One of the Federal Reserve's governors, Lisa Cook, whom Donald Trump recently attempted to fire—and who retained her position thanks to the US Supreme Court—stated on Monday that the Fed is open to lowering interest rates at its final meeting in 2025. On one hand, her stance raises no questions, as Cook clarified that "if the economic data allows for easing." In other words, her position is not different from that of most FOMC members—if economic data demands a new round of easing, it will be implemented. On the other hand, Cook noted that the Fed would need to gather data from "unconventional sources" amid the ongoing "shutdown" in America.

What are these "unconventional sources"? It is not unreasonable to think that certain calculations regarding inflation, jobs, or layoffs could be produced by various institutions or private organizations. But how reliable are such data? I remind you that the ADP report, which essentially reflects the same data as Nonfarm Payrolls, will be released on Wednesday, while this week's Nonfarm Payrolls will once again be passed over "until better times." However, the market typically reacts very rarely to the ADP report, and the ADP report's values rarely align closely with Nonfarm Payrolls.

As we can see, two essentially identical reports consistently demonstrate significantly different values. Therefore, data from "alternative sources" can vary greatly from reality.

It should also be noted that Lisa Cook, after her "resurrection" within the Fed, slightly changed her tone to a more "dovish" stance. Recall that in early summer, former Fed governor Adriana Kugler left her position abruptly and without explanation. In her place, temporarily, came Stephen Miran, who now votes for a 50-basis-point cut at every meeting. Did Donald Trump "break" Lisa Cook with his pressure? Recently, Trump's attacks on Cook have ceased, even though just a few weeks ago the Trump administration was using phrases like 'appeals' and 'reinvestigating' Cook's alleged misconduct in 2021 related to receiving preferential mortgage rates. Could there have been some sort of deal between Trump and Cook?

