November has seen surprising events unfold in the financial markets. Instead of rising after weak labor market data from alternative sources, EUR/USD maintained its resilience. After winning the midterm elections, Democrats yielded to Republican demands. The Senate supported a bill for temporary government funding until January 30 without concessions on healthcare. The approaching end of the shutdown initially strengthened the U.S. dollar. These developments left investors scratching their heads.

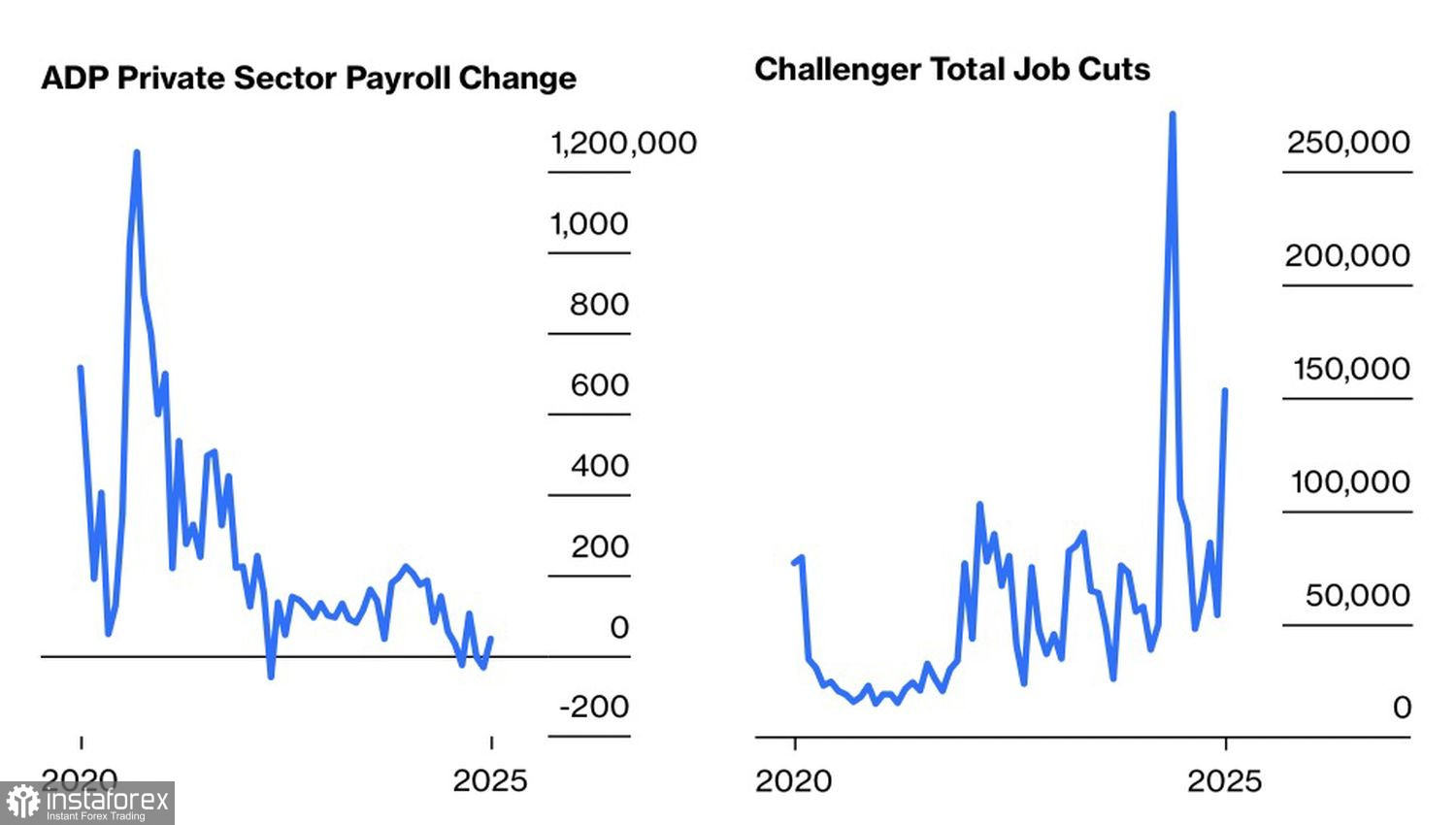

Dynamics of U.S. Labor Market Indicators

Employment in the private sector, according to ADP, left much to be desired. Statistics from Challenger, Gray & Christmas signaled a spike in layoffs, while figures from Indeed.com indicated a reduction in job vacancies for four consecutive years. The labor market is not faring well. However, derivatives maintain chances for a federal funds rate cut in December at approximately 63-67%.

