The GBP/USD currency pair also traded quite calmly on Monday, although it might seem that Trump made many Americans happy with his promises to pay $2,000 each and the imminent end of the "shutdown." Why then did the dollar not strengthen, and why did the market practically ignore these two events?

Without delving into the details of the agreement between Democrats and Republicans in the Senate that allowed Trump to promise the imminent end of the government shutdown, let's say that at any moment, things could go wrong. The senators only agreed on temporary funding for the government until January 30. In other words, for 3 months. Thus, it is reasonable to assume that a new "shutdown" could begin early next year, as the demands of both parties remain essentially unchanged.

Let's remind ourselves that the Democrats blocked approval of the funding proposal because Trump wanted to cut social spending and medical subsidies. It was reported yesterday that the Democrats agreed to unblock the government in exchange for negotiations to fully maintain the Medicaid program, which must now take place in December. Thus, the Republican Party had to make concessions in exchange for temporary funding for the government. If the December negotiations fail, a new "shutdown" will begin in February.

For the Democratic Party, a "shutdown" causes much less damage than it does for the Republicans. According to recent social surveys, the majority of Americans blame Trump and his party for the stoppage of work. Therefore, the more "shutdowns" there are, and the longer they last, the lower the political ratings of the ruling party fall. And next year, there are midterm elections in which the Democrats aim to win.

Moreover, the "shutdown" is still not over, as the funding proposal approved by the Senate over the weekend now goes to the House of Representatives for a vote. Practically any member of Congress could call for amendments to the bill at any time, which could delay the unblocking of government work for several more days. There are many Democrats in Congress opposed to any concessions to Trump. Trump himself could also block the final agreement, as he is against any changes to his spending proposal for 2026. The Democrats only approved funding for 3 months, which may not be enough for the president. Therefore, as they say, "the ice has moved," but the end of this sad story could still be very far off.

It should also be noted that throughout the entire duration of the "shutdown," the dollar has been steadily rising. Not sharply, but steadily. Therefore, in light of the potential end of the "shutdown," expecting its growth seems illogical. The market has ignored the "shutdown," ignored Trump's new tariffs, and ignored the Fed's dovish actions. And now it may continue to do so, but in the opposite direction. This is because any current strengthening of the dollar is inherently illogical and corrective. The medium-term upward trend remains, so even new events and data are not needed for its resumption. The existing data already available to the market will suffice.

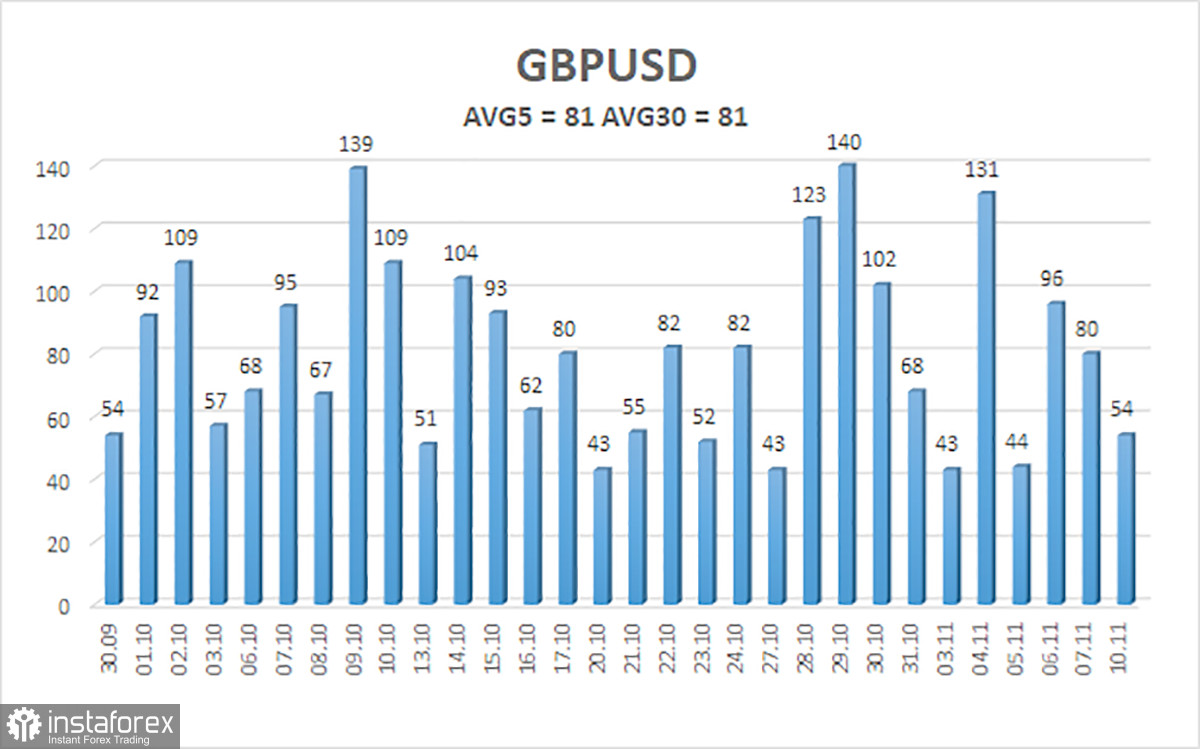

The average volatility of the GBP/USD pair over the past five trading days stands at 81 pips, which is considered "average" for this pair. On Tuesday, November 11, we expect movement within the range limited by levels 1.3073 and 1.3235. The upper linear regression channel is directed downward, but due to a technical correction on the higher timeframes. The CCI indicator has entered the oversold area four times, warning of a resumption of the upward trend. A new bullish divergence has formed, from which the recent surge began.

Closest Support Levels:

S1 – 1.3062

S2 – 1.2939

S3 – 1.2817

Closest Resistance Levels:

R1 – 1.3184

R2 – 1.3306

R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the upward trend of 2025, and its long-term prospects have not changed. Donald Trump's policies will continue to weigh on the dollar, so we do not expect the dollar to strengthen. Thus, long positions with targets at 1.3260 and 1.3430 remain relevant in the near term while the price remains above the moving average. If the price is located below the moving average line, small shorts can be considered with targets at 1.3062 and 1.2939 based on technical grounds. From time to time, the American currency shows corrections (in the global sense), but for a trend-based strengthening, it needs real signs of a conclusion to the trade war or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, it indicates that the trend is currently strong.

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will spend the following days, based on current volatility indicators.

- The CCI indicator entering the oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.