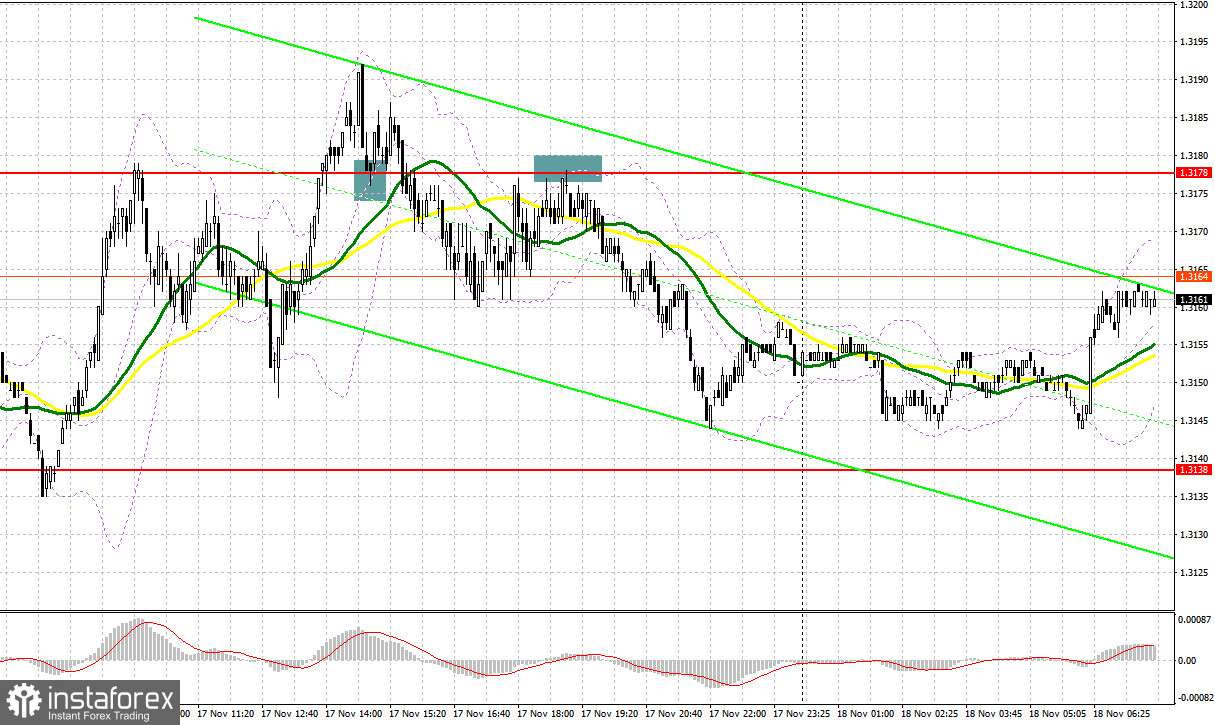

Yesterday, several entry points into the market were created. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I pointed out the level of 1.3172 and planned to make market entry decisions based on it. The rise and establishment of a false breakout around 1.3172 provided a selling entry point for the pound, resulting in a small 15-pip decline. In the second half of the day, active bearish action near the 1.3178 resistance level provided another entry point for short positions, yielding around 30 pips of profit.

To open long positions on GBP/USD, the following is required:

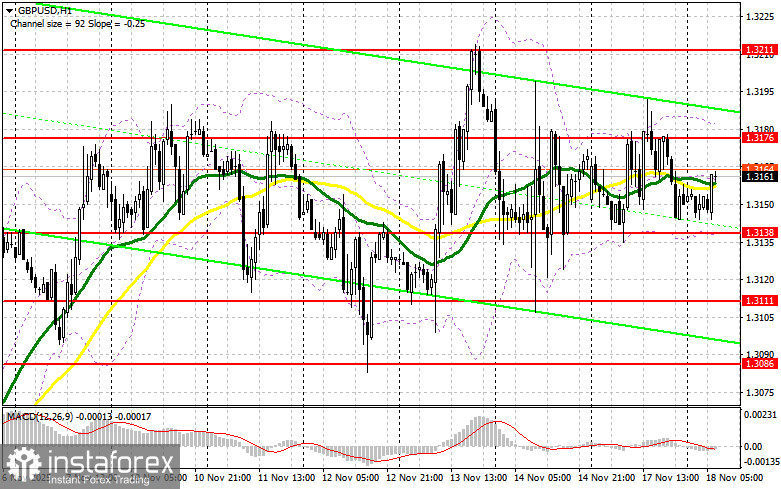

Data on the Empire Manufacturing Index's growth in the U.S. exceeded economists' forecasts, and statements from Federal Reserve officials on interest rate cuts supported the U.S. dollar against the British pound. However, this did not lead to serious changes in the balance of power. Today, no data is scheduled for the U.K. in the first half of the day, with only a speech from Bank of England MPC member Huw Pill anticipated. If pressure returns to the pound after the politician's comments, only the establishment of a false breakout in the vicinity of support at 1.3138 will warrant opening long positions, targeting an increase in the pair to the resistance level at 1.3176. A breakout and retest above this range will increase the chances of GBP/USD strengthening, potentially triggering stop-loss orders from sellers and providing a suitable entry point for long positions with the potential to reach 1.3211. The furthest target will be the 1.3244 area, where I intend to secure profits. In the event of a decline in GBP/USD and a lack of buying activity at 1.3138, pressure on the pair will increase, leading to a move towards the next support level at 1.3111. Only a false breakout there will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on the bounce from the low at 1.3086, targeting a 30-35 pip intra-day correction.

To open short positions on GBP/USD, the following is required:

Sellers showed their presence yesterday, but the price did not breach the channel. In the event of another rise in GBP/USD today in the first half of the day following Pill's speech, I expect bearish action near the resistance level of 1.3176, established during yesterday's American session. A false breakout will be sufficient to sell the pound, with a target decline towards support at 1.3138. A breakout and retest from below this range will seriously impact buyers' positions, leading to the triggering of stop-loss orders and paving the way to 1.3111. The furthest target will be the 1.3086 area, where I will secure profits. If GBP/USD rises and there is a lack of activity at 1.3176, buyers will have a chance for a larger rise in the pair, which may lead to the continuation of the bullish market. In this case, it would be better to postpone the sales until the 1.3211 resistance level is tested. I will only open short positions there on a false breakout. If there is no downward movement there, I will sell GBP/USD immediately on the bounce from 1.3244, but only with the expectation of a downward correction in the pair of 30-35 pips intraday.

Recommended for Review:

Due to the U.S. shutdown, fresh Commitment of Traders (COT) data is not being published. The latest is only relevant as of September 23.

In the COT report for September 23, there was a decrease in short positions and an increase in long positions. Pressure on the dollar remains, especially after recent data that will likely force the U.S. Federal Reserve to continue lowering interest rates. At the same time, the Bank of England's policies remain cautious, indicating their clear plans for continued inflation control, although this has not instilled much confidence in pound buyers recently. The short-term future dynamics of the GBP/USD exchange rate will be determined by new fundamental statistics. The latest COT report indicates that long non-commercial positions increased by 3,704 to 84,500, while short non-commercial positions decreased by 912 to 86,464. As a result, the spread between long and short positions narrowed by 627.

Indicator Signals:

- Moving Averages: Trading occurs around the 30-day and 50-day moving averages, indicating market uncertainty.

- Note: The periods and prices of moving averages are considered by the author on the hourly chart (H1) and differ from the general definition of classical daily moving averages on the daily chart (D1).

- Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.3138 will serve as support.

Description of Indicators:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Period – 50. Highlighted in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Period – 30. Highlighted in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes, meeting certain requirements.

- Long Non-commercial Positions: The total long open position of non-commercial traders.

- Short Non-commercial Positions: The total short open position of non-commercial traders.

- Total Non-commercial Net Position: The difference between the short and long positions of non-commercial traders.