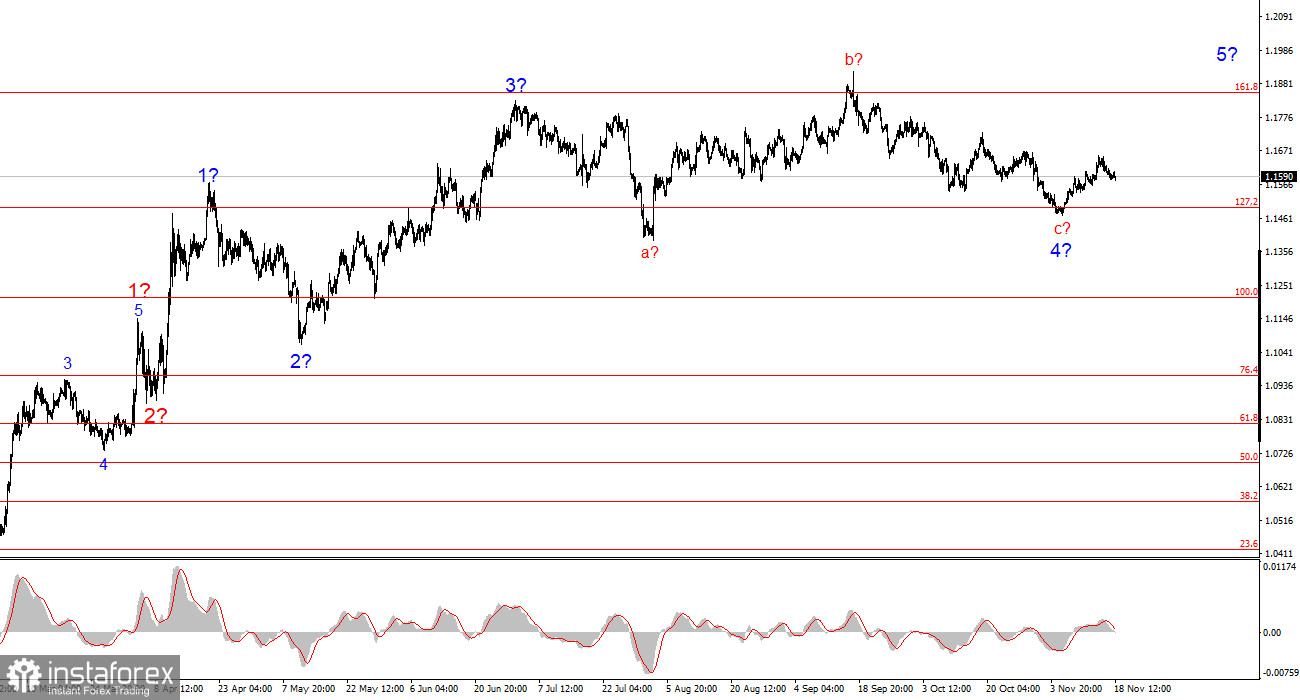

The wave pattern on the 4-hour chart for EUR/USD has transformed, but overall it still looks quite clear. There is no talk of canceling the upward trend segment that began in January 2025, but the wave pattern has become significantly more complex and prolonged since July 1. In my view, the instrument is in the process of forming corrective wave 4, which has taken on an unconventional shape. Within this wave, we observe exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

