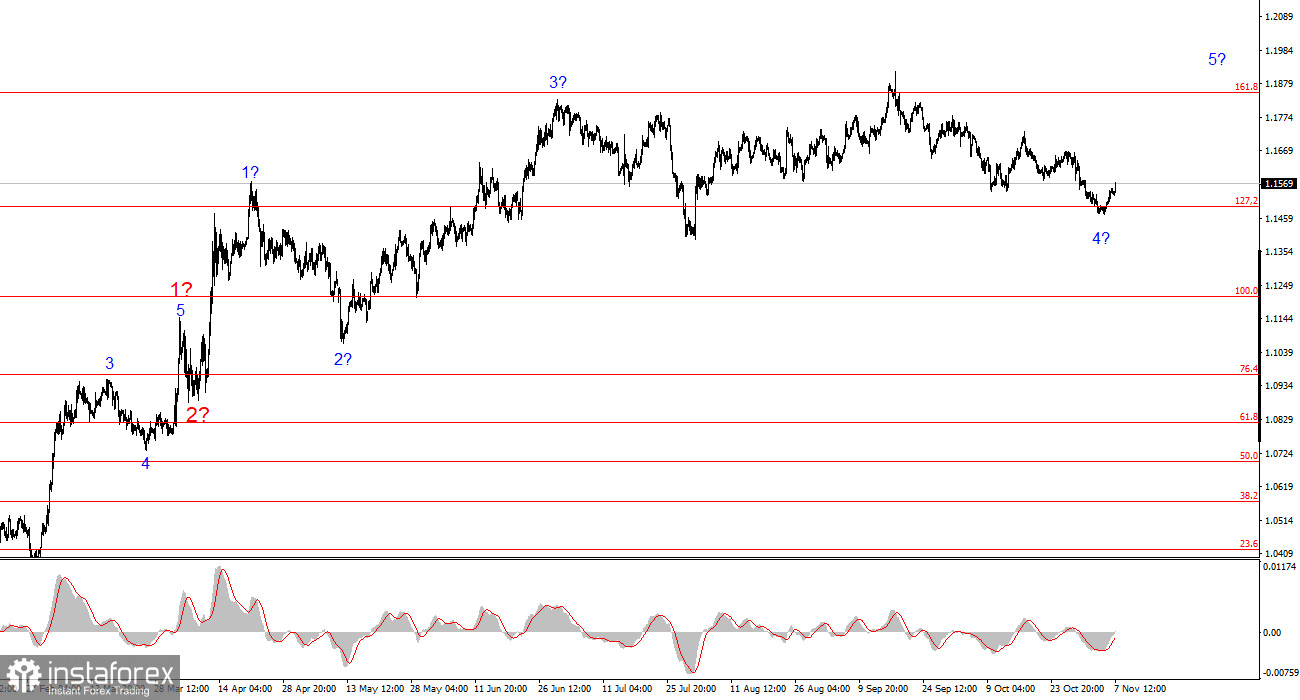

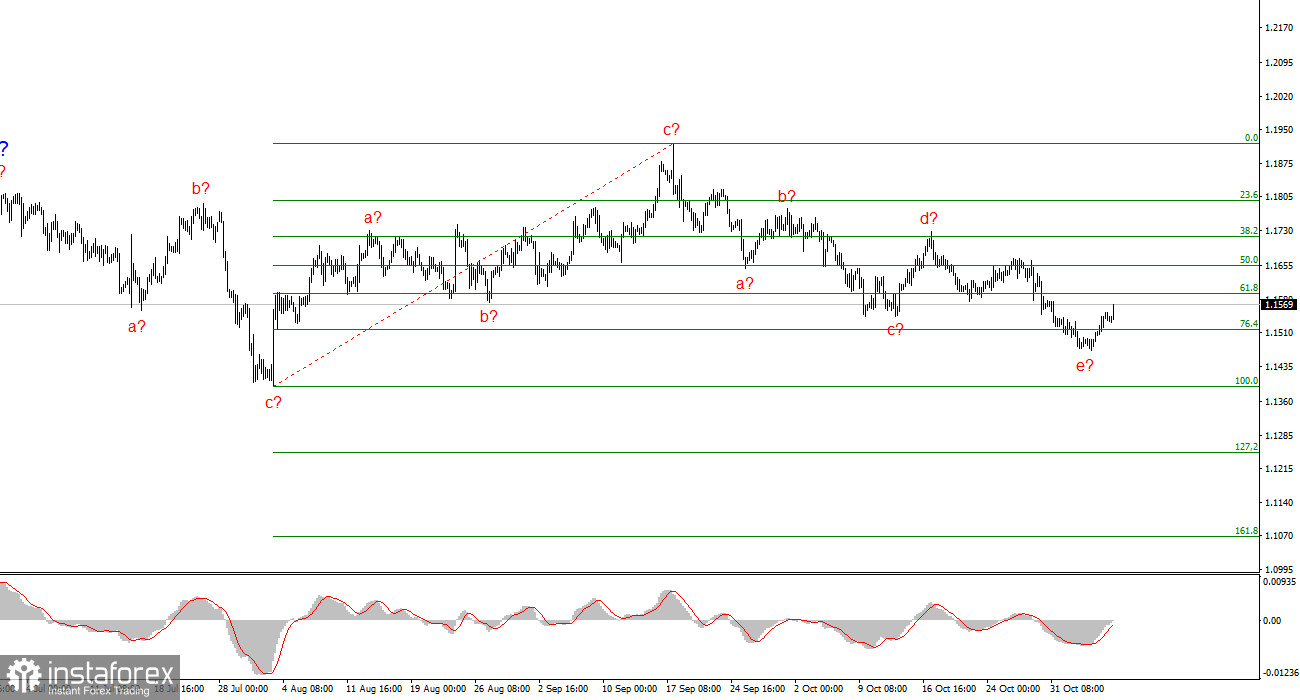

The wave pattern on the 4-hour EUR/USD chart has changed — unfortunately, not for the better. It's still too early to conclude that the upward segment of the trend has ended, but the latest decline in the euro forced a revision of the wave count. Now we can observe a series of corrective structures, which likely form part of the global wave 4 within the broader upward trend. In this case, wave 4 has taken on an unusually extended form, but the overall wave pattern remains coherent.

The construction of the upward trend segment continues, and the news background still largely fails to support the U.S. dollar. The trade war initiated by Donald Trump continues. The conflict between the President and the Federal Reserve continues. Market expectations for a dovish Fed remain strong — particularly for 2026. The U.S. government shutdown persists. The labor market is cooling. In my view, the recent strengthening of the dollar is somewhat paradoxical — but paradoxes are not uncommon in the markets.

In my opinion, the upward wave formation is not yet complete, with potential targets extending up to the 1.25 level. The most recent movement formed a five-wave corrective structure, so I now expect the instrument to rise again as part of the next bullish wave sequence.

The EUR/USD rate rose by 75 basis points over Thursday and Friday. It's not much, but market volatility remains relatively subdued. The euro should be pleased with even such modest growth — over the past month, demand for it had been steadily declining.

I wouldn't say that the news flow on Thursday or Friday supported buyers — quite the opposite. For instance, yesterday's two European reports on retail sales and industrial production came in weaker than market expectations, and today there were no significant news releases at all. Therefore, I consider wave analysis to be the key tool for determining the pair's future dynamics right now.