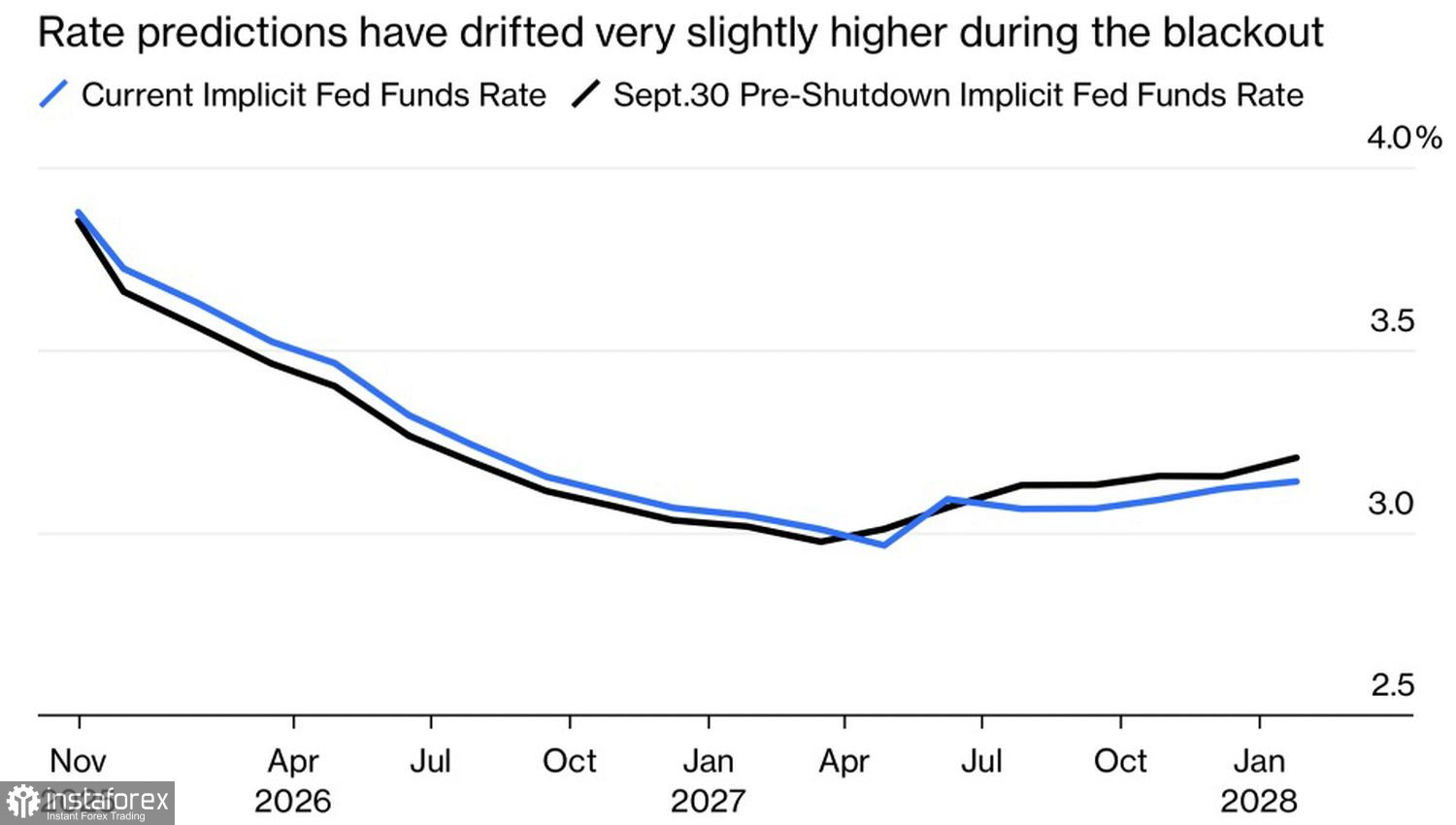

It seems investors have concluded that the Federal Reserve will overlook alternative data and act as it would without them. This means considering only the non-farm employment figures from June to August. The question of easing monetary policy by the end of the year appears resolved, no matter how much the "hawks" of the FOMC express concern about excessively high inflation.

Dynamics of Market Expectations for the Federal Funds Rate

The end of the shutdown theoretically should have reduced uncertainty, but in reality, it may increase. In the near term, the market will be flooded with numerous reports delayed due to the government shutdown. Not all of these will necessarily point in the same direction: inflation and employment are slowing. Most likely, the information will be fragmented and contradictory. As a result, the chances of a Fed rate cut in December will fluctuate, along with EUR/USD.

