The GBP/USD currency pair traded up throughout Thursday. Most traders likely wonder why. However, for those who regularly read our reviews, this question should not arise. Let's look at the situation from yesterday in general. In the morning, news broke that the US government had finished the longest shutdown in history after 43 days. Is this a positive factor for the American economy and currency? Undoubtedly. So why did the dollar fall during the day? Also in the morning, the UK published reports on GDP and industrial production. Both reports were a dismal failure. If the British economy grew by even a meager 0.1%, industrial production fell by 2% in September. Is this negative news for the pound sterling? Certainly. So why did the pound rise from the very start of the day?

We answer these questions almost daily. Because market movements are currently illogical. The market pushed the euro and the pound down, while the dollar rose artificially. Why was it pushed, and for what reason? The answers can vary, but the most obvious one is manipulation. Market makers seemed to indicate to retail traders that the dollar would continue to rise. Alternatively, they may be hunting for liquidity. Regardless, there is no logic in the strengthening of the US currency. Thus, any downward movement is primarily a technical correction or manipulation, but not a market trend. The global fundamental background fully justifies any upward movement.

Let's remind ourselves that there are very few positive news items for the British pound itself. Therefore, it may seem that the British currency has logically fallen in recent months. However, the problems in Britain pale in comparison to the issues faced by the US. The main issue is Donald Trump, who needs a cheap dollar, who requires the Federal Reserve to maintain a "soft" monetary policy, who is ready to impose new tariffs, who is prepared to wage war with Venezuela, who is willing to impose sanctions on everyone in the world, and who is ready to declare a state of emergency for any reason. Given these circumstances, do you think the attractiveness of American assets and currency is increasing?

The US economy is growing, and that's a fact, but this growth is again supported by an enormous money supply in the US. The US stock market is rising, but experts have been warning about its "overheating" and a "bubble" that will burst sooner or later for several years now. Furthermore, the most recent rise in stock indices has been solely attributed to companies involved in artificial intelligence. Investors sensed profit and did not want to miss out, turning a blind eye to Trump's policies. Thus, no matter how low the pound falls, regardless of how bad things are in Britain, we continue to expect only growth from GBP/USD. It's simply a matter of the global trend and the daily timeframe. On such a timescale, corrections can easily take several months. But that does not mean that the "anti-dollar trend" is over.

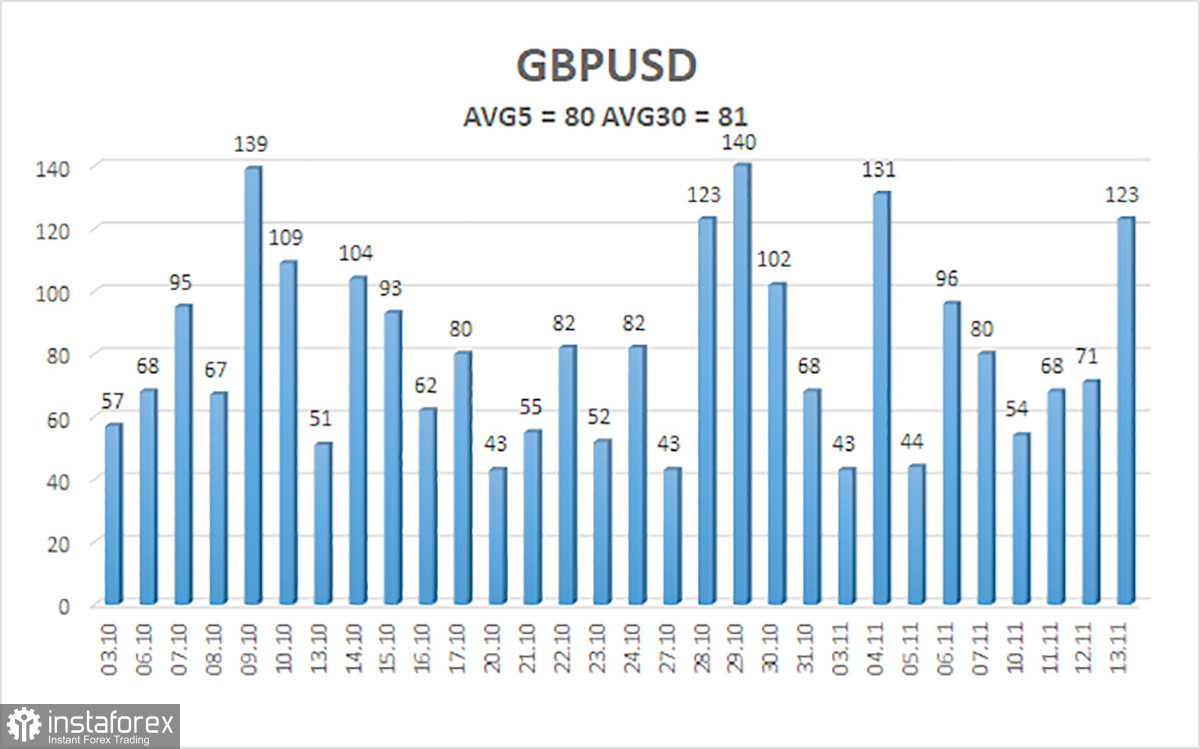

The average volatility of the GBP/USD pair over the last five trading days is 80 pips. For the pound/dollar pair, this figure is considered "average." We expect the pair to trade between 1.3130 and 1.3290 on Friday. The upper channel of the linear regression is downward, but due to technical corrections on higher timeframes. The CCI indicator has entered the oversold area four times (!), which warns of a resumption of the upward trend. A new bullish divergence has formed from which the last wave of growth started.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD currency pair is trying to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to pressure the dollar, so we do not expect the dollar to appreciate. Therefore, long positions with targets at 1.3306 and 1.3428 remain relevant in the near term if the price remains above the moving average. If the price is below the moving average line, small short positions can be considered with targets of 1.3062 and 1.2939 based on technical grounds. From time to time, the American currency shows corrections (in a global context), but for the trend to strengthen, it needs real signs of the completion of the trade war or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, it indicates that the trend is currently strong.

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will spend the following days, based on current volatility indicators.

- The CCI indicator entering the oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.