As a result, the pair fell by 20 pips.

Weak US manufacturing data for October supported the Japanese yen in the afternoon, but it did not lead to a significant shift in the balance of power. The brief surge of optimism sparked by hopes for a more dovish Federal Reserve policy quickly waned, underscoring the resilience of the dominant factors shaping the USD/JPY pair.

The primary driver holding back the yen's strengthening remains the significant divergence in monetary policies between the Fed and the Bank of Japan. Additionally, Japan is facing several internal economic issues, including low economic growth and the need for new stimulus, which the newly appointed Prime Minister of Japan is striving to achieve. Thus, although weak manufacturing data from the US provided temporary support to the Japanese currency, the fundamental differences in the economic conditions and monetary policies of the two countries continue to dominate, preventing any significant shift in the dynamics of the currency market. Investors remain cautious regarding the yen, not expecting any substantial changes in the BoJ's policy direction toward rate hikes.

Regarding the intraday strategy, I will primarily rely on implementing Scenarios No. 1 and No. 2.

Buy Scenarios

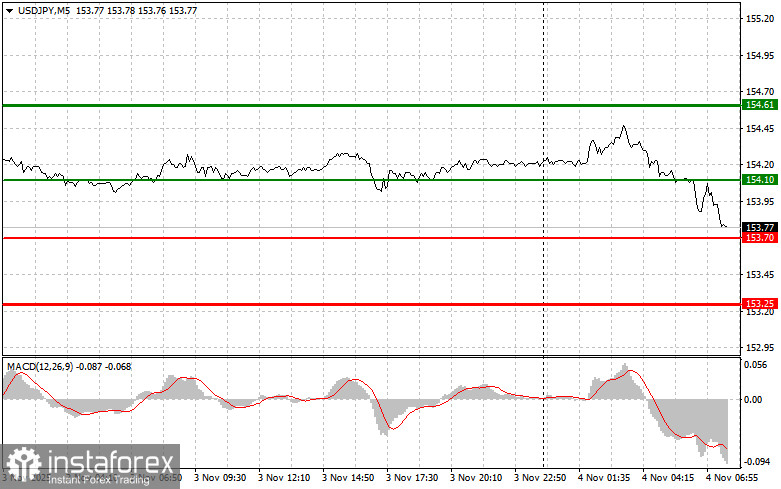

- Scenario No. 1: I plan to buy USD/JPY today when the price reaches around 154.10 (green line on the chart), targeting a move to 154.61 (thicker green line on the chart). Near 154.61, I plan to exit my long positions and initiate shorts in the opposite direction (anticipating a movement of 30-35 pips back from this level). It is advisable to resume buying the pair during corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

- Scenario No. 2: I also plan to buy USD/JPY today if there are two consecutive tests of 153.70 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposite levels of 154.10 and 154.61.

Sell Scenarios

- Scenario No. 1: I plan to sell USD/JPY today only after the 153.70 level is updated (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 153.25 level, where I intend to exit my shorts and open immediate longs in the opposite direction (anticipating a 20-25-pip reversal from this level). It is best to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning its downward movement.

- Scenario No. 2: I also plan to sell USD/JPY today if the price tests 154.10 twice while the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downward. A decrease can be expected towards the opposite levels of 153.70 and 153.25.

What the Chart Shows:

- Thin Green Line: Entry price at which to buy the trading instrument.

- Thick Green Line: Expected price level for setting Take Profit or manually securing profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price at which to sell the trading instrument.

- Thick Red Line: Expected price level for setting Take Profit or manually securing profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market must exercise great caution when making trading decisions. Before the release of significant fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.