Trade analysis and recommendations for trading the British pound

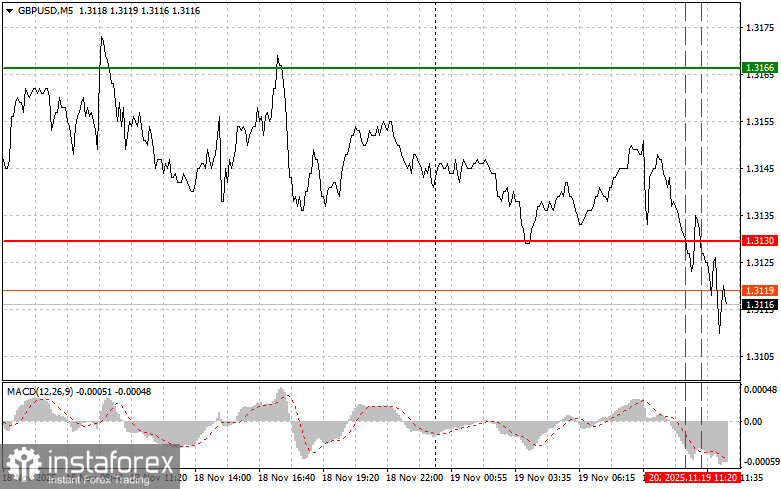

The test of the 1.3130 price level occurred when the MACD indicator had already moved far down from the zero line, which limited the pair's downward potential. The second test of 1.3130 happened while the MACD was in the oversold zone, which resulted in the implementation of Scenario No. 2 for buying the pound, although the pair did not manage to show any significant upward movement.

The pound reacted with a decline to news that inflation in the U.K. in October increased but fully matched economists' forecasts. Such a market reaction indicates that investors are highly sensitive to even the smallest signals concerning the Bank of England's monetary policy outlook. The fact that the actual data matched the expectations is not negative in itself; however, given the current situation—where inflation still significantly exceeds the 2% target—market participants perceived this as a sign that the Bank of England may not rush to ease monetary policy. At the same time, the fall of the pound may be temporary and driven by speculative sentiment. In the long run, the pound's exchange rate will depend on fundamental factors such as the overall state of the British economy, trade relations with other countries, and the geopolitical landscape.

Later today, market participants are awaiting the publication of the minutes from the latest Federal Reserve meeting. Investors always closely examine every word of the Fed minutes in hopes of finding clues about the future trajectory of monetary policy. Special attention will be given to discussions on inflation, employment, and economic growth prospects.

U.S. trade balance data is also of significant interest. A widening trade deficit may indicate declining competitiveness of U.S. goods in the global market, which in turn can negatively affect the country's economic growth. John Williams's speech may add further clarity to monetary policy expectations. His stance in favor of rate cuts makes his remarks particularly important for investors seeking confirmation of their expectations.

As for intraday strategy, I will mainly focus on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

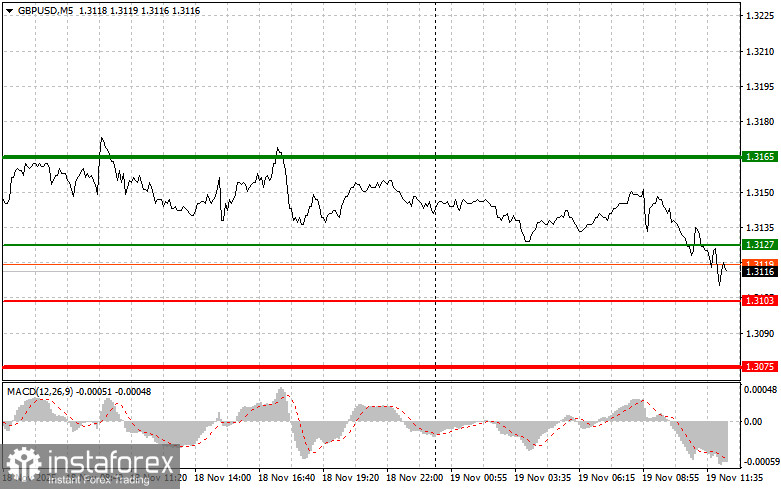

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3127 (green line on the chart), targeting a rise to 1.3165 (thicker green line on the chart). Near 1.3165, I will exit long positions and open short positions in the opposite direction (expecting a 30–35-point move in reverse). Pound growth today can be expected only with a dovish stance from the Fed.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if the price tests 1.3103 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels 1.3127 and 1.3165 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after breaking below 1.3103 (red line on the chart), which should lead to a quick decline. The key target for sellers will be 1.3075, where I will exit shorts and immediately open long positions in the opposite direction (expecting a 20–25-point rebound). Pressure on the pound will return if the Fed takes a hawkish stance. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario No. 2: I also plan to sell the pound today if the price tests 1.3127 twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels 1.3103 and 1.3075 can be expected.

What's on the chart:

- Thin green line – entry price for buying the trading instrument

- Thick green line – expected level for placing Take Profit or locking in profit, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – expected level for placing Take Profit or locking in profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones

Important

Beginner Forex traders must make entry decisions very carefully. Before the release of major fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember: successful trading requires having a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are—by definition—a losing strategy for any intraday trader.