Are investors ready for a downturn? The last major sell-offs in the S&P 500 occurred 16 years ago. They were so extensive that it took the broad stock index 66 months to return to record highs. The other five episodes of "bear markets" in the 21st century have taught traders just one thing: buy the dips.

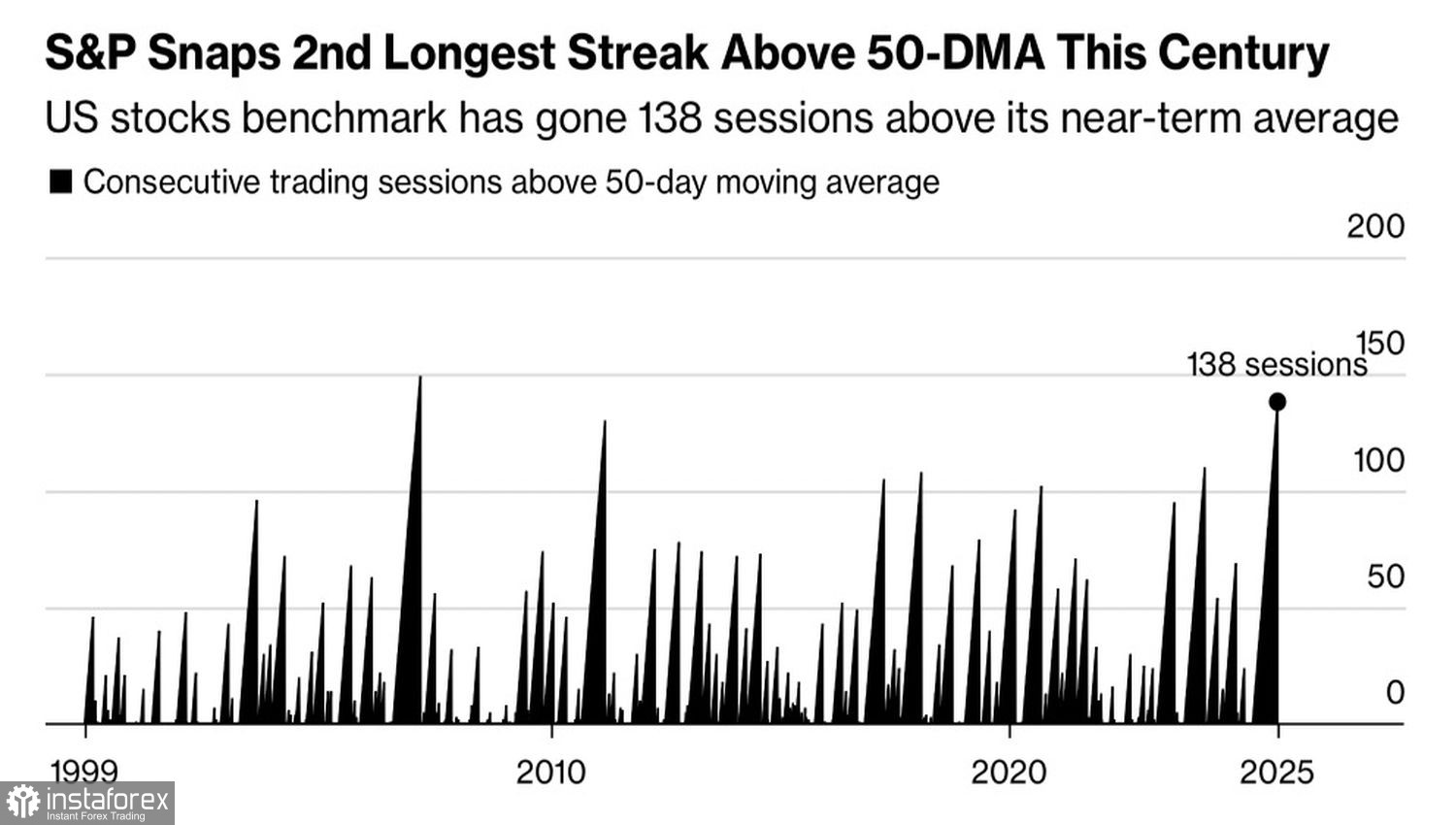

The first drop since May of the S&P 500 below the 50-day moving average became an important signal of a potential continuation of the pullback. The broad stock index had been above key dynamic support for 138 trading sessions. This is the longest streak since 2007 and the second-longest this century. Symbolically, the first happened just before the global economic crisis of 2008-2009.

Dynamics of the S&P 500 Series Above the 50-Day Moving Average

There is an opinion that downturns in the U.S. economy occur due to excessive monetary policy tightening and the Federal Reserve's reluctance to lower high rates amid high inflation. These processes are indeed taking place right now. More and more FOMC officials are expressing concern about excessively high prices. However, Christopher Waller believes the central bank should act pre-emptively—continuing the monetary expansion cycle to support the cooling labor market.

If, instead of a soft landing, the U.S. economy plunges into a recession, there will be a strong case for selling the S&P 500. Who will then remember the strongest corporate earnings season since 2021? About 90% of companies in the broad stock index have reported their third-quarter financial results. Four out of five exceeded profit forecasts, with an average over the last decade of 75%. More than three-quarters of issuers surpassed Wall Street's revenue estimates, which is also above the average of two-thirds.

On November 19, NVIDIA will release its report. The futures market anticipates a reaction in its shares of +/- 6.5%. If this happens, it will significantly shake the stock indices. Moreover, the same day will see the minutes from the October FOMC meeting, followed by the long-awaited September U.S. labor market report the next day.

S&P 500 Dynamics and Morgan Stanley's Forecast

Despite signals of a potential market transition into bear territory, optimists have not disappeared. Morgan Stanley is issuing one of the most "bullish" forecasts on Wall Street, projecting the S&P 500 to rise to 7,800 by the end of 2026. This assumes that the broad stock index will see its fourth consecutive year of double-digit growth.

The positive outlook is based on expectations of a 17% increase in corporate earnings per share in 2026 and 12% in 2027.

Technically, the bounce from dynamic resistance, as shown by moving averages on the daily chart of the S&P 500, has indicated the strength of the bears. Previously established short positions, including those from the pivot level of 6805, make sense to hold and periodically increase. Target levels are seen at 6560 and 6400.