The euro, the pound, and other risk assets received little support and were unable to sustain their gains against the US dollar.

Yesterday, the US government resumed operations. Donald Trump signed the H.R. 5371 law, officially ending the record-long shutdown that was widely anticipated but had no effect. Firstly, the markets had long priced in the probability of the government resuming operations. Traders, having learned from the bitter experiences of past shutdowns, had already calculated possible scenarios and adapted to them. Secondly, the acute lack of fundamental indicators pertaining to the American economy remains the main reason why strong movements have not happened in the currency market recently. Soon, everyone will closely watch the fresh statistics that will clarify the situation.

Today, in the first half of the day, figures on industrial production in the Eurozone and the European Central Bank's economic bulletin are expected. These events will undoubtedly attract traders' attention, as they offer valuable insights into the state of the European economy. Data on industrial production will serve as an important indicator of the health of the manufacturing sector, which is a key driver of the Eurozone economy. An increase in industrial production is usually seen as a positive signal that indicates economic strengthening and may lead to a strengthening of the euro. Conversely, a decline in industrial production could raise concerns about slowing economic growth and, in turn, weaken the currency. The ECB's economic bulletin is equally important, as it will provide a broader context for understanding the current economic situation in the Eurozone and offer assessments of inflation, economic growth, and prospects for monetary policy.

As for the pound, quite significant data are expected today in the first half of the day, including GDP growth, changes in industrial production, and the balance of trade in goods, which will set the direction for the GBP/USD pair. Traders are eagerly awaiting the release of these macroeconomic indicators, as they can shed light on the state of the British economy. Sustained GDP growth may signal the strength of domestic demand and improve the prospects for the pound sterling. Meanwhile, an increase in industrial production will indicate a recovery in the manufacturing sector, which will also have a positive impact on the British currency. However, a trade deficit could exert pressure on GBP/USD, especially if it turns out to be larger than expected.

Economists forecast a decline in GDP for the third consecutive quarter, which is unlikely to please pound buyers. If the actual figures align with forecasts, the market's reaction may be muted.

If the data aligns with economists' expectations, it is better to act on the Mean Reversion strategy. If the data comes in significantly above or below economists' expectations, the Momentum strategy will be most effective.

Momentum Strategy (Breakout):

For the EUR/USD Pair:

- Buy on a breakout above the level of 1.1595, which may lead to a rise in the euro to around 1.1610 and 1.1645.

- Sell on a breakout below the level of 1.1570, which may lead to a decrease in the euro to around 1.1543 and 1.1521.

For the GBP/USD Pair:

- Buy on a breakout above the level of 1.3130, which may lead to a rise in the pound to around 1.3181 and 1.3216.

- Sell on a breakout below the level of 1.3105, which may lead to a drop in the pound to around 1.3086 and 1.3052.

For the USD/JPY Pair:

- Buy on a breakout above the level of 155.15, which may lead to a rise in the dollar to around 155.54 and 155.87.

- Sell on a breakout below the level of 154.75, which may lead to a decline in the dollar to around 154.30 and 153.97.

Mean Reversion Strategy (Pullback):

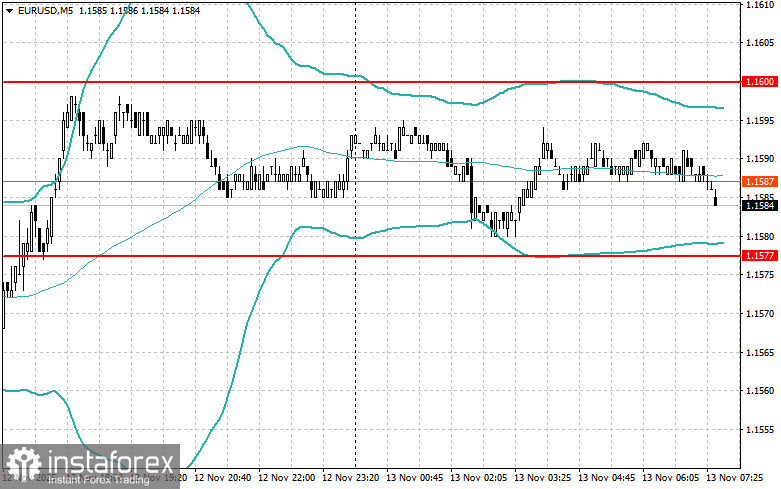

For the EUR/USD Pair:

- Look for sells after a failed breakout above 1.1600 and a return below this level.

