Trade Review and Advice for Trading the European Currency

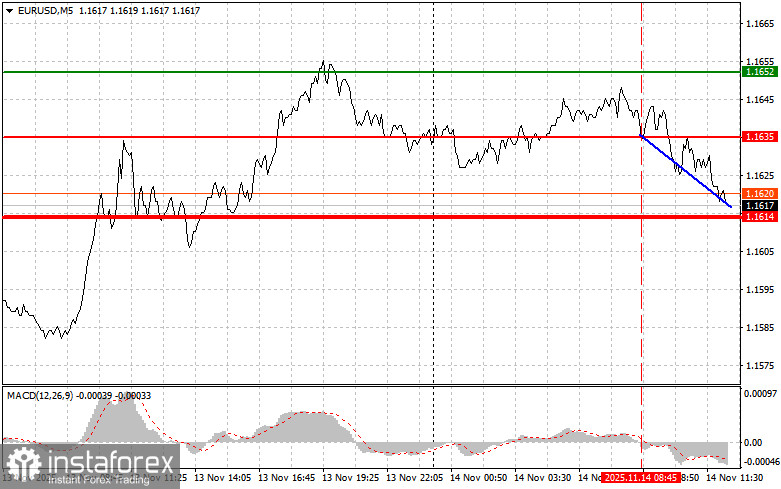

The test of the 1.1635 price occurred when the MACD indicator had just begun moving downward from the zero line, which confirmed a correct entry point for selling the euro and resulted in a decline toward the target level of 1.1614.

Several public speeches by FOMC members are scheduled for the afternoon, including Jeffrey Schmid, Lorie K. Logan, and Raphael Bostic. Given the growing support among policymakers for the idea of temporarily pausing the rate-cutting cycle, it is quite possible that these members will adopt a similar stance. If Committee members continue to express aligned views, this could significantly support the U.S. dollar and strengthen its position. Investors closely monitoring statements by Federal Reserve representatives will be assessing the likelihood of future monetary tightening.

As for the intraday strategy, I will be relying mostly on Scenarios No. 1 and No. 2.

Buy Signal

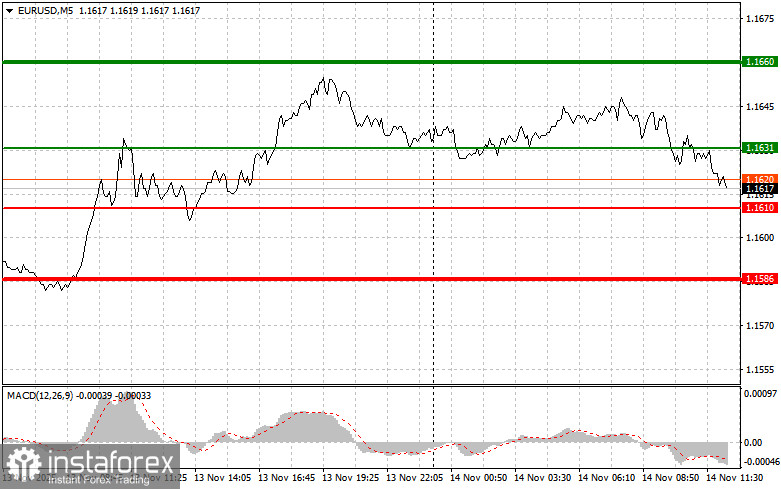

Scenario No. 1: Today, it is possible to buy the euro when the price reaches the level of 1.1631 (green line on the chart) with a target of rising to 1.1660. At 1.1660, I plan to exit the market, as well as open short positions in the opposite direction targeting a movement of 30–35 points from the entry point. Counting on euro growth today is only reasonable after dovish rhetoric from FRS representatives.Important! Before buying, make sure that the MACD indicator is above the zero line and only beginning to rise from it.

Scenario No. 2: I also plan to buy the euro if there are two consecutive tests of the 1.1610 price at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 1.1631 and 1.1660 may then be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1610 level (red line on the chart). The target will be 1.1586, where I will exit the market and immediately buy in the opposite direction (expecting a 20–25 point reversal from the level). Downward pressure on the pair will return today if FRS representatives take a hawkish stance.Important! Before selling, make sure that the MACD indicator is below the zero line and only beginning to decline from it.

Scenario No. 2: I also plan to sell the euro if there are two consecutive tests of the 1.1631 price at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A drop toward the opposite levels of 1.1610 and 1.1586 may then be expected.

Chart Legend:

- Thin green line – entry price for buying the trading instrument

- Thick green line – suggested price for placing Take Profit or manually securing profit, since further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – suggested price for placing Take Profit or manually securing profit, since further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to follow overbought and oversold conditions

Important

Beginner traders in the Forex market must make entry decisions with great caution. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you may lose your entire deposit very quickly—especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the example I've provided above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.