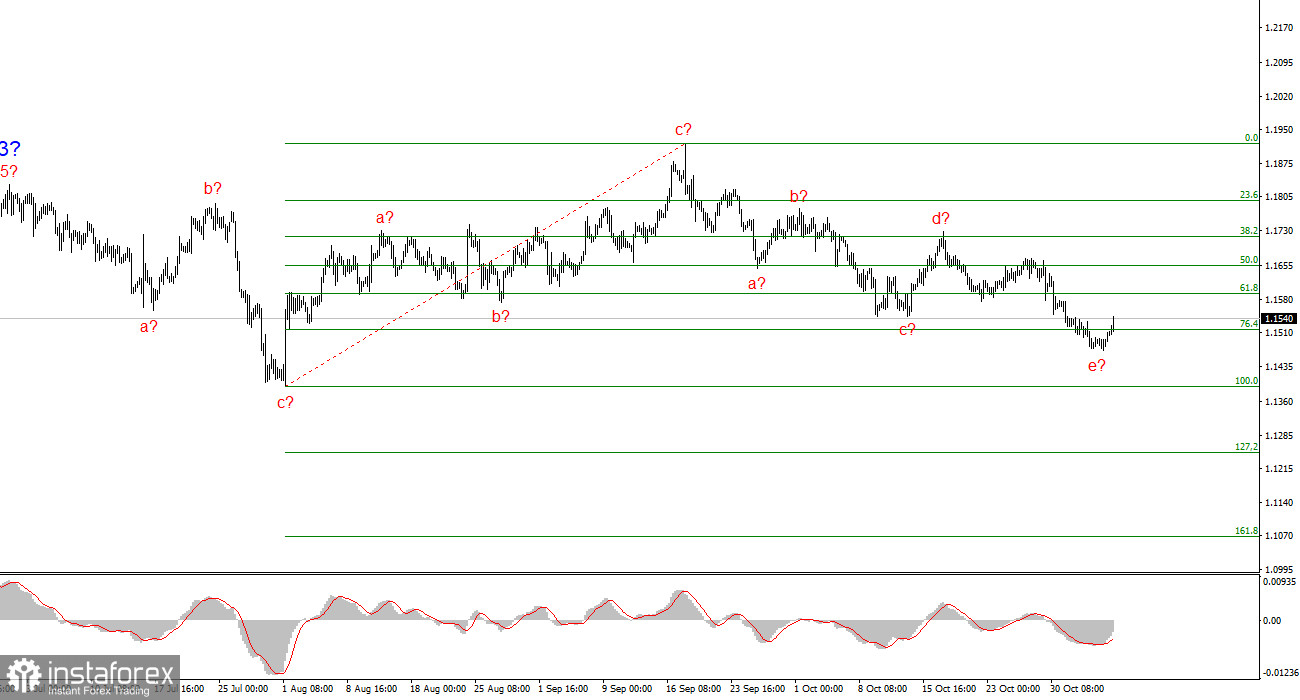

The wave pattern on the 4-hour chart for EUR/USD has changed—and unfortunately, not for the better. It's still too early to conclude that the upward trend segment has been canceled, but the recent decline in the euro has made it necessary to revise the wave structure. We now see a series of corrective formations, which may be part of a larger wave 4 within the overall uptrend. In that case, wave 4 has taken on an unusually extended shape, though the overall wave pattern remains intact.

The upward trend formation continues, while the news background still largely fails to support the dollar. The trade war initiated by Donald Trump continues. His conflict with the Federal Reserve also persists. Market expectations for a dovish Fed rate policy remain strong, especially looking ahead to 2026. Meanwhile, the U.S. government shutdown drags on, and the labor market is cooling. In my opinion, the recent strengthening of the dollar is somewhat of a paradox—but paradoxes do happen in the markets.

