Analysis of Transactions and Trading Tips for the British Pound

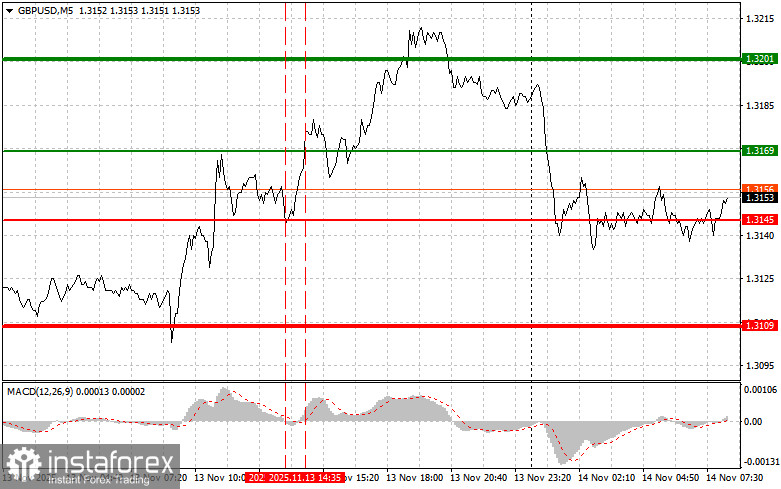

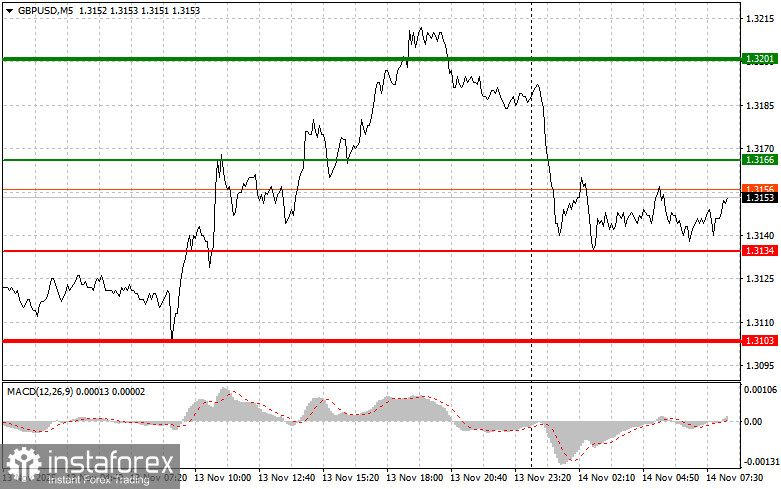

The test of the price at 1.3145 coincided with the MACD indicator just beginning to move down from the zero mark, confirming the right entry point for selling the pound. However, the trade incurred a loss as the pair did not decline.

The statements by the UK Chancellor of the Exchequer regarding her consideration of abandoning tax increases led to buying activity for the pound, while uncertainty regarding the future actions of the U.S. Federal Reserve created additional problems for the dollar, resulting in the strengthening of the GBP/USD pair.

Since there are no economic data releases from the United Kingdom today, all attention is focused on the upcoming budget plan that Reeves will present in just over ten days. There are high hopes pinned on this document, and any hints of revisions to the financial strategy could cause fluctuations in the British pound's exchange rate. Investors will closely analyze the government's proposals concerning taxation, funding for public needs, and economic stimulation. The situation is complicated by increasing pressure on the current Conservative government from both opposition forces and the public.

Regarding the intraday strategy, I will rely more on scenarios No. 1 and No. 2.

Buying Scenarios

Scenario No. 1: I plan to buy the pound today when it reaches the entry point around 1.3166 (green line on the chart), targeting a move to 1.3202 (thicker green line on the chart). Around 1.3202, I intend to exit my long positions and open shorts, expecting a move of 30-35 pips in the opposite direction from that level. Anticipate a rise in the pound today with positive news. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the price at 1.3134 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal upwards. A rise towards the opposite levels of 1.3166 and 1.3201 can be expected.

Selling Scenarios

Scenario No. 1: I plan to sell the pound today after the 1.3134 level (red line on the chart) is reached, which will trigger a rapid decline in the pair. The key target for sellers will be the level of 1.3103, where I plan to exit my shorts and open immediate longs in the opposite direction, expecting a movement of 20-25 pips in the opposite direction from that level. Pound sellers will only manifest with favorable prices. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today if the price tests 1.3166 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline towards the opposite levels of 1.3134 and 1.3103 can be expected.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.