Another factor is that the markets are influenced not only by monetary policy. According to the Supreme Court hearings, U.S. tariffs may soon be deemed illegal and abolished. This would result in chaos in the global economy and financial markets. Which assets would benefit from this? Goldman Sachs believes that the U.S. dollar will be one of the beneficiaries, suggesting that the U.S. economy will improve and trade uncertainty will decrease.

In my opinion, trade uncertainty will not decrease. The White House has a Plan B, and Donald Trump will not give up tariffs, regardless. At the same time, the budget deficit and national debt will increase, as the funds raised will need to be repaid. The dollar is more likely to lose than to gain.

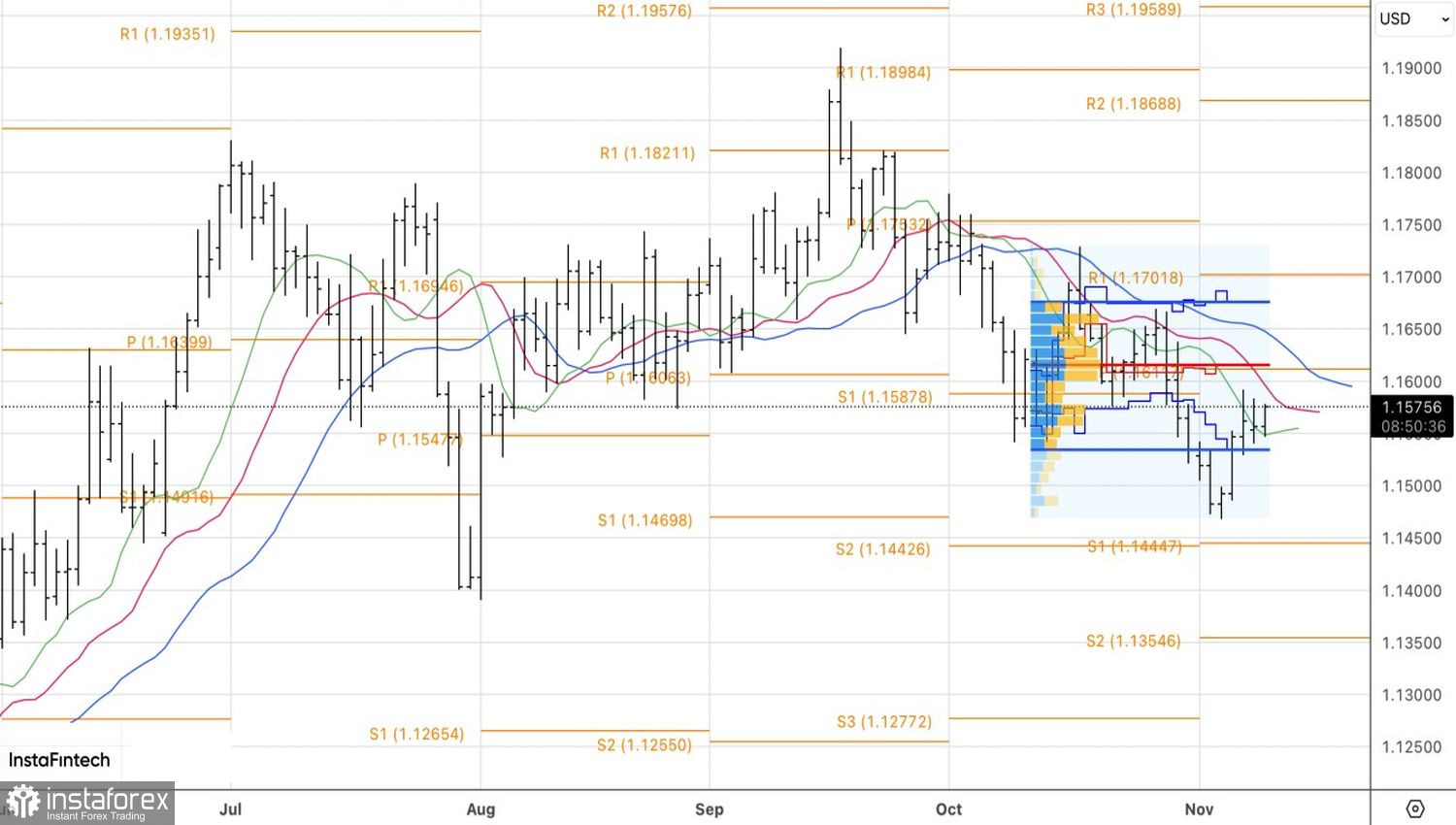

Technically, there is an inside bar on the daily chart of EUR/USD. It seems logical to place pending buy orders at the level of 1.158 and sell orders at 1.154. The chances of realizing the first scenario appear more favorable.