The Japanese yen is under pressure. On Monday, Nikkei Asia reported that Japan's Prime Minister, Sanae Takaichi, plans to begin discussions on tax reform this week. The main goal is to reduce certain taxes to stimulate investment and consumer demand, while increasing other tax rates and eliminating exemptions to offset the budget deficit. The report notes that the ruling Liberal Democratic Party (LDP), together with its coalition partners, will discuss the tax package for the coming year, including the cancellation of gasoline and diesel fuel surcharges, which may reduce budget revenues by about 1.5 trillion yen.

On Monday, government data showed that Japan's economy contracted for the first time in six quarters during the July–September period. This complicates the prospects for a rapid interest rate hike by the Bank of Japan, especially amid growing political resistance.

Finance Minister Satsuki Katayama, during a Tuesday press conference, expressed concern about the recent rapid and one-sided moves in the currency market, which have sparked speculation about possible government action. He emphasized that the government is closely monitoring excessive fluctuations and chaotic movements in the foreign-exchange market, recognizing the urgency of the situation—something that helps deter traders from opening new bearish positions on the yen.

Against this backdrop, Federal Reserve officials have recently stressed the need for caution in further monetary easing, as current economic data remain a weak basis for rate cuts. This stance has reduced market expectations for a potential December rate reduction, supporting the US dollar and the USD/JPY pair.

Even so, dollar bulls are currently acting cautiously and prefer to wait for new signals regarding the Federal Reserve's policy outlook. In this regard, investors' attention will be focused on the Fed meeting minutes due Wednesday, as well as US employment reports scheduled for Thursday.

It is also worth paying attention to statements from key Federal Reserve members, whose speeches may become an important factor in boosting dollar demand and creating short-term trading opportunities for USD/JPY.

From a technical standpoint, the fact that prices broke above the psychological level of 155.00 yesterday favors the bulls. Oscillators on the daily chart are positive, confirming the optimistic outlook. Further growth of USD/JPY beyond 155.60 toward the round level of 156.00 appears quite likely.

On the other hand, a corrective pullback below 155.00 will find strong support, attracting buyers near 154.50. However, a break below this level would trigger technical selling, pushing USD/JPY toward 154.00 and lower.

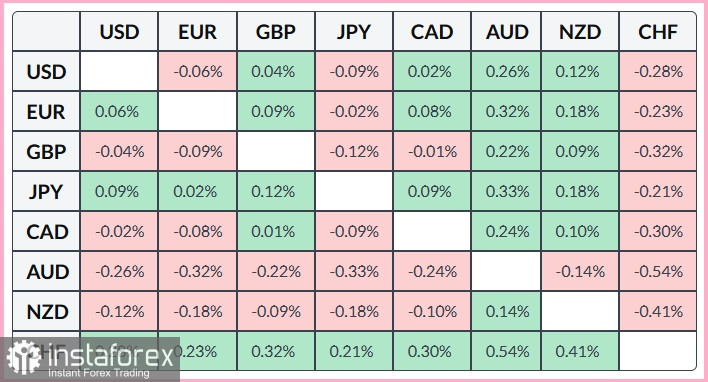

The table below shows the percentage change of the Japanese yen against major currencies today. The most notable movement is against the Australian dollar.