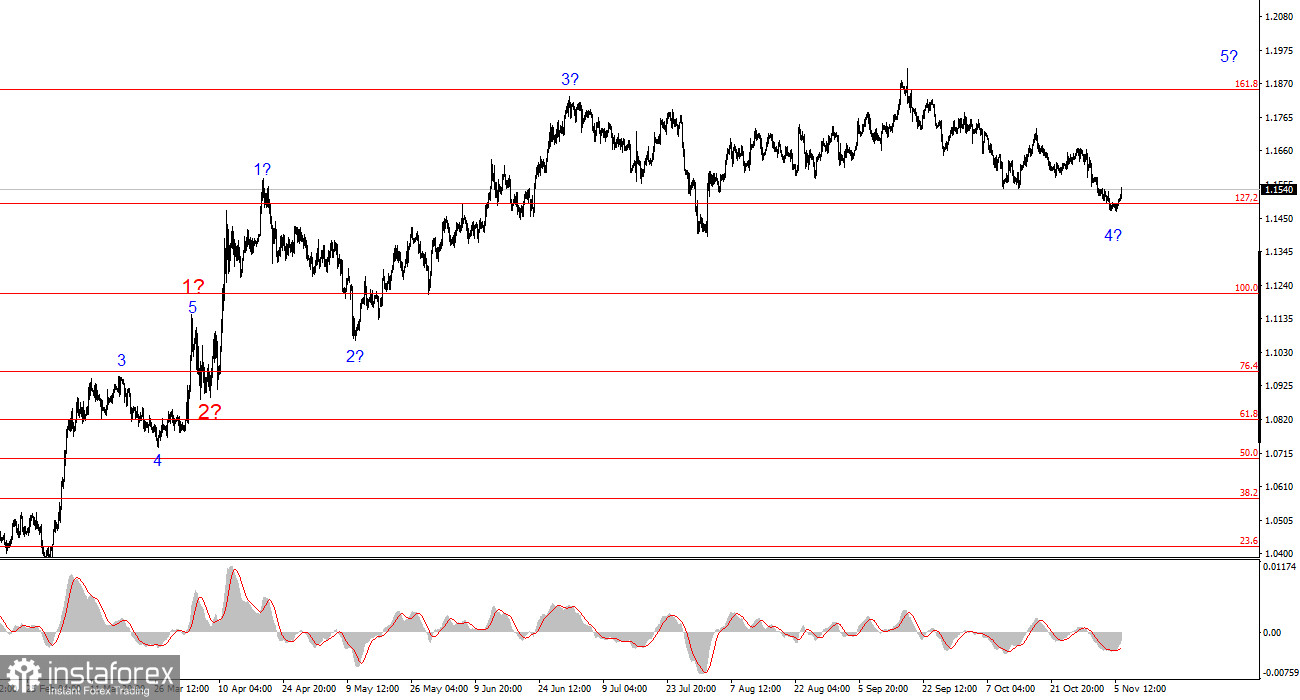

I believe the upward wave structure has not yet been completed, and its targets may extend as high as the 1.25 level. Therefore, the euro could still decline for some time—without strong fundamental reasons (as we've seen over the past month)—but the wave structure still implies a continuation of the uptrend.

The EUR/USD pair rose by 60 basis points on Thursday, an increase it hasn't seen for weeks. It's worth noting that volatility increased slightly today, even though the news background remained rather poor. The market seems to be trading by its own rules, as news has had little to no influence on price movements.

For example, on Monday, a weak U.S. ISM manufacturing index failed to weaken the dollar. On Wednesday, strong ISM data and a solid ADP employment report also failed to boost the dollar. And today, disappointing German industrial production and EU retail sales reports somehow led to a stronger euro. Clearly, there's no logical connection between news and market reaction this week.

And in my view, this disconnect extends beyond this week. In October, there were plenty of events that clearly pointed to a new wave of dollar weakness, which at that time would have fully matched the wave structure. Yet, the market continued to buy the U.S. dollar. Even now, it's difficult to say who exactly was driving demand for the dollar, given that many economists report declining demand for it in futures markets.

We've seen the wave pattern of the corrective trend become more complex, but the global trend remains intact. In trading, patience is key, and I believe we have finally reached the movement we were waiting for.

General Conclusions

Based on the current EUR/USD analysis, I conclude that the instrument continues to build its upward trend. The market is currently in a pause, but Donald Trump's policies and the Federal Reserve's stance remain strong factors for potential dollar weakness in the future. The targets for the current trend segment may extend up to the 1.25 level. At present, we are likely witnessing the formation of corrective wave 4, which is taking on a complex and extended shape. Therefore, in the near term, I continue to focus only on buy positions, as all downward structures still appear corrective in nature. The latest a–b–c–d–e structure may be nearing completion or may already be complete.

On a smaller scale, the entire upward section of the trend is clearly visible. The wave structure is not entirely standard, since the corrective waves vary in size—for example, major wave 2 is smaller than internal wave 2 within wave 3. However, this sometimes happens. I would remind traders that it's best to identify clear and simple structures on the chart rather than trying to label every single wave. The current upward formation leaves little room for doubt.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to revisions.

- If you are uncertain about what's happening in the market, it's better to stay out.

- There can never be 100% certainty about market direction. Always use Stop Loss orders.

- Wave analysis can (and should) be combined with other forms of analysis and trading strategies.