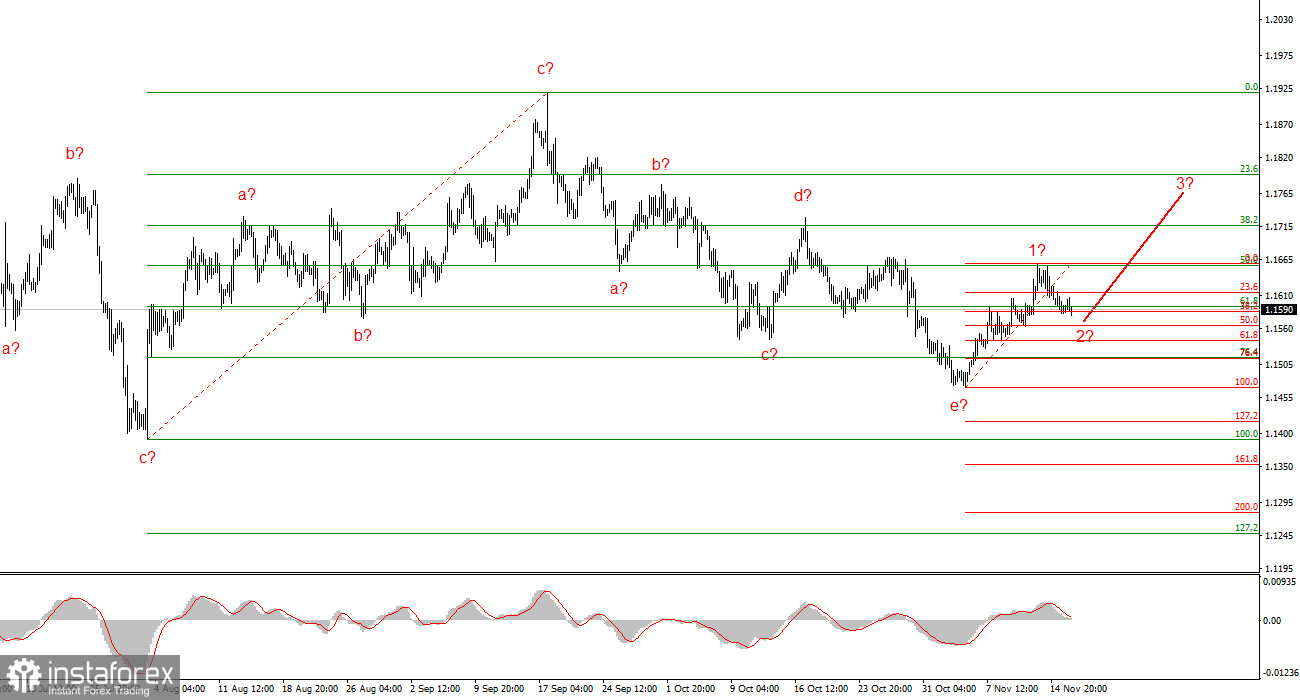

In my opinion, the construction of the upward trend segment is not complete, and its targets extend up to the 1.25 level. The a-b-c-d-e wave series looks complete, and therefore, in the coming weeks, I expect the formation of a new upward wave cycle. We have seen one upward wave already, and now the instrument is building a downward wave. Thus, it can be assumed that we are seeing the first and second waves of a new trend segment. If this assumption is correct, the second wave may extend 38.2%–61.8% of the first wave. Therefore, the third wave may begin from the 1.1541–1.1587 level.

The EUR/USD rate barely moved throughout Tuesday. Early in the new week, price fluctuations are very weak, and the news backdrop is nonexistent. As a result, the instrument is slowly declining, forming a corrective wave. On Wednesday, the news backdrop will again be fairly weak, so market activity may once again be close to zero. Nevertheless, I still expect the instrument to rise.

The latest downward wave structure did not have strong news support. During the formation of the a-b-c-d-e series, the question repeatedly arose: why is demand for the US dollar increasing? I remind you that at the very beginning of this wave structure, the overall picture looked like the start of a new impulse wave. But for unclear reasons, the US currency continued to rise in value, which led to a strong complication of the presumed wave 4.

Interestingly, the market paid practically no attention to the US government "shutdown"; otherwise, the US dollar would not have been able to rise. The market also ignored the end of the shutdown, because the dollar has been falling for a week now. Based on this, I continue to conclude that the news backdrop is not of interest to market participants at this time. If this assumption is correct, then the only basis for analysis is wave structure. Since we have seen a convincing and complete downward pattern, I now expect at least a three-wave upward series. This may be an a-b-c structure, which would be part of the same wave 4, or it may be the beginning of a new impulse wave sequence as part of the future wave 5.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues forming an upward trend segment. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors that may lead to a weakening of the US dollar in the future. Targets for the current trend segment may extend to the 1.25 level. At this time a new upward wave series may begin forming. I expect the third wave of this series—either wave c or wave 3—to begin from the 1.1541–1.1587 level. In any case, in the coming days I am considering long positions with targets near 1.1740.

At a smaller scale, the entire upward trend segment is visible. The wave pattern is not very standard, since the corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. I remind you that it is best to identify clear structures on the chart rather than forcing every wave into place. The current upward structure raises no doubts.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often produce changes.

- If you lack confidence in what is happening in the market, it is better not to enter it.

- One can never have 100% certainty about market direction. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.