Bitcoin recovered quite well yesterday to around $93,500, but was unable to hold that level and is currently trading below $91,000. Ethereum also pulled back above $3,150, but at the time of writing, it has returned to around $3,000.

Meanwhile, many traders are anxiously watching the market as assets rapidly lose value, despite news of institutional and corporate purchases of cryptocurrency. According to the November BofA survey, the level of cryptocurrency adoption among institutions remains very low. Approximately 76% of global fund managers surveyed have not yet invested in crypto and are only considering it in the near future.

This raises doubts about the common belief that institutional investors provide a reliable foundation for the cryptocurrency market. Their potential participation is often seen as a guarantee of stability and further growth; however, reality is still far from these expectations.

It turns out that the current volatility and price declines are primarily driven by retail investor sentiment and speculative operations rather than long-term strategies of major players. This makes the market particularly vulnerable to panic selling and negative news.

For this reason, traders should exercise caution and focus on fundamental analysis rather than relying solely on short-term trends or the promise of institutional investors entering through spot ETFs. Diversifying a portfolio and adopting a conservative investment approach can help minimize risk amid current uncertainty.

As for intraday strategies in the cryptocurrency market, I will continue to trade on significant dips in Bitcoin and Ethereum, with the expectation of a continued medium-term bullish market that has not disappeared.

As for short-term trading, the strategy and conditions are described below.

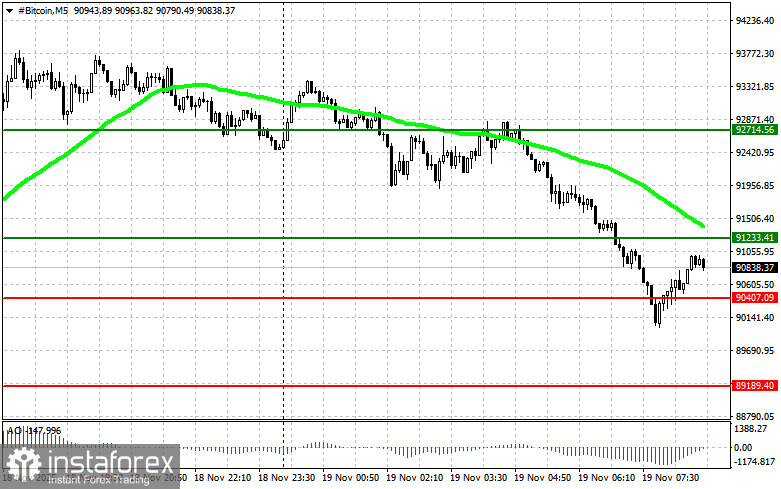

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching an entry point around $91,300, with a target of growth to $92,700. Around $92,700, I will exit the buys and sell immediately on a rebound. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: Buying Bitcoin can be done from the lower boundary of $90,400 if there is no market reaction to its breakdown back toward the levels of $91,300 and $92,700.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching an entry point around $90,400, with a target to drop to $89,200. Around $89,200, I will exit the sells and buy immediately on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome indicator is in the zone below zero.

Scenario #2: Selling Bitcoin can be done at the upper boundary of $91,300 if there is no market reaction to its breakdown back toward $90,400 and $89,200.

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today upon reaching an entry point around $3,048, with a target of growth to $3,150. Around $3,150, I will exit the buys and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome indicator is in the zone above zero.

Scenario #2: Buying Ethereum can be done at the lower boundary of $3,012 if there is no market reaction to its breakdown back toward $3,048 and $3,150.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching an entry point around $3,012, aiming to drop to $2,950. Around $2,950, I will exit the sell and buy immediately on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome indicator is in the zone below zero.

Scenario #2: Selling Ethereum can be done at the upper boundary of $3,048 if there is no market reaction to its breakdown back toward $3,012 and $2,950.