Bitcoin has just slightly recovered to around $104,000, but for now, this looks like nothing more than a minor correction before another plunge in the cryptocurrency market. Ethereum has also reached $3,480 and then paused.

According to recent data, long-term investors in Bitcoin sold approximately 400,000 BTC last month, amounting to $45 billion. Clearly, such a volume of sales disrupted market stability, which we are currently witnessing. Ongoing selling pressures compound the current market crash, as seasoned participants actively realize profits.

This is mainly due to macroeconomic uncertainty stemming from the U.S. government shutdown, which continues to affect all asset classes, including cryptocurrencies. Inflation and the pause in the rate-cutting cycle lead investors to seek safer investment options, provoking capital outflow from riskier assets like Bitcoin. Additionally, the lack of progress in developing new cryptocurrency regulations plays a role. Finally, we cannot overlook the psychological factor: after a prolonged period of growth and reaching historical highs, investors tend to lock in profits, fearing further corrections. This effect is intensified by stop-loss triggers and liquidations in the futures market, further fueling the downward trend.

However, it is important to understand that as the market declines further, more buyers may emerge looking to purchase at more attractive prices, since the long-term bullish cycle has not disappeared.

I will continue to operate based on any significant dips in Bitcoin and Ethereum, anticipating the continuation of the bullish market in the medium term, which remains intact.

As for short-term trading, the strategy and conditions are described below.

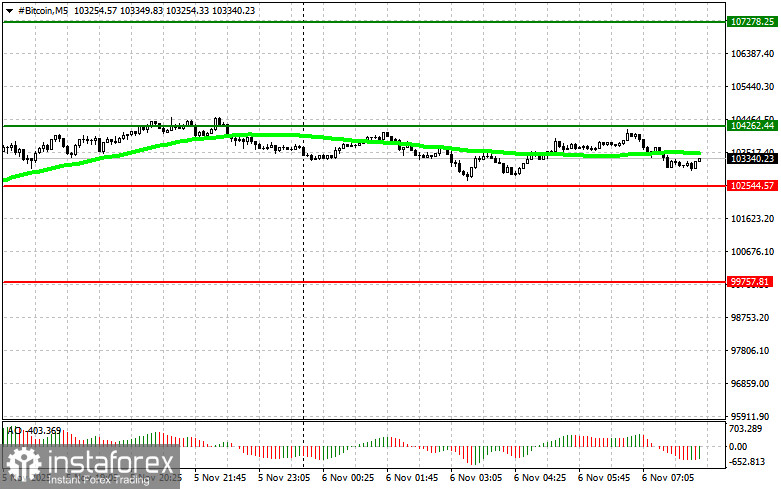

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today upon reaching an entry point around $104,200, targeting a move to $107,200. At around $107,200, I will exit my purchases and sell immediately on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: I can buy Bitcoin from the lower boundary of $102,500 if there is no market reaction to the breakout back toward levels $104,200 and $107,200.

Sell Scenario

- Scenario #1: I will sell Bitcoin today upon reaching an entry point around $102,500, targeting a decline to $99,700. At around $99,700, I will exit my sales and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: I can sell Bitcoin from the upper boundary of $104,200 if there is no market reaction to the breakout back toward levels $102,500 and $99,700.

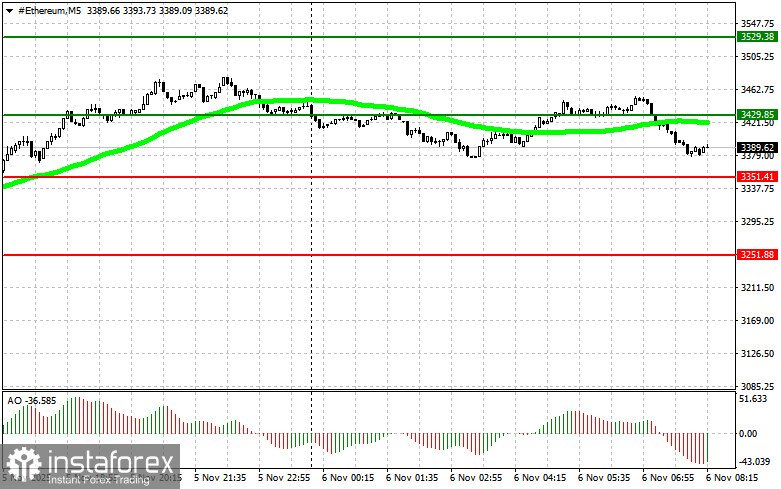

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today upon reaching an entry point around $3,429, targeting a move to $3,529. At around $3,529, I will exit my purchases and sell immediately on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: I can buy Ethereum from the lower boundary of $3,351 if there is no market reaction to the breakout back toward levels $3,429 and $3,529.

Sell Scenario

- Scenario #1: I will sell Ethereum today upon reaching an entry point around $3,351, targeting a decline to $3,251. At around $3,251, I will exit my sales and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: I can sell Ethereum from the upper boundary of $3,429 if there is no market reaction to the breakout back toward levels $3,351 and $3,251.