Bitcoin has fallen below $90,000, and interestingly, there are still no major buyers at these levels. Ethereum also fell below $3,000 yesterday.

The absence of buyers is not surprising. Retail players have been under pressure from large sell-offs, and medium-term buyers who accumulated at an average price of $100,000–$102,000 are also facing significant challenges. Against this backdrop, it is not surprising that from November 10 to 14, spot Bitcoin ETFs recorded a net outflow of $1.1 billion, while spot Ethereum ETFs lost over $729 million.

Undoubtedly, this trend raises concerns in the market. Traders are likely reassessing their strategies amid the significant downturn in the cryptocurrency market. Additionally, the overall macroeconomic uncertainty related to the monetary policy of central banks and inflation puts additional pressure on risk assets, including cryptocurrencies.

It is worth noting that the outflow from ETFs can be attributed to various factors, from profit-taking after recent price increases to reallocating capital to other asset classes—such as gold, which is currently offering much higher returns.

In the near term, the further dynamics of the cryptocurrency market will largely depend on the development of the macroeconomic situation and the return of new money to spot ETFs. It is possible that if markets stabilize and fundamental indicators improve, we might see a return of buyers and a resumption of price growth by the end of the year. However, under current conditions, the risks of a correction remain quite high.

Regarding intraday strategies in the cryptocurrency market, I will also rely on significant pullbacks of Bitcoin and Ethereum in anticipation of the continuation of the bullish market in the medium term, which has not disappeared.

As for short-term trading, the strategy and conditions are outlined below.

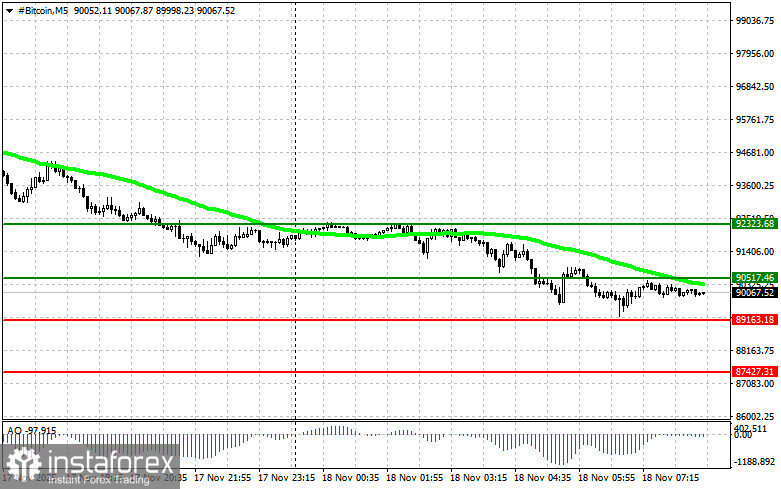

Bitcoin

Buy Scenario

- Scenario #1: Buy Bitcoin today at an entry point around $90,500, with a target price of $92,300. Near $92,300, I will exit the buys and sell immediately on the bounce. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Bitcoin from the lower boundary at $89,100 if there is no market reaction upon breaching it back to the levels of $90,500 and $92,300.

Sell Scenario

- Scenario #1: Sell Bitcoin today upon reaching an entry point around $89,100 with a target drop to $87,400. Near $87,400, I will exit the sells and buy immediately on the bounce. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Bitcoin from the upper boundary at $90,500 if there is no market reaction upon breaching it back to the levels of $89,100 and $87,400.

Ethereum

Buy Scenario

- Scenario #1: Buy Ethereum today upon reaching an entry point around $3,028 with a target growth to $3,106. Near $3,106, I will exit the buys and sell immediately on the bounce. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Ethereum from the lower boundary at $2,969 if there is no market reaction upon breaching it back to the levels of $3,028 and $3,106.

Sell Scenario

- Scenario #1: Sell Ethereum today upon reaching an entry point around $2,969 with a target drop to $2,897. Near $2,897, I will exit the sell and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Ethereum from the upper boundary at $3,028 if there is no market reaction upon breaching it back to the levels of $2,969 and $2,897.