Analysis of Trades and Recommendations for Trading the Euro

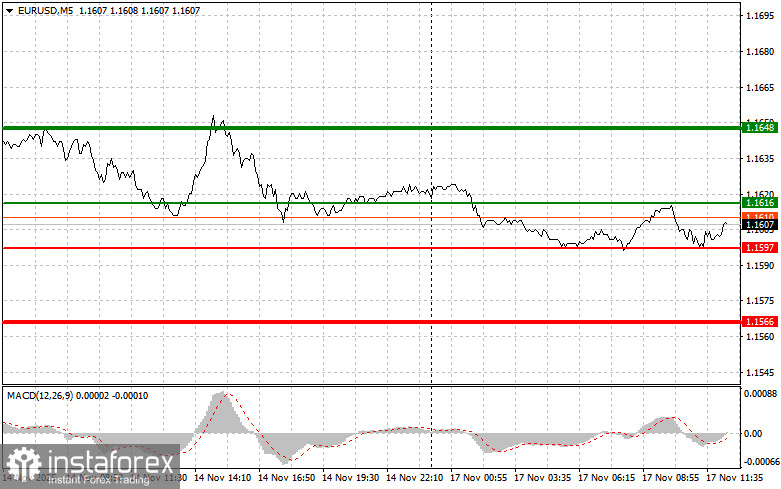

The test of the 1.1606 price level occurred when the MACD indicator had just begun to move upward from the zero line, which confirmed the correct entry point for buying the euro and resulted in a 10-point rise in the pair.

Given that the drop in Italy's consumer price index matched analysts' expectations exactly, the data did not lead to any major market movements in the currency market. The slowdown in inflation is primarily due to the easing growth rate of energy prices. The fact that inflation remains under control allows the central bank to act more softly, stimulating and supporting economic growth.

This afternoon, market attention will shift to the publication of the Empire Manufacturing Index, as well as speeches by several members of the Federal Reserve, including John Williams, Philip N. Jefferson, and Christopher Waller. Many of them are known to support a more cautious pace of interest rate cuts in the U.S., so the market will be closely examining their statements for any hints regarding future monetary policy. Diverging views within the Fed on the optimal policy strategy could increase market volatility. However, policymakers will be seeking a balance between stimulating economic growth and containing inflation — a balance that will shape the U.S. dollar's performance in the near future.

As for the intraday strategy, I will rely mainly on Scenarios #1 and #2.

Buy Signal

Scenario #1:

Today, the euro can be bought when the price reaches 1.1616 (green line on the chart) with a target of rising to 1.1648. At 1.1648, I plan to exit the market and also open a sell trade in the opposite direction, expecting a move of 30–35 points from the entry point. A bullish scenario today will only be realistic if the Fed officials deliver dovish rhetoric.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2:

I also plan to buy the euro today in case of two consecutive tests of the 1.1597 level at a moment when MACD is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposing levels of 1.1616 and 1.1648 can be expected.

Sell Signal

Scenario #1:

I plan to sell the euro after the price reaches 1.1597 (red line on the chart). The target will be 1.1566, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25-point rebound from the level). Downward pressure on the pair will return today if Fed members take a hawkish stance. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2:

I also plan to sell the euro today in case of two consecutive tests of the 1.1616 level at a moment when MACD is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposing levels of 1.1597 and 1.1566 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought.

- Thick green line – the level where Take Profit can be set or profits manually secured, as further growth above this level is unlikely.

- Thin red line – entry price at which the trading instrument can be sold.

- Thick red line – the level where Take Profit can be set or profits manually secured, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important Notes for Beginner Forex Traders

Beginner traders must be very cautious when choosing entry points in the market. Before major fundamental reports are released, it is best to remain out of the market to avoid getting caught in sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, your entire deposit can be lost very quickly — especially if you ignore money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are, from the start, a losing strategy for an intraday trader.