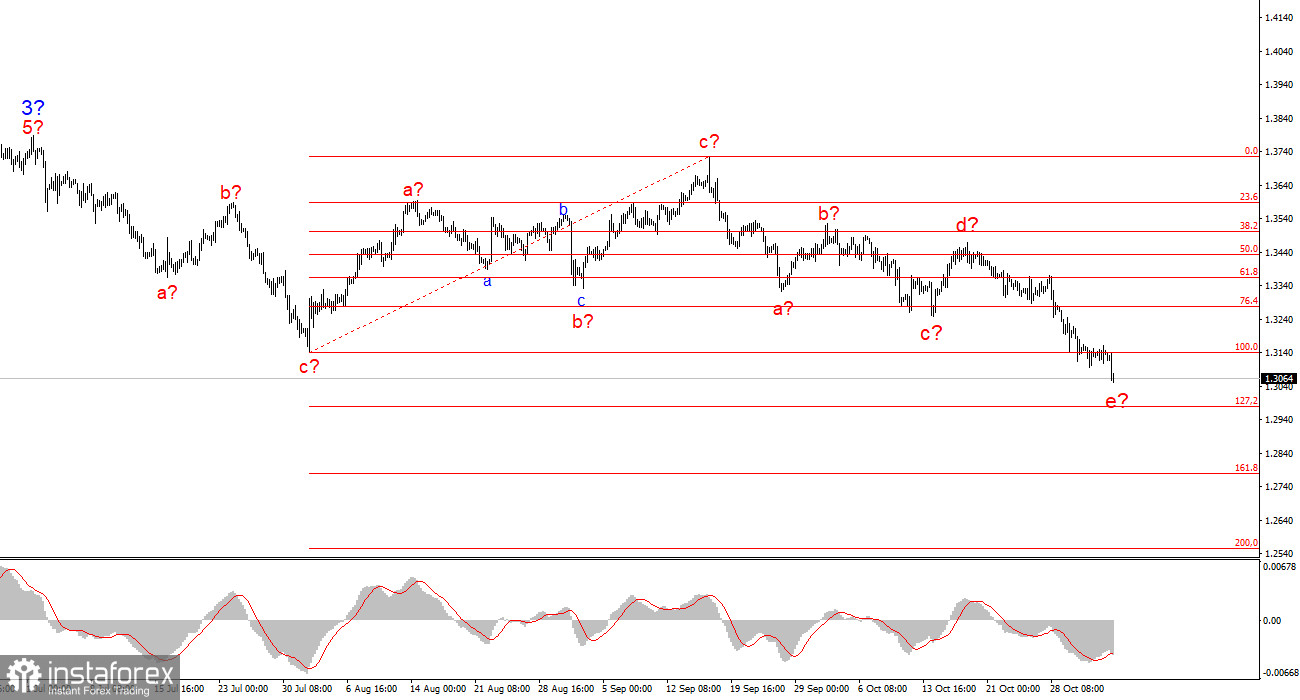

Wave Analysis of EUR/USD

Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward trend. Currently, the market is in a pause, but Donald Trump's policies and the Fed's remain significant factors in the future decline of the US currency. Targets for the current trend section may extend up to the 25 level. At this time, we can observe the construction of corrective wave 4, which takes on a very complex and elongated form. Therefore, in the near future, I still consider only long positions, as any downward structures appear to be corrective. The latest structure—a-b-c-d-e—may be nearing completion.

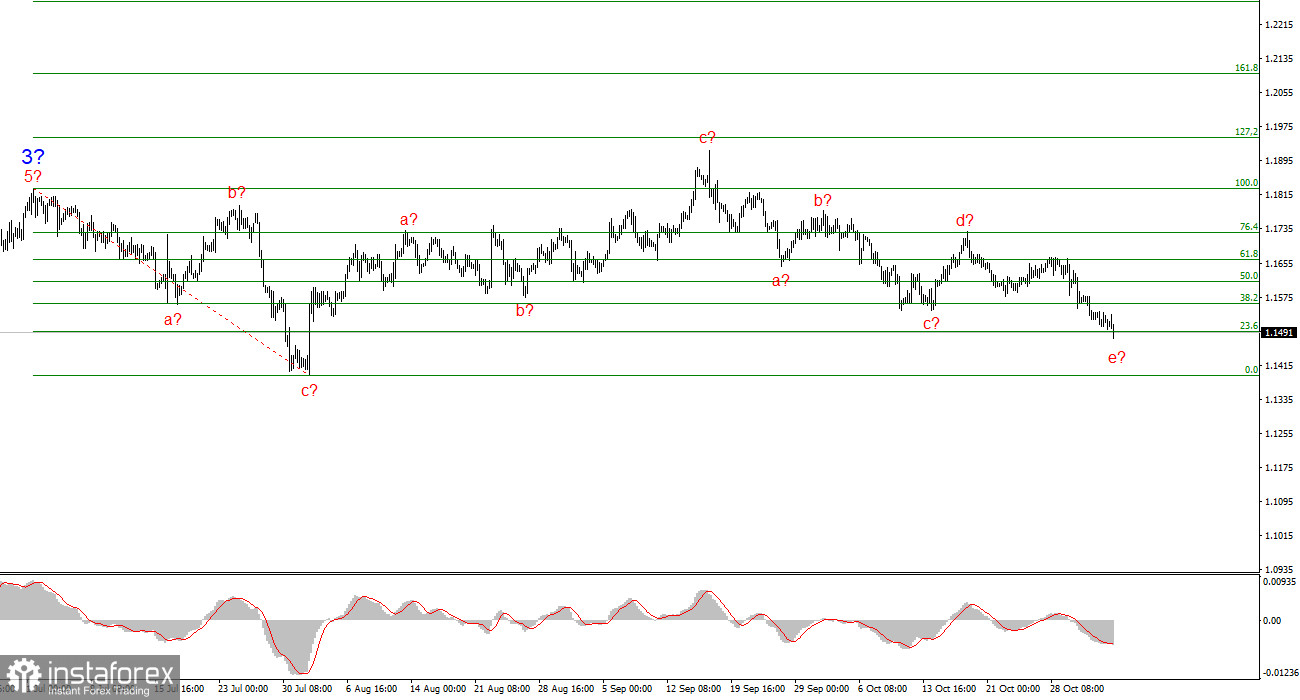

Wave Analysis of GBP/USD

The wave pattern for the GBP/USD instrument has changed. We continue to deal with an upward, impulsive trend section, but its internal wave structure is becoming more complex. Wave 4 takes on a three-wave form, and its structure is significantly more elongated than wave 2. Another downward corrective structure is nearing completion. I continue to expect that the main wave structure will resume its development with initial targets around 38 and 40 levels, and I believe this could happen as early as the beginning of November.

Key Principles of My Analysis

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often undergo changes.

- If there is no confidence in market movements, it is better not to enter the market.

- There is no such thing as 100% certainty in directional movements, and there never can be. Always remember to use protective stop loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.