Trade Analysis and Tips for Trading the Euro

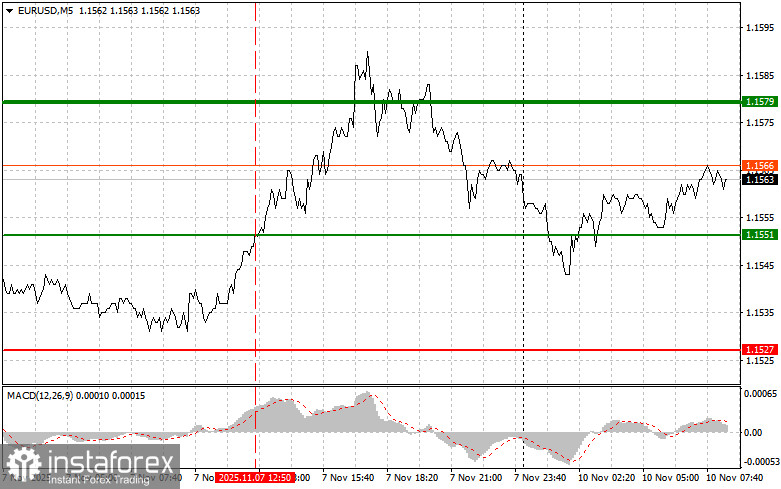

Testing the price at 1.1551 coincided with the MACD indicator advancing significantly above the zero mark, which limited the pair's upside potential. For this reason, I did not buy the euro and missed out on the pair's strong upward movement.

In the U.S., a sharp decline in the University of Michigan's consumer sentiment index weakened the American currency against the euro. Market participants interpreted this as a harbinger of slowing U.S. economic growth, negatively affecting the dollar's status as a safe haven. The downward trend of the dollar can be explained by expectations of further dovish actions from the U.S. Federal Reserve, despite some warnings from its policymakers about the need to avoid rushing into easing. Meanwhile, the European Central Bank continues to adopt a more conservative policy, providing additional incentive for the euro's growth. The differences in monetary policy approaches of the two leading central banks have a significant impact on currency dynamics, and the current situation is a vivid confirmation of that.

Today, there are no significant macroeconomic data releases in the Eurozone; the only event is the publication of the Sentix investor confidence index. Although the Sentix index is not a decisive factor in ECB policy, it provides an assessment of investors' outlooks and forecasts for economic growth in the region. A decline in confidence reflected in this index could indicate potential vulnerability for the euro. On the other hand, positive Sentix data could temporarily support the euro by alleviating selling pressure. However, it is important to remember that this is just one of many factors influencing the exchange rate. The long-term dynamics of the euro will primarily depend on the ECB's monetary policy, inflation indicators, and the overall state of the European economy.

Regarding intraday strategies, I will focus more on implementing Scenarios 1 and 2.

Buy Scenarios

- Scenario 1: Today, I can buy the euro upon reaching a price around 1.1571 (green line on the chart) with a target for growth to the level of 1.1599. At the point of 1.1599, I plan to exit the market and sell the euro back, aiming for a movement of 30-35 pips from the entry point. The expectation of the euro's growth can follow positive data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from there.

- Scenario 2: I also plan to buy the euro today if the price tests 1.1554 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal. A rise to the opposing levels of 1.1571 and 1.1599 can be expected.

Sell Scenarios

- Scenario 1: I plan to sell the euro once it reaches 1.1554 (red line on the chart). The target will be 1.1534, where I plan to exit the market and immediately buy back (aiming for a 20-25-pip move in the opposite direction). There is unlikely to be significant pressure on the pair today. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting its decline from there.

- Scenario 2: I also plan to sell the euro today if the price tests 1.1571 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline to the opposing levels of 1.1554 and 1.1534 can be anticipated.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.