Yesterday, US stock indices ended mixed. The S&P 500 fell by 0.05%, while the Nasdaq 100 rose by 0.13%. The Dow Jones Industrial Average declined by 0.65%.

Futures for American stock indices rose along with technology stocks in Asia as investors focused on the earnings results from AI leader Nvidia Corp. and US economic data, which will set the tone for markets this week. Nvidia's financial report, expected to either confirm or refute optimistic growth forecasts in the AI sector, will determine the company's success and is viewed as a barometer of the overall health of the tech industry. Any signs of slowing growth could trigger a chain reaction in stock markets worldwide. Investors are awaiting not only the financial results but also management's comments regarding the prospects of the AI market, competition, and potential risks.

Alongside this, market attention is fixed on US economic data, which is expected to shed light on the state of the world's largest economy. Data on inflation, employment, and consumer demand will be particularly significant.

Against this backdrop, S&P 500 futures rose by 0.4%, while Nasdaq 100 futures increased by 0.6%. Among the companies that experienced gains were Samsung Electronics Co. and SK Hynix Inc., which promised to increase investments in South Korea. Sentiment also improved in the cryptocurrency sector, with Bitcoin up 1.8%, bouncing back from a low around 93,000.

Trading in European stock markets opened moderately. Japanese indices fell following the first contraction in six quarters, while shares of companies related to tourism and retail declined amid heightened tensions in relations with China.

In other market segments, gold continued to fall for the third consecutive day, while the dollar strengthened by 0.1%. Treasury bonds remained stable as investors prepared for the upcoming economic data release, which will provide insight into the Fed's rate forecast. Last week, numerous Fed officials expressed skepticism regarding the necessity of a rate cut in December or openly opposed it.

Last week, traders revised the probability of a quarter-point rate cut in December to below 50%, as some Fed representatives indicated that such a move is far from guaranteed.

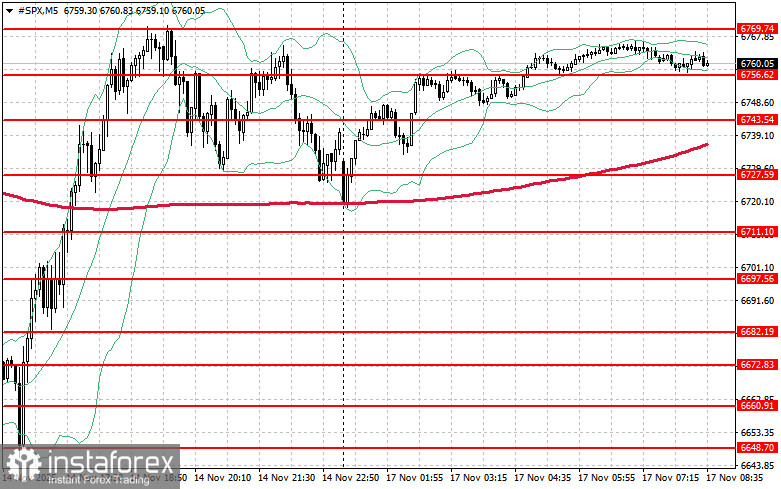

In regard to the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,769. This will help the index gain ground and pave the way for a potential surge to the new level of $6,784. An equally important objective for bulls will be to maintain control above $6,801, which would strengthen buyers' positions. In the event of a downward move driven by reduced risk appetite, buyers must assert themselves in the $6,756 area. A break below this level would quickly push the trading instrument back to $6,743 and open the path toward $6,727.