Analysis of Macroeconomic Reports:

There are very few macroeconomic reports scheduled for Friday, and the market has been reacting very rarely to local news and macroeconomic reports in recent weeks. Thus, the Eurozone GDP report for the third quarter has a "loud" headline but may actually be ignored by traders. Economic growth is expected to be 0.2%, which is very low in any case. As we can see, the European Central Bank's monetary policy easing has not yet led to an acceleration in the economy. The euro is unlikely to gain support from this report, but it may continue to rise on technical factors.

Analysis of Fundamental Events:

General Conclusions:

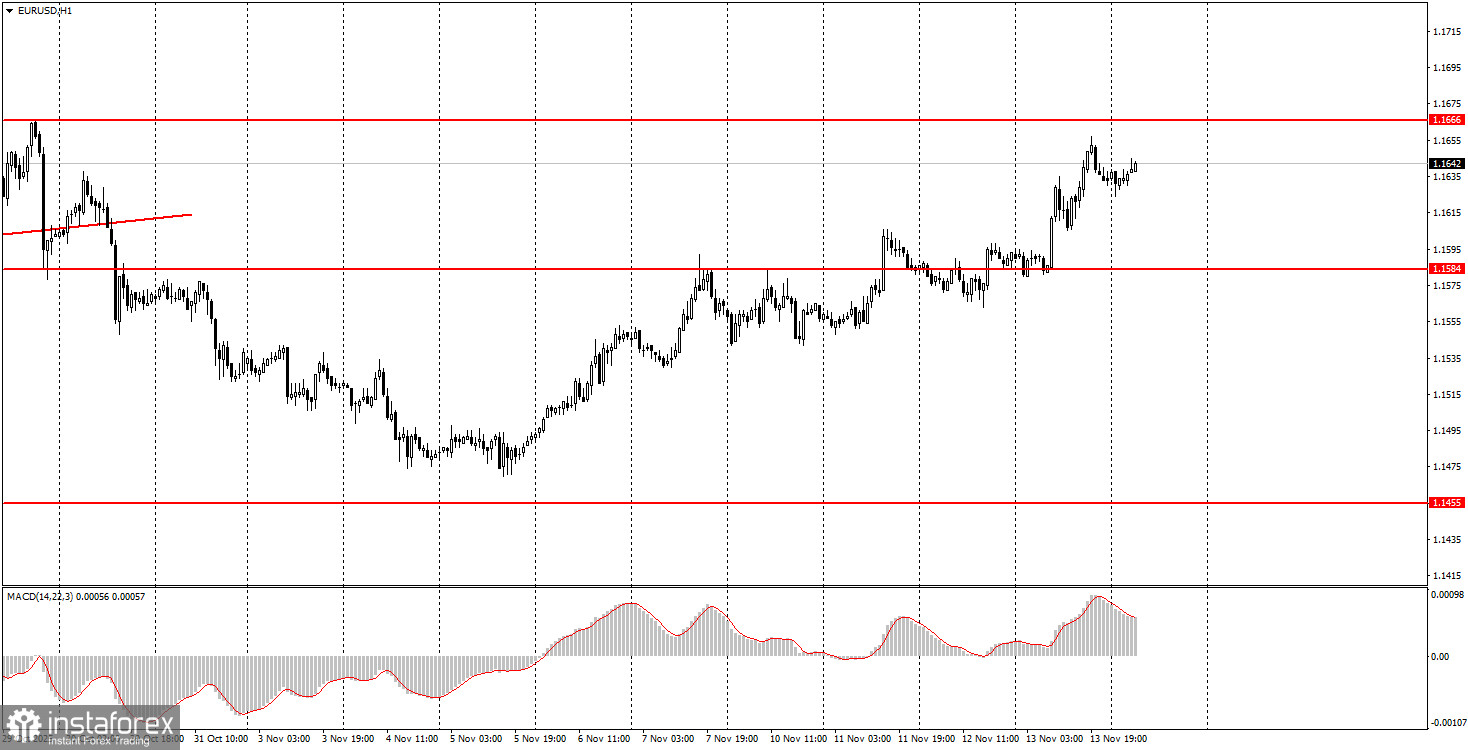

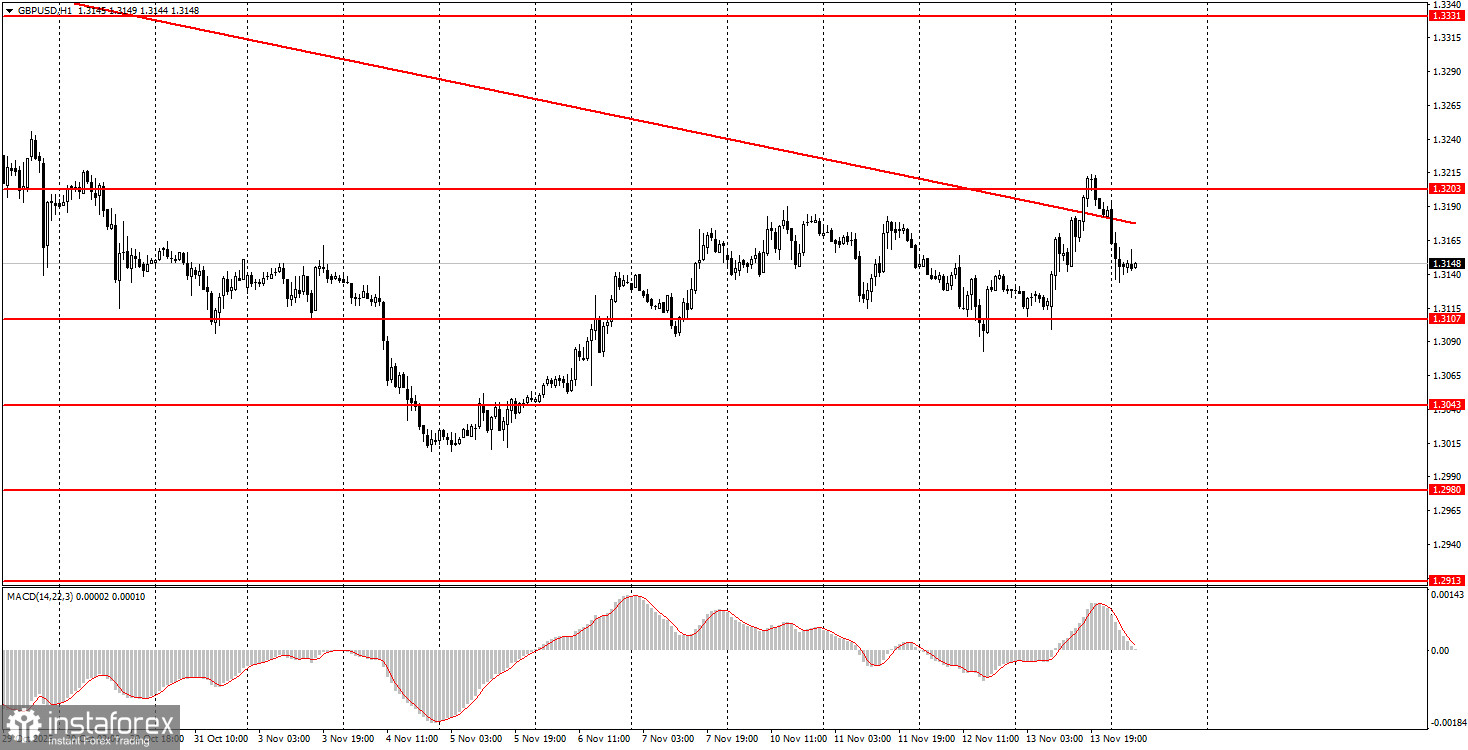

On the last trading day of the week, both currency pairs may continue moving north, but a decline cannot be ruled out. The euro has a great trading area at 1.1655-1.1666. For the British pound, there are two relevant trading areas for Friday: 1.3096-1.3107 and 1.3203-1.3211.

Key Principles of My Trading System:

- The strength of the signal is considered based on the time taken to form the signal (bounce or breach of a level). The less time taken, the stronger the signal.

- If two or more trades have been opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can create numerous false signals or may not form them at all. In any case, it's best to stop trading at the first signs of a flat.

- Trading deals are opened during the period between the start of the European session and the middle of the American session, after which all deals should be closed manually.

- On the hourly timeframe, it is preferable to trade based on signals from the MACD indicator only when there is good volatility and a trend that is confirmed by a trend line or trend channel.

- If two levels are too close to each other (between 5 and 20 pips), they should be treated as an area of support or resistance.

- After a 15-20-pip move in the right direction, a Stop Loss should be set to breakeven.

What the Charts Show:

- Support and resistance price levels are targets for opening buy or sell positions. Take Profit levels can be placed around them.

- Red lines indicate trend channels or trend lines, reflecting the current trend and indicating the preferred trading direction.

- The MACD indicator (14,22,3) — histogram and signal line — is a supplementary indicator that can also be used as a source of signals.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.