Trade Analysis and Recommendations for the British Pound

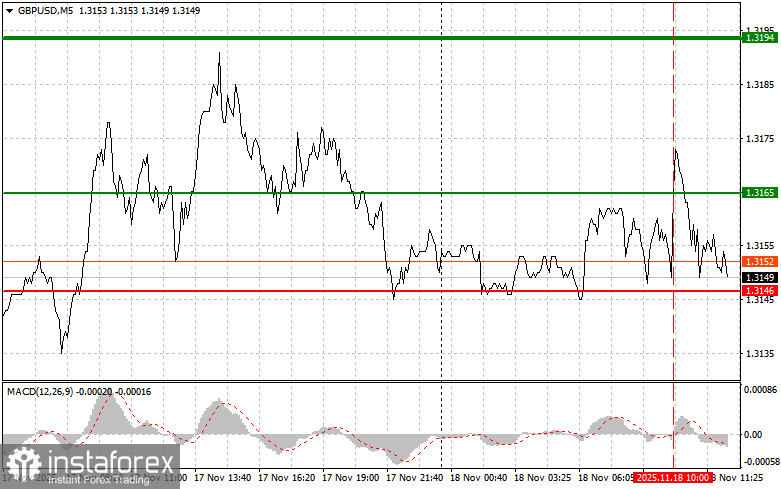

The price test at 1.3165 occurred at a moment when the MACD indicator had just begun moving upward from the zero line, which confirmed a correct buy-entry point for the pound. As a result, the pair rose by only 10 points before pressure on the pound returned.

Due to the lack of important U.K. statistics, the British pound continued to trade within a sideways channel. However, despite the current stability, experts note growing uncertainty surrounding the Bank of England's future monetary policy and the budget set to be presented on November 26. Inflationary risks, although showing signs of slowing, still remain above the target level, creating a dilemma for the regulator: continue easing policy at the risk of fueling prices, or maintain the pause further, putting at risk an economy that now strongly needs stimulus.

In the second half of the day, all attention will turn to the U.S. NAHB Housing Market Index and manufacturing orders data. FOMC member Michael S. Barr and his colleague Thomas Barkin will also speak. The NAHB housing market index may indicate further deterioration in sentiment among builders, reflecting high mortgage rates and overall economic uncertainty. A decline in manufacturing orders would highlight a slowdown in the industrial sector, putting pressure on the dollar. Speeches by Barr and Barkin will be the key event of the day. Given persistent inflation, they are likely to emphasize the need to maintain a restrictive monetary policy. Any signals indicating readiness to abandon rate cuts could trigger dollar strengthening.

As for the intraday strategy, I will rely primarily on scenarios No. 1 and No. 2.

Buy Signal

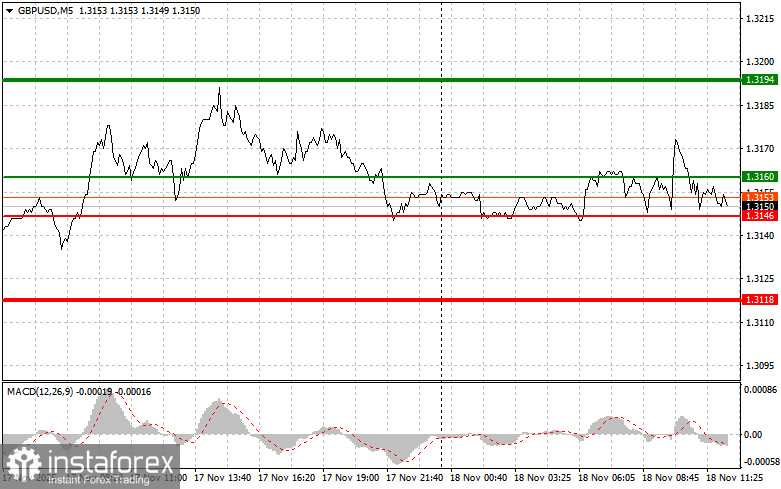

Scenario No. 1: Today, I plan to buy the pound at the entry level around 1.3160 (green line on the chart), targeting a rise to 1.3194 (thicker green line). Near 1.3194, I will exit buy positions and open sell trades in the opposite direction (expecting a 30–35 point movement in the opposite direction). Pound appreciation today is likely only if the Fed adopts a dovish stance.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if two consecutive tests of the 1.3146 price level occur while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. Growth toward the opposite levels of 1.3160 and 1.3194 can then be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the price breaks below 1.3146 (red line on the chart), which will lead to a rapid decline in the pair. Sellers' key target will be 1.3118, where I will exit sell positions and open buys in the opposite direction (expecting a 20–25 point rebound). Pressure on the pound will return if the Fed adopts a hawkish stance.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3160 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward 1.3146 and 1.3118 can be expected.

Chart Legend:

- Thin green line – entry price at which the instrument can be bought

- Thick green line – suggested Take Profit area or level for manually fixing profit, as further growth above this level is unlikely

- Thin red line – entry price at which the instrument can be sold

- Thick red line – suggested Take Profit area or level for manually fixing profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to use overbought and oversold zones as guidance

Important

Beginner Forex traders must make entry decisions very cautiously. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you ignore money management and trade large volumes.

And remember, successful trading requires having a clear trading plan, such as the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for intraday traders.