If the decline resumes, the downward wave sequence that began on September 17 will become even more complex and extended. It currently looks somewhat convincing, but if it stretches further, it will lose coherence entirely. In that case, the entire wave structure since July 1 might require revision. Hence, the euro is still playing with fire at this point.

Let me remind you that the fundamental backdrop still supports the euro, as noted by many analysts. If we abstract away from the wave structure, there's nothing unusual in recent weeks — just a typical correction within a clear long-term uptrend. Accordingly, my bias remains bullish.

General Conclusions

Based on my analysis of EUR/USD, I conclude that the pair continues to build its upward trend segment. The market is currently in a pause, but Donald Trump's policies and the Fed's stance remain significant factors that could contribute to further dollar weakness in the future.

The targets for the current upward segment may extend up to the 1.25 level. At present, the market is forming a complex and extended corrective wave 4. Its internal structure (a-b-c-d-e) may be approaching completion or already finished. Therefore, I currently view buying opportunities as preferable, since all the latest downward structures appear corrective in nature.

On a smaller scale, the entire bullish trend segment is visible. The wave pattern is not perfectly standard, as the corrective waves vary in size — for example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, such irregularities do occur. I'll remind you that it's better to identify clear, readable patterns on the chart rather than obsessing over every minor wave. At the moment, the upward structure looks mostly clear and convincing.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex patterns are difficult to trade and often lead to revisions.

- If you're uncertain about what's happening in the market, it's better to stay out.

- Absolute certainty in market direction is impossible. Always use protective Stop Loss orders.

- Wave analysis can and should be combined with other types of analysis and trading strategies.