Demand for the US dollar has been increasing for over a week, starting around the time when the "smell" of the government shutdown's conclusion emerged in America. Perhaps the shutdown isn't really the issue, and the market, which initially ignored the government halt, continues to do so now? This sounds quite plausible, but in my reviews, I have previously mentioned that it is not solely about the shutdown that the market "does not see." The matter lies in the overall news background.

Let's consider another recent event that gave the dollar a chance at success, rare in 2025. Following a series of speeches from FOMC officials, the probability of a rate cut at the December meeting dropped to 53%. Not long ago, futures markets assessed the likelihood of a third consecutive easing between 60% and 90%. For example, Susan Collins stated that the interest rate should remain unchanged in December, as further reductions would lead to even greater inflation. Her colleague, Raphael Bostic, also supported the option of keeping the current rate. The market, which has been expecting the most "dovish" actions from the American central bank for two consecutive years, has once again started to retreat from its convictions.

If we analyze all statements and speeches by Jerome Powell and his colleagues who are not "Trump's proteges," it becomes evident that the Fed did not intend to lower rates more than twice in 2025. Powell mentioned two rounds of monetary policy easing back at the beginning of the year. Indeed, he could not have known how events in the country with a new president would develop, but essentially, the Fed has adhered to its baseline scenario. Moreover, the "dot-plot" graphs, which are released quarterly, have consistently indicated that the weighted average expectation among all Fed governors for rate cuts is two rounds of 25 basis points each.

If we recall all of Powell's comments regarding inflation, the FOMC president has always stated that inflation cannot suddenly become a secondary indicator. In other words, most FOMC governors were unwilling to sacrifice price stability to save the labor market. At the beginning of the year, no one could have predicted that the labor market would need saving.

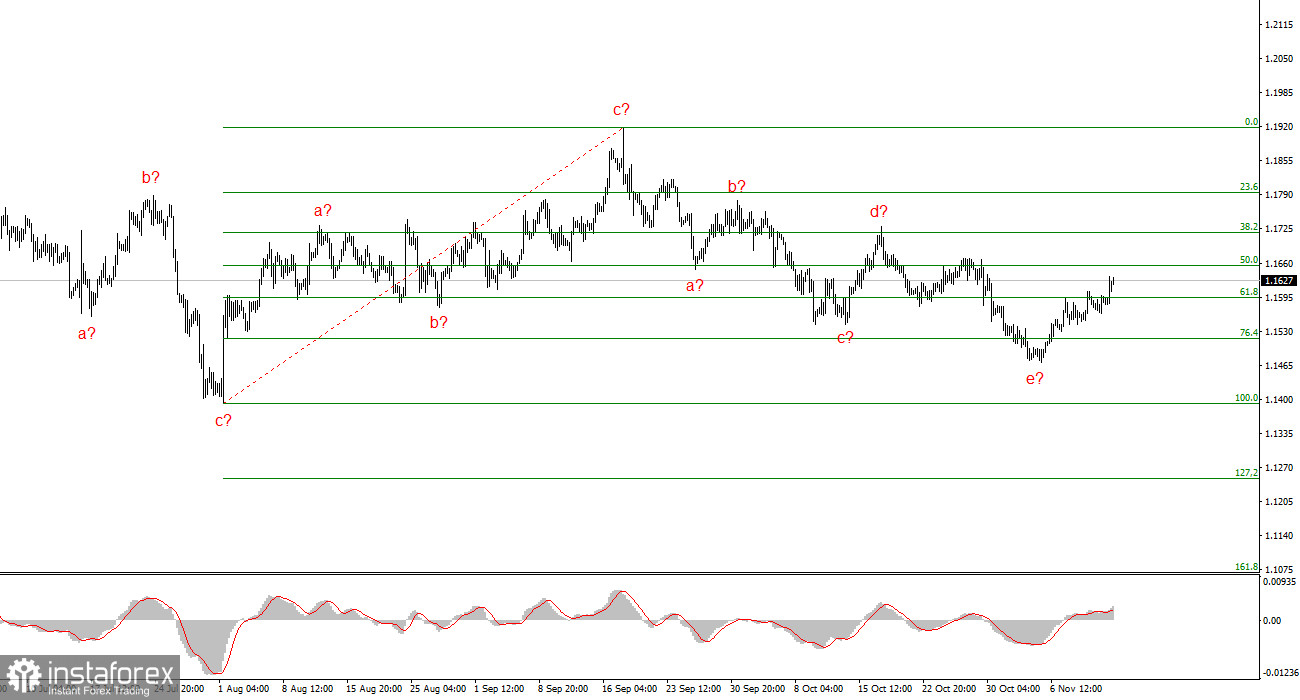

Wave Analysis of EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to develop an upward trend segment. The market has paused in recent months, but Donald Trump's policies and the Fed's actions remain significant factors in the future decline of the American currency. The targets for the current trend segment may reach the 25-figure mark. Currently, the formation of corrective wave 4 is underway, which has taken on a very complex and elongated appearance. Its latest internal structure, a-b-c-d-e, is nearing completion or may already be finished. Therefore, I'm reconsidering long positions now with targets positioned around the 19 figure.

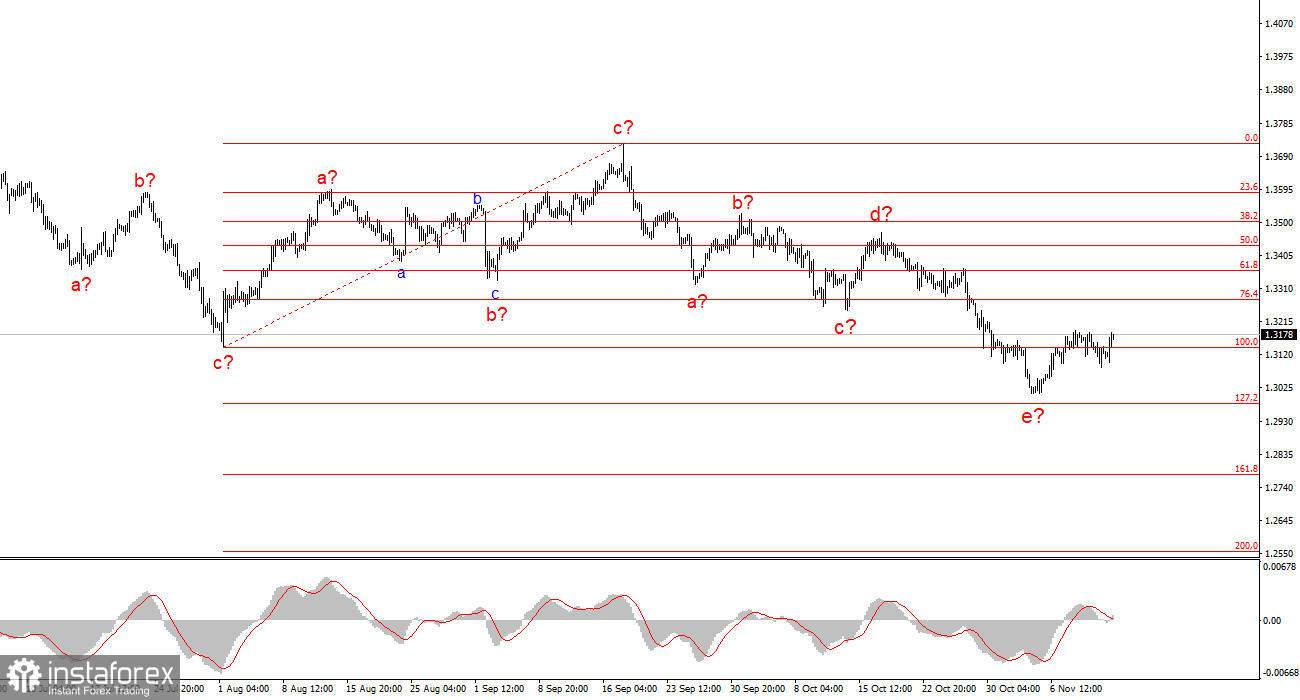

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive trend segment, but its internal wave structure is becoming more complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in c within 4 is presumed to be close to completion. I expect the main wave structure to resume development with initial targets around the 38 and 40 figures.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often result in changes.

- If there is no confidence in market movements, it is better not to enter the market.

- There is never 100% certainty in the direction of movement, nor will there ever be. Remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.