- Look for buys after a failed breakout above 1.1577 and a return to this level.

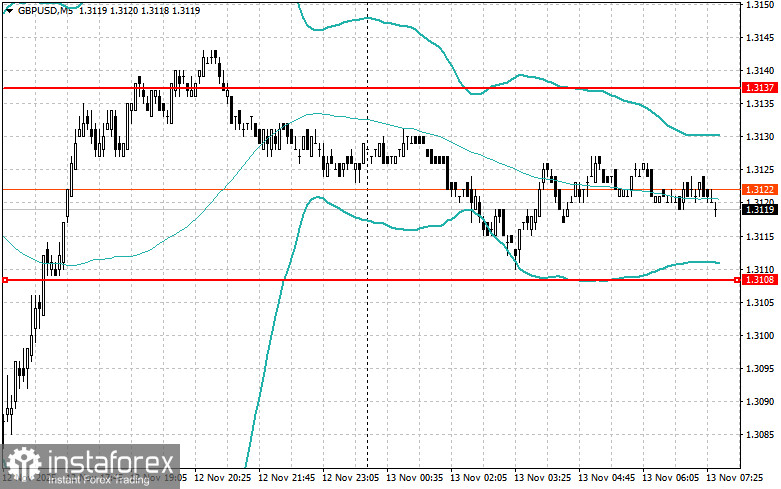

For the GBP/USD Pair:

- Look for sells after a failed breakout above 1.3137 and a return below this level.

- Look for buys after a failed breakout above 1.3108 and a return to this level.

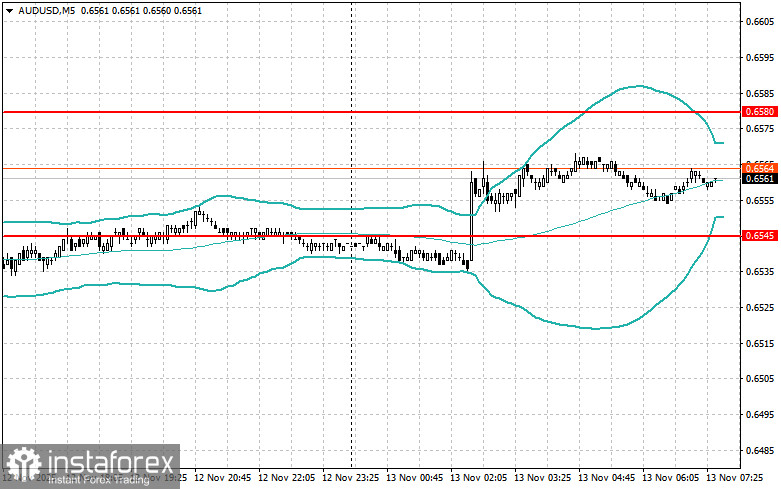

For the AUD/USD Pair:

- Look for sells after a failed breakout above 0.6580 and a return below this level.

- Look for buys after a failed breakout above 0.6545 and a return to this level.

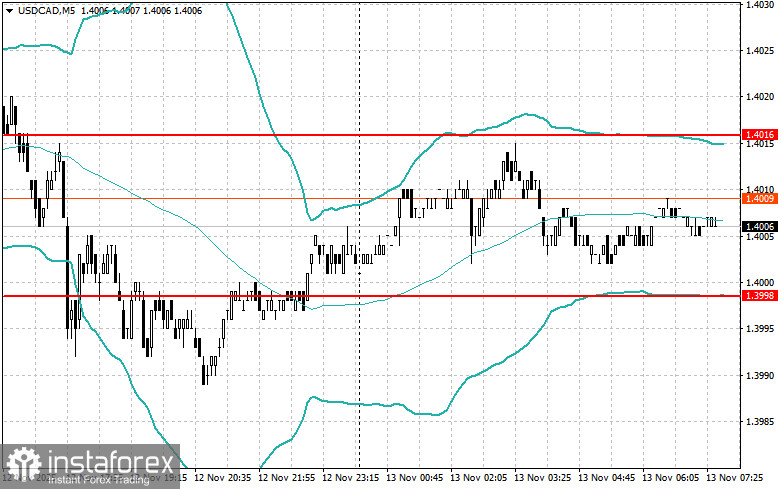

For the USD/CAD Pair:

- Look for sells after a failed breakout above 1.4016 and a return below this level.

- Look for buys after a failed breakout above 1.3998 and